The insatiable demand for AI chips has sparked a $5 billion spending spree among tech giants, with companies like Nvidia, AMD, and Intel vying for dominance in the rapidly evolving artificial intelligence market. In a scene reminiscent of Black Friday for nerds, tech CEOs in hoodies and sneakers are storming the Silicon Valley Supermarket, frantically tossing AI chips into their carts. This $5 billion shopping spree is fueled by the insatiable hunger for artificial intelligence, with companies scrambling to power everything from self-driving cars to virtual assistants that can finally understand your weird accent. The demand for these tiny tech wonders has skyrocketed, turning the AI chip market into a high-stakes game of “my AI is smarter than your AI,” where one wrong move could leave you stuck with last year’s model.

Nvidia Leads the Charge

Leading the pack in this silicon-powered race is Nvidia (NVDA), the reigning champion of AI chips. With their cutting-edge GPUs promising to make computers smarter than your average teenager, Nvidia has been flexing its technological muscles and setting the pace for the industry. Their dominance has forced competitors to up their game, sparking a fierce battle for innovation and market share in the AI chip arena. As demand continues to surge, Nvidia’s position at the forefront of this revolution has made it a darling of both tech enthusiasts and investors alike, with its stock price reflecting the company’s pivotal role in shaping the future of AI computing.

Tech Giants’ Chip Battle

While Nvidia may be leading the charge, AMD and Intel (INTC) are not content to sit on the sidelines of this silicon showdown. These tech titans are pulling out all the stops to convince the world that their chips are the true brainiacs of the AI revolution. It’s a constant battle of one-upmanship, with each company trying to outdo the others with bigger and better AI capabilities. As the demand for these smart little wafers continues to grow, fueled by AI’s insatiable appetite for data, the competition is only getting fiercer. It’s like watching a high-stakes game of chess, but instead of pawns and knights, the pieces are transistors and algorithms.

AI Fiber Frenzy

Hold onto your fiber optics, folks! Lumen Technologies reported just hit the jackpot in the AI-powered internet gold rush, securing a whopping $5 billion in new business faster than you can say “artificial intelligence.” It’s like Black Friday for data centers, with tech giants scrambling to hoard fiber capacity as if it were the last roll of toilet paper in a pandemic. But wait, there’s more! Lumen’s not stopping at $5 billion – they’re are apparently eyeing another $7 billion in potential deals, because why settle for a fortune when you can have a mega-fortune? To keep up with this insatiable appetite for data, Lumen’s planning to double its network faster than you can say “buffer,” and they’ve buddied up with Corning to create cables so dense, they’ll make your grandma’s fruit cake look light and fluffy. As Lumen’s CEO Kate Johnson puts it, this AI boom is like giving the internet a triple espresso shot – it’s going to be one wild ride, folks!

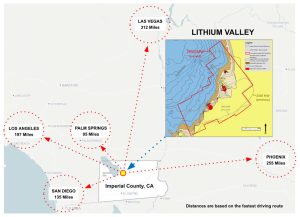

CalEthos’ AI Data Bonanza…

Hold onto your GPUs, folks! Little known CalEthos (GEDC) seemingly just scored the real estate deal of the century in the AI gold rush, snagging a whopping 315 acres in the soon-to-be-famous “Manufacturing Zone” of Lithium Valley. It’s like they’ve found the promised land for data centers, complete with all the bells and whistles an AI could dream of – if AIs could dream, that is. We’re talking prime real estate with more connections than a Silicon Valley networking event: high-voltage lines, geothermal power plants, and fiber optics galore.

But wait, there’s more! CalEthos isn’t just building any old data center – they’re planning a 420-megawatt campus that’ll make even the most power-hungry AI algorithms drool. It’s like they’re building a five-star resort for data, where ChatGPT and its cousins can vacation in style. And with plans to expand to 3 to 4 million square feet of data center space, it seems CalEthos is preparing for the day when AIs decide to take over the world – or at least dominate our internet searches. Who knew that the key to feeding our insatiable AI appetite would be found in a place called Lithium Valley? It’s like the entire tech industry decided to go on a lithium-powered diet!

Investor Interest

As the AI chip market heats up, investors are watching with bated breath, eager to cash in on the next big technological breakthrough. The frenzy surrounding these silicon marvels has turned the investment landscape into a virtual candy store, with venture capitalists and tech enthusiasts alike scrambling to get a piece of the action. This surge in interest has not only driven up stock prices for companies like Nvidia but has also sparked a wave of funding for AI startups and chip manufacturers, creating a ripple effect across the entire tech industry.