Intel Corporation (INTC) released Q4 earnings that ended December 26, exceeding market estimates. The chip giant reported adjusted revenue of $19.5 billion versus $18.31 billion expected and adjusted EPS of $1.09 versus $0.91 expected. Intel expects $18.3 billion in adjusted sales in the first quarter of 2022, beating analyst expectations of $17.62 billion.

Key Highlights:

- Intel’s largest business, it’s Client Computing Group, dropped 7% year-over-year to $10.1 billion but was still ahead of analysts’ average estimate of $9.6 billion.

- Intel’s Data Center Group unit also exceeded expectations, with revenue rising 20% to $7.3 billion, compared to the average estimate of $6.7 billion.

- Intel raised its quarterly cash dividend by 5% to $0.365 per share.

- CEO Pat Gelsinger informed that the company’s next-generation server chip, Sapphire Rapids, is on schedule to start shipping this quarter, and production is expected to ramp in the second quarter.

- The company’s subsidiary, Mobileye, which focuses on self-driving car technology, reported $356 million in sales during the quarter, a 7% annual increase.

Last week, Intel planned to build a chip-making complex in Ohio which could house as many as eight fabs, or chip factories, with production set to begin in 2025. The company is planning to invest at least $20 billion to get the first two factories up and running.

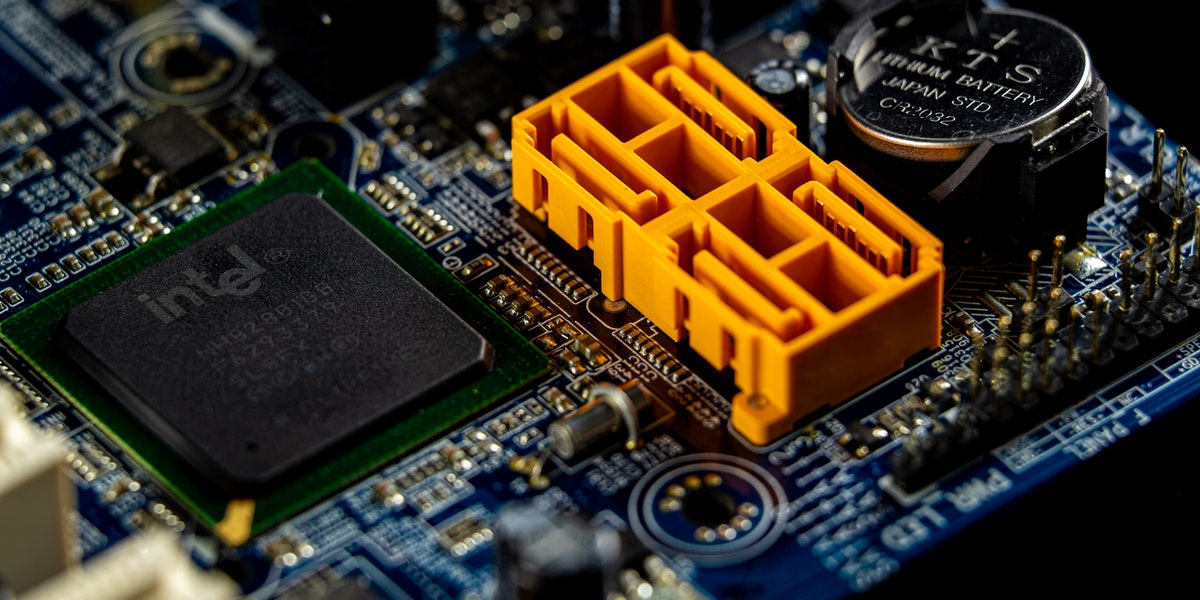

Intel Corporation (INTC) seeks to expand the boundaries of technology to provide the most amazing experience possible while designing, manufacturing, and selling integrated digital technology globally. To learn more about Intel Corporation (INTC) and to track its progress please visit the Vista Partners Intel Corporation Coverage Page.

Vista Partners LLC (”Vista”) is a California Registered Investment Advisor based in San Francisco. Vista delivers timely and relevant insights via the website: www.vistapglobal.com with daily stories, weekly market updates, monthly macroeconomic newsletters, podcasts, & Vista’s proprietary equity and market research to help you stay informed and stay competitive. Vista’s mission is to invest partner capital while arming investors with a comprehensive global financial perspective across all market sectors. Vista also seeks to provide select issuers with actionable advice regarding fundamental development, corporate governance, and capital market directives.

Stay Informed! Stay Competitive! Please join us at Vista Partners, receive our FREE email updates throughout the week, and view our exclusive content and research.