As per reports, Walmart Stores, Inc. has announced that it has closed its previously announced $2 billion inaugural green bond offering. Net proceeds will be allocated to fund current and prospective projects to advance Walmart’s sustainability goals. The green bond is Walmart’s first offering under the company’s Green Financing Framework, published August 2021, it details the company’s alignment with the 2021 Green Bond Principles.

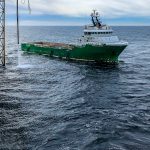

Walmart to allocate an amount equal to the net proceeds of the $2 billion offerings toward a portfolio of Eligible Green Investments under the following Eligible Green Categories, like renewable energy projects; high-performance buildings projects; sustainable transport projects; zero waste and circular economy projects; quality and efficient water stewardship projects; and habitat restoration and conservation. Annually, Walmart will issue a public report with all the information on the allocation of bond proceeds to Eligible Green Investments till an amount equal to the net proceeds of the green bond has been allocated.

Walmart has a comprehensive ESG strategy and is working towards its commitment under the pillars of Opportunity, Sustainability, Community, and Ethics & Integrity. Walmart aims to be supplied with 100% renewable energy by 2035 across its global operations, electrify and zero out emissions from all its vehicles, including long-haul trucks, by 2040, and transition to low-impact refrigerants for its facilities by 2040.

Walmart Stores, Inc. (WMT) is a worldwide retailer that operates in various formats. The three segments of the company include Walmart U.S., Walmart International, and Sam’s Club. The company is comprised of discount stores, supermarkets, supercenters, hypermarkets, warehouse clubs, cash and carry stores, home improvement stores, specialty electronics stores, apparel stores, drug stores, convenience stores, and membership-only warehouse clubs; and retail Websites. To learn more about Walmart (WMT) and to continue to track its progress please visit the Vista Partners Walmart Coverage Page.

Vista Partners LLC (”Vista”) is a California Registered Investment Advisor based in San Francisco. Vista delivers timely and relevant insights via the website: www.vistapglobal.com with daily stories, weekly market updates, monthly macroeconomic newsletters, podcasts, & Vista’s proprietary equity and market research to help you stay informed and stay competitive. Vista’s mission is to invest partner capital while arming investors with a comprehensive global financial perspective across all market sectors. Vista also seeks to provide select issuers with actionable advice regarding fundamental development, corporate governance, and capital market directives.

Stay Informed! Stay Competitive! Please join us at Vista Partners, receive our FREE email updates throughout the week, and view our exclusive content and research.