The global diabetes care market, valued at $18.9 billion in 2023, is projected to reach $35.8 billion by 2028, with the insulin pump segment expected to grow from $5.26 billion to $21.65 billion by 2032. As reported by Fortune Business Insights, this rapid growth is driven by increasing diabetes prevalence and technological advancements in insulin delivery devices.

Diabetes Market Growth

The diabetes care industry is experiencing a sugar rush of growth, with projections sweeter than a bowl of candy. Did you know that 1 in 4 healthcare dollars in the US are spent on diabetes and diabetes related complications? By 2028, experts predict the market will balloon to an estimated $35.8 billion, representing a compound annual growth rate (CAGR) of 13.6%. This rapid expansion is fueled by factors such as increasing diabetes prevalence and technological advancements in treatment options. The insulin pump segment, in particular, is pumping up profits at an even faster rate, with a projected CAGR of 17.2% from 2023 to 2032. This growth trajectory suggests that diabetes care is becoming an increasingly lucrative field, with opportunities as abundant as carbs at a pasta buffet.

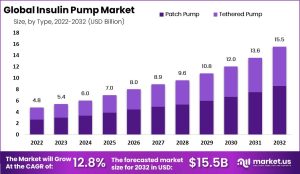

Insulin Pump Market Projections

The insulin pump market is set for explosive growth, with projections indicating a surge from $5.26 billion in 2023 to a staggering $21.65 billion by 2032. This represents a compound annual growth rate (CAGR) of 17.2%, outpacing the overall diabetes care market. The rapid expansion is driven by increasing adoption of advanced diabetes management technologies and a growing preference for continuous insulin delivery systems over traditional methods. Analysts predict that by 2027, pump adoption among patients with type 1 diabetes could reach approximately 65% in the U.S. and 20% in international markets. However today, only 1 in 3 Americans with type 1 diabetes use a pump. This number has been materially unchanged for 15 years. Also, only 8% of insulin dependent Americans with type 2 diabetes use a pump, but this number is just starting to rise…

Key Insulin Pump Companies

Leading the charge in the insulin pump market are industry giants Medtronic (MDT), Abbott Laboratories (ABT), and Roche Diagnostics. These companies dominate the landscape, offering innovative solutions for diabetes management. Emerging players like Tandem Diabetes Care (TNDM) are also making waves, with ambitious predictions for market penetration. Other notable contenders include F. Hoffmann-La Roche Ltd., which launched the mySugr Pump Control app in May 2021, allowing patients to control their pumps directly via smartphone.

Insulin Pump Adoption Rates

Adoption rates for insulin pumps are on the rise, with Tandem Diabetes Care projecting significant growth by 2027. In the United States, pump usage among type 1 diabetes patients is expected to reach approximately 65%, but currently it is only at the approx. 20% level. This trend reflects the increasing preference for advanced diabetes management technologies over traditional insulin delivery methods. The shift is driven by the pumps’ ability to provide more precise insulin dosing, improved glucose control, and enhanced quality of life for users, but the current pumps have there issues that have restrained further adoption to date.

New MODD1 Insulin Pump Seeks To Grow Adoption Significantly…

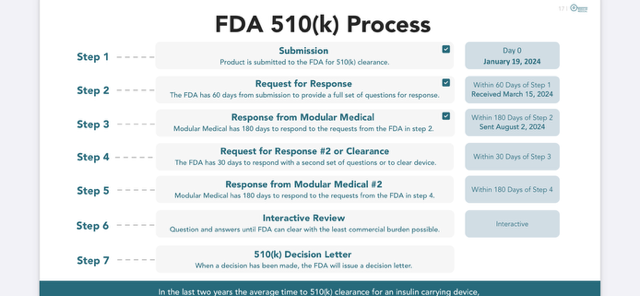

Modular Medical (NASDAQ: MODD), a development-stage insulin delivery technology company, submitted its MODD1 next-generation insulin pump to the FDA for 510(k) clearance process earlier this year on January 19, 2024. The company aims to revolutionize the diabetes market by addressing the “three-Cs” that have hindered pump adoption: complexity, cumbersomeness, and cost. The MODD1 is designed to be user-friendly and affordable, featuring a two-part patch pump design, an easy-to-learn interface, and scalable manufacturing. Paul DiPerna, Chairman and CTO of Modular Medical, believes that their simplified design will encourage “almost-pumpers” to adopt the technology without the complexity and expense of current solutions. As the company awaits FDA feedback, it plans to prepare applications for UKCA mark approval in the United Kingdom and move its pilot production line to a manufacturing partner in preparation for commercial launch.

MODD1 Is Making FDA Progress

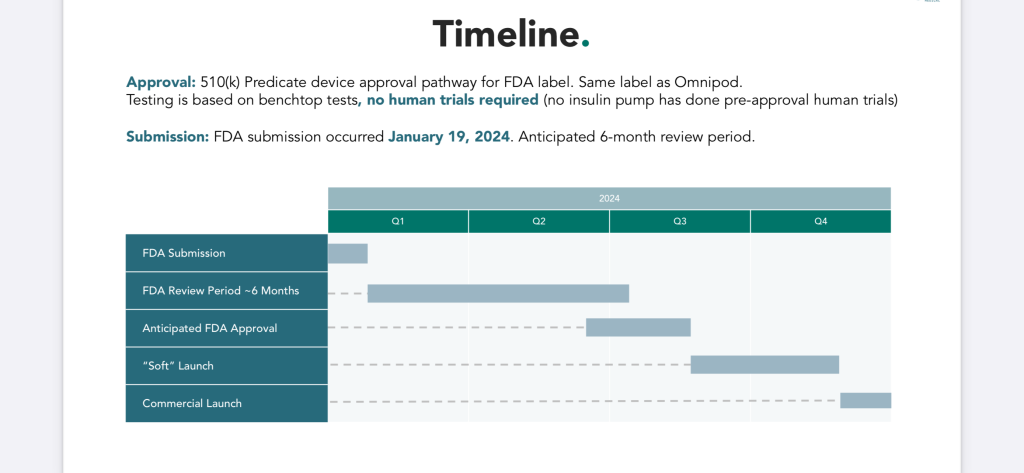

Timeline For MODD1?…

On Friday, August, 2, 2024, Modular Medical confirmed that they had taken the next step in their FDA process where they submitted their response to The FDA’s questions. See the detailed process outlined above from Modular Medical’s presentation that was updated this past Friday. Also see, the Modular Medical Timeline presentation slide that depicts a timeline for the FDA Clearance process for 2024.

How Modular Medical’s MODD1 Lower Insulin Pump Costs

Modular Medical aims to revolutionize insulin pump technology with its MODD1 device, designed to be more affordable and user-friendly than existing options. As reported by Medical Device Network, the company recently submitted the MODD1 for FDA 510(k) clearance, positioning it as a simplified solution for the 75% of potential users who currently opt out of pump therapy due to complexity and cost barriers.

Simplified Pump Design

The MODD1 features a user-friendly interface with a one-button bolus delivery system, eliminating the need for extensive training. This intuitive design includes a simple light system (red, yellow, green) to indicate operational status, and allows users to monitor pump activity via their smartphones without requiring an external controller. By streamlining the user experience, Modular Medical aims to reduce the complexity that has historically deterred potential pump users, making insulin pump therapy more accessible to a broader population.

Cost-Effective Manufacturing

Leveraging innovative microfluidics technology, the MODD1 insulin pump is designed for low-cost production. This approach, combined with a scalable manufacturing process, enables Modular Medical to keep production costs down while maintaining quality. The company’s two-part patch pump design and easy-to-learn interface contribute to a differentiated, lower-cost marketing approach. By moving their pilot production line to a manufacturing partner, Modular Medical is preparing for a commercial launch that can meet demand while maintaining affordability.

Affordable Consumables

The MODD1 utilizes a 90-day reusable pump body paired with three-day consumable insulin cartridges, significantly reducing the frequency and cost of replacements. This design, along with a single-use disposable battery, minimizes ongoing expenses for users. The pump’s 300-unit/3mL reservoir capacity matches other insulin pumps on the U.S. market, ensuring compatibility with standard insulin volumes while maintaining cost-effectiveness.

Targeting ‘Almost-Pumpers’

The MODD1 is strategically positioned to appeal to “almost-pumpers” – individuals who could benefit from insulin pump therapy but have been deterred by the complexity and cost of existing options[1]. By addressing the “three-Cs” – complexity, cumbersomeness, and cost – Modular Medical aims to expand the adoption of insulin pump technology. This approach targets the estimated 75% of potential users who currently opt for multiple daily injections instead of pumps, potentially reducing healthcare costs and improving long-term patient outcomes.