The global diabetes care market, valued at $18.9 billion in 2023, is projected to reach $35.8 billion by 2028, with the insulin pump segment expected to grow from $5.26 billion to $21.65 billion by 2032. As reported by Fortune Business Insights, this rapid growth is driven by increasing diabetes prevalence and technological advancements in insulin delivery devices. Modular Medical, Inc. (NASDAQ: MODD, $1.957, +6.36% and up +28.77% in the aftermarket at $2.52) is an insulin delivery system technology company preparing to launch a market expansion product with a more accessible, easier to prescribe, and easier to pay for and live with technology. Using its patented technologies, the company seeks to eliminate the tradeoff between complexity and efficacy, thereby making top quality insulin delivery both affordable and simple to learn. Their mission is to improve access to the highest standard of glycemic control for people with¬†diabetes taking it beyond ‚Äúsuperusers‚ÄĚ and providing ‚Äúdiabetes care for the rest of us.‚Ä̬†Modular Medical was founded by Paul DiPerna, a seasoned medical device professional and microfluidics engineer. Prior to founding Modular Medical, Mr. DiPerna was the founder (in 2005) of Tandem Diabetes and invented and designed its t:slim insulin pump. More information is available at https://modular-medical.com.

After the market’s close today (Wednesday, September 4, 2024), Modular Medical, Inc. announced it has received U. S. Food and Drug Administration (“FDA”) clearance to market and sell its MODD1 pump in the United States. With its commercial manufacturing infrastructure substantially established, the Company anticipates the MODD1 should be available for sale in early 2025. MODD1 is a patch pump for ALL adults with Type 1 and Type 2 diabetes

that is designed to be simpler and more affordable to expand access to diabetes technology for previously underserved communities.

James (Jeb) Besser, CEO of Modular Medical (NASDAQ: MODD)

“For too long, the benefits of superior glycemic control achieved by insulin pumps have, due to cost and complexity, been restricted to only the most sophisticated, motivated and well-insured users. The goal of Modular Medical has always been to change this by making diabetes technology accessible and affordable to underserved communities. We seek to make the experience of going ‚Äėon a pump’ simpler and less intimidating and to widen the base beyond the current pump users,” said Jeb Besser, CEO of Modular Medical.

Paul DiPerna, Chairman and President of Modular Medical

“I want to thank our employees for their hard work and dedication in bringing this product to the market and our shareholders for their ongoing support of the Company. We will continue to deliver on our mission of enabling ‚Äėdiabetes care for the rest of us’ and delivering on the needs of all patients and clinicians,” added Paul DiPerna, Chairman and President of Modular Medical.

Modular Medical, Inc. today also announced it will hold a conference call and webcast tomorrow, Thursday, September 5, 2024, at 8:30 a.m. Eastern Time to discuss the U. S. Food and Drug Administration (“FDA”) clearance of its MODD1 pump, as well as next steps and milestones.

Conference Call and Webcast Information

Date: September 5, 2024

Time: 8:30 a.m. Eastern Time (5:30 a.m. Pacific Time)

Conference Call Number: 1-888-506-0062

International Call Number: +1-973-528-0011

Passcode: 914895

Webcast: Click Here

Recently, in a move that‚Äôs sure to spice up the insulin pump manufacturing scene, Modular Medical announced, August 7, that it is packing its bags and heading south of the border. The company has begun transferring its pilot line manufacturing operations to a Phillips Medisize site in Queretaro, Mexico. Trusted for nearly 60 years, Phillips Medisize, a Molex company, is a global leader in front-end design, development and manufacturing solutions for highly regulated industries ‚ÄĒ pharma, in vitro diagnostics, med tech, consumer, automotive and defense. Operating as a single integrated collaborator, they ¬†help their customers reduce risk and achieve product realization quickly and efficiently. Their innovation, quality and reliability enhance the lives of millions of people around the world.¬†Modular Medical‚Äôs relocation is happening alongside the FDA‚Äôs ongoing 510(k) review of the MODD1 Insulin Delivery System. Chief Operating Officer Kevin Schmid confidently predicts that the manufacturing operation will be validated and ready for human-use production by early next year. The MODD1 system will be manufactured in a clean room in Queretaro, while the printed circuit board assembly will be crafted in Guadalajara, showcasing a truly international effort in diabetes care technology. Phillips Medisize, a Molex company, has been a crucial partner in developing Modular Medical’s platform product, supply chain, and manufacturing operations. Their collaboration extends beyond basic manufacturing, providing expertise in injection molding, packaging, electronics design, and assembly operations. This partnership has been instrumental as Modular Medical transitions from pre-commercial production to high-volume device manufacturing. The collaboration leverages Phillips Medisize’s global and diversified supplier base, enabling the design and development of manufacturing capabilities specifically tailored for the MODD1 Insulin Delivery System. Phillips Medicine was founded in 1964 in Phillips, WI, employs¬†6 thousand employees worldwide, has¬†24 manufacturing locations in 11 countries, including 5 R&D centers globally¬†2.5M+ square feet of manufacturing space, & maintains¬†Class 7 & 8 cleanrooms and tool building sites. The insulin pump market is experiencing robust growth, with a valuation of USD 6.05 billion in 2023 and a projected compound annual growth rate (CAGR) of 8.22% from 2024 to 2030. This expansion is driven by technological advancements, increasing diabetes prevalence, and a growing elderly population. Key players in the market include Medtronic (MDT), Abbott Laboratories (ABT), Roche Diagnostics & Tandem Diabetes Care, Inc (TNDM). The global diabetes care devices market is expected to reach USD 52.34 billion by 2029, growing at a CAGR of 12.22% from 2024 to 2029. This growth is fueled by rising healthcare spending, increased awareness about diabetes management, and the development of innovative devices like continuous glucose monitors and automated insulin delivery systems.

Gain Further Insights From The CEO of Modular Medical…

On Friday, August 9, our sister organization, Tribe Public (www.TribePublic.com), hosted a brief CEO Presentation and Q&A Webinar-based event with Jeb Besser, CEO of Modular Medical (NASDAQ: MODD) titled¬†‚ÄúDiabetes Care Innovator Modular Medical Takes Next Steps.‚ÄĚ Please learn more by clicking on the video link below:¬†

Diabetes Market Growth

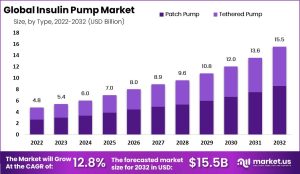

The diabetes care industry is experiencing a sugar rush of growth, with projections sweeter than a bowl of candy. Did you know that 1 in 4 healthcare dollars in the US are spent on diabetes and diabetes related complications? By 2028, experts predict the market will balloon to an estimated $35.8 billion, representing a compound annual growth rate (CAGR) of 13.6%. This rapid expansion is fueled by factors such as increasing diabetes prevalence and technological advancements in treatment options. The insulin pump segment, in particular, is pumping up profits at an even faster rate, with a projected CAGR of 17.2% from 2023 to 2032. This growth trajectory suggests that diabetes care is becoming an increasingly lucrative field, with opportunities as abundant as carbs at a pasta buffet.

Insulin Pump Market Projections

The insulin pump market is set for explosive growth, with projections indicating a surge from $5.26 billion in 2023 to a staggering $21.65 billion by 2032. This represents a compound annual growth rate (CAGR) of 17.2%, outpacing the overall diabetes care market. The rapid expansion is driven by increasing adoption of advanced diabetes management technologies and a growing preference for continuous insulin delivery systems over traditional methods. Analysts predict that by 2027, pump adoption among patients with type 1 diabetes could reach approximately 65% in the U.S. and 20% in international markets. However today, only 1 in 3 Americans with type 1 diabetes use a pump. This number has been materially unchanged for 15 years. Also, only 8% of insulin dependent Americans with type 2 diabetes use a pump, but this number is just starting to rise…

Key Insulin Pump Companies

Leading the charge in the insulin pump market are industry giants Medtronic (MDT), Abbott Laboratories (ABT), and Roche Diagnostics. These companies dominate the landscape, offering innovative solutions for diabetes management. Emerging players like Tandem Diabetes Care (TNDM) are also making waves, with ambitious predictions for market penetration. Other notable contenders include F. Hoffmann-La Roche Ltd., which launched the mySugr Pump Control app in May 2021, allowing patients to control their pumps directly via smartphone.

Insulin Pump Adoption Rates

Adoption rates for insulin pumps are on the rise, with Tandem Diabetes Care projecting significant growth by 2027. In the United States, pump usage among type 1 diabetes patients is expected to reach approximately 65%, but currently it is only at the approx. 20% level. This trend reflects the increasing preference for advanced diabetes management technologies over traditional insulin delivery methods. The shift is driven by the pumps’ ability to provide more precise insulin dosing, improved glucose control, and enhanced quality of life for users, but the current pumps have there issues that have restrained further adoption to date.