company profile

InMed Pharmaceuticals Inc. (NASDAQ: INM) is a global leader in the research, development and manufacturing of rare cannabinoids, including clinical and preclinical programs targeting the treatment of diseases with high unmet medical needs. They also have significant know-how in developing proprietary manufacturing approaches to produce cannabinoids for various market sectors.

Rare cannabinoids are an emerging class of compounds which are gaining interest for their potential medical benefits. InMed has initiated three pharmaceutical programs – including a completed Phase 2 clinical trial in epidermolysis bullosa and preclinical programs in glaucoma and neurodegenerative disease.

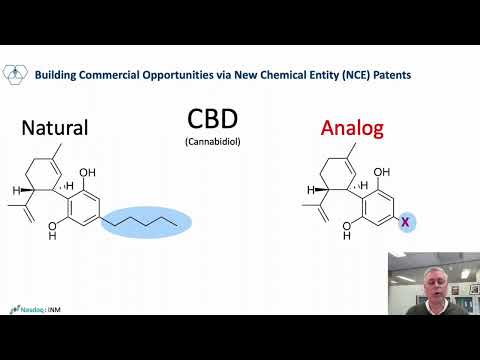

Unlike natural cannabinoids isolated from the plant which are not patentable, InMed’s proprietary cannabinoid analogs are patentable and are recognized as new chemical entities (NCEs). These analogs are expected to offer similar or improved therapeutic effects compared to their parent (naturally occurring) cannabinoid with modifications that may make them preferred candidates to treat specific diseases. They are screening these analogs for their therapeutic properties and pharmaceutical development.

InMed’s subsidiary, BayMedica, is producing a portfolio of premium rare cannabinoids as raw ingredients for your health and wellness products. They have engineered bioidentical cannabinoids with high purity and consistency, and free of THC.They currently manufacture the rare, minor cannabinoids cannabichromene (CBC), tetrahydrocannabivarin (d9-THCV), cannabidivarin (CBDV) and cannabicitran (CBT) which are available for B2B purchase.

On July 20, InMed highlighted results for BayMedica including the realization of $2.3M revenues (unaudited) in Q4 2023, which represented a 123% increase quarter over quarter (“QoQ”) gain a triple digit increase now for two consecutive quarters and a locking in a third consecutive quarter with significant revenue growth. InMed further confirmed that BayMedica continues to optimize its manufacturing processes and supply chain logistics to reduce the overall cost of goods, while also improving the already high quality and purity levels for all products in its portfolio. BayMedica has been focused on creating redundancy at both ends of the supply chain by securing more sources of raw materials as well as securing additional downstream purification partners. In addition, BayMedica has recently hired a director for manufacturing and logistics to oversee the supply chain function and manage third party vendors. Now BayMedica, through its manufacturing partners, has steadily increased manufacturing throughput to maintain supply of finished goods to meet customer demand over the last 12 months. With completed and ongoing process improvements, BayMedica has the capability to potentially scale production to metric tonnes (thousands of kilograms) should demand continue to rise.

vista's key points

- InMed Pharmaceuticals is a global leader in the pharmaceutical research, development and manufacturing of rare cannabinoids and cannabinoid analogs, including clinical and preclinical programs targeting the treatment of diseases with high unmet medical needs.

- InMed has significant know-how in developing proprietary manufacturing approaches to produce cannabinoids for various market sectors.

- Rare cannabinoids are an emerging class of compounds which are gaining interest for their potential medical benefits.

- InMed is researching the therapeutic benefits of several rare cannabinoids and have produced a growing library of rare cannabinoid analogs for development.

- InMed has initiated three pharmaceutical programs – including a completed Phase 2 clinical trial in epidermolysis bullosa and preclinical programs in glaucoma and neurodegenerative disease.

- InMed has expanded its pharmaceutical pipeline to investigate rare cannabinoids for their potential in treating neurodegenerative disease such as Alzheimer’s Disease, Parkinson’s Disease, Huntington’s Disease and others.

- InMed sponsored research, entitled "Cannabinoids modulate cytotoxicity and neuritogenesis in Amyloid-beta-treated neuronal cells", demonstrated the ability of a specific rare cannabinoid ("pCBx") in InMed's 900 Series library of potential candidates that reduces amyloid toxicity and tau protein expression while enhancing neuronal cell growth and neuritogenesis markers in vitro, all considered to be important targets in the potential treatment of neurodegenerative diseases such as Alzheimer's.

- Published a peer-reviewed study showing the anti-inflammatory potential of rare cannabinoids.

- InMed's wholly owned subsidiary, BayMedica, produces highly pure rare cannabinoids d9-THCV, CBC, CBDV and CBT for the consumer health and wellness industry.

- InMed's BayMedica realized $2.3M revenues (unaudited) in Q4 2023, which represented a 123% increase quarter over quarter gain a triple digit increase now for two consecutive quarters and a locking in a third consecutive quarter with significant revenue growth. InMed also confirmed that they have optimized and scaled up manufacturing processes over the last 12 months to meet increasing demand.

- InMed confirmed that they have optimized and scaled up manufacturing processes over the last 12 months to meet increasing demand

- At March 31, 2023, InMed's total issued and outstanding shares were 3,328,191.

- On March 13, InMed announced that a peer-reviewed scientific study entitled “Rare phytocannabinoids exert anti-inflammatory effects on human keratinocytes via the endocannabinoid system and MAPK signalling pathway” has been published in the International Journal of Molecular Sciences.

- At March 31, 2023, Inmed's cash, cash equivalents and short-term investments were $9.6 million, which compares to $6.2 million at June 30, 2022.

- The 52 Week Trading Range is $.8930 - $19.50

VISTA'S PROGRESS REPORT

InMed Pharmaceuticals (“InMed”) is a publicly traded company on the Nasdaq that trades under the symbol INM. InMed is a global leader in the pharmaceutical research, development and manufacturing of rare cannabinoids and cannabinoid analogs, including clinical and preclinical programs targeting the treatment of diseases with high unmet medical needs. They also have significant know-how in developing proprietary manufacturing approaches to produce cannabinoids for various market sectors. InMed pharmaceutical programs include a Phase 2 clinical trial studying the safety and efficacy of cannabinol (CBN) cream for epidermolysis bullosa and preclinical programs in glaucoma and neurodegenerative disease.InMed’s rare cannabinoids are being applied across a spectrum of uses – from pharmaceutical development to wholesale sales to the consumer health and wellness sector. In addition, a wholly owned subsidiary of InMed, BayMedica, produces highly pure rare cannabinoids d9-THCV, CBC, CBDV and CBT for the consumer health and wellness industry.

On July 20, InMed Pharmaceuticals Inc. provided a commercial and manufacturing update on its subsidiary BayMedica LLC (“BayMedica”), a leading supplier of bioidentical rare cannabinoids to the Health and Wellness (“H&W”) market.

“We are very encouraged to see another strong quarter with (unaudited) revenues in excess of $2.3M, representing our third consecutive quarter with significant revenue growth,” said Eric A. Adams, InMed’s President and CEO. He added, “As demand for minor cannabinoids continues to increase, we see a potential path for BayMedica to become a profitable standalone business subsidiary and contribute margin to the pharmaceutical R&D parent.”

View InMed’s latest powerpoint presentation here.

Read Morevista's key points

- InMed Pharmaceuticals is a global leader in the pharmaceutical research, development and manufacturing of rare cannabinoids and cannabinoid analogs, including clinical and preclinical programs targeting the treatment of diseases with high unmet medical needs.

- InMed has significant know-how in developing proprietary manufacturing approaches to produce cannabinoids for various market sectors.

- Rare cannabinoids are an emerging class of compounds which are gaining interest for their potential medical benefits.

- InMed is researching the therapeutic benefits of several rare cannabinoids and have produced a growing library of rare cannabinoid analogs for development.

- InMed has initiated three pharmaceutical programs – including a completed Phase 2 clinical trial in epidermolysis bullosa and preclinical programs in glaucoma and neurodegenerative disease.

- InMed has expanded its pharmaceutical pipeline to investigate rare cannabinoids for their potential in treating neurodegenerative disease such as Alzheimer’s Disease, Parkinson’s Disease, Huntington’s Disease and others.

- InMed sponsored research, entitled "Cannabinoids modulate cytotoxicity and neuritogenesis in Amyloid-beta-treated neuronal cells", demonstrated the ability of a specific rare cannabinoid ("pCBx") in InMed's 900 Series library of potential candidates that reduces amyloid toxicity and tau protein expression while enhancing neuronal cell growth and neuritogenesis markers in vitro, all considered to be important targets in the potential treatment of neurodegenerative diseases such as Alzheimer's.

- Published a peer-reviewed study showing the anti-inflammatory potential of rare cannabinoids.

- InMed's wholly owned subsidiary, BayMedica, produces highly pure rare cannabinoids d9-THCV, CBC, CBDV and CBT for the consumer health and wellness industry.

- InMed's BayMedica realized $2.3M revenues (unaudited) in Q4 2023, which represented a 123% increase quarter over quarter gain a triple digit increase now for two consecutive quarters and a locking in a third consecutive quarter with significant revenue growth. InMed also confirmed that they have optimized and scaled up manufacturing processes over the last 12 months to meet increasing demand.

- InMed confirmed that they have optimized and scaled up manufacturing processes over the last 12 months to meet increasing demand

- At March 31, 2023, InMed's total issued and outstanding shares were 3,328,191.

- On March 13, InMed announced that a peer-reviewed scientific study entitled “Rare phytocannabinoids exert anti-inflammatory effects on human keratinocytes via the endocannabinoid system and MAPK signalling pathway” has been published in the International Journal of Molecular Sciences.

- At March 31, 2023, Inmed's cash, cash equivalents and short-term investments were $9.6 million, which compares to $6.2 million at June 30, 2022.

- The 52 Week Trading Range is $.8930 - $19.50

exclusive content

Vista Partners creates exclusive content based on the ongoing research of companies included in the VP Watchlist.

vp watchlist

The VP Watchlist contains current coverage companies that deserve consideration for short term and long term portfolio additions.

recent news

-

InMed to Participate in Fierce Biotech Webinar...

24 October 2024 | 12:00 pm

-

InMed Appoints Dr. Barry Greenberg, Johns Hopkins...

22 October 2024 | 12:00 pm

-

InMed Pharmaceuticals Reports Full Year Fiscal 2024...

30 September 2024 | 12:00 pm

Interviews

Stay Informed. Stay Competitive with FREE Insights on the Stock Market, Dow 30 & Emerging Opportunities.

Get Free Email Updatesvideos

- InMed Pharmaceuticals (NASDAQ: INM) – Addressing The Increasing Demand For Rare Cannabinoids

- What are Cannabinoid Analogs and Why are they Important?

- How Alzheimer’s Changes the Brain

- InMed Pharmaceuticals (NASDAQ: INM) “Addressing The Increasing Demand For Rare Cannabinoids”

- How Cannabis Legalization Is Changing The Workplace

- InMed Pharmaceuticals (INM) “Accelerating The Commercialization of Rare Cannabinoids” 9-21-21 Tribe Event!

- InMed’s IntegraSyn™ – a flexible, high yield & cost-effective cannabinoid manufacturing system