Wednesday’s Markets Proved To Be Too Slippery As Investors Headed For The Exit Towards The Close!

- Published Mar 24, 2021

- Apple

- Current Coverage

- Fate Therapeutics, Inc.

- Market News

Happy Wednesday!

I hope that all of you had a wonderful day and found ways to make money in the markets. Today’s markets started off fairly well and even felt sort of positive for a good portion of the day, that is, until somewhere around the second half when it seemed the market’s floors got a bit too slippery and many investors started heading for the exits. Overall, the markets suffered from a number of fears including the fact that the markets had had hot all time highs. in addition, we worldwide web is reporting the news of additional COVID-19 lockdown headlines surfacing in Europe (Germany, Italy, Netherlands,…), our good neighbors to the north (Canada) who’s slow vaccination program combined with more contagious virus variants are pushing push them into a third wave of coronavirus infections, stories about ‘Long COVID’ symptoms, and now from the cruise industry we were informed that the CDC is keeping cruise line restrictions in play until Nov. 1, 2021.

Adding to investor’s worries and sobering mood today, was the fact that many of the beloved and highly weighted names were suffering throughout the day. In fact, the communication services sector fell 1.7%, the consumer discretionary sector dropped 1.5%, & the information technology sector lost 1.2%. The FAANG’s ended follows: Apple (AAPL) shares closed at $120.09, -2%, Amazon (AMZN) closed at $3,087.07, -1.61%, Alphabet (GOOG) closed at $2,045.06, -.38%%, Facebook (FB) closed at $282.14, -2.92%, & Netflix (NFLX) closed at $520.81/share, -2.67%. EV giant Tesla (TSLA) closed at $630.27, -4.82%. Cathie Wood’s ARK Innovation ETF (ARKK), highly weighted in Tesla (10.63%), obviously fell today as it closed $114.78, -5.7%.

The macroeconomic schedule did not give us to much to get excited about either. The Durable goods orders report confirmed a 1.1% drop month/month in February. The IHS final Markit Manufacturing PMI for March came in at 59 while the final Services PMI for March was 60. The weekly MBA Mortgage Applications Index dropped by 2.5%.

At the end of the day all indices headed down today with the Russell 2000 taking the worst hit again today as it closed at 2,134.17 (-2.35%) dropped another 2.35% on top of yesterday’s sizable 3.58% fall. The Nasdaq also closed down more than 2 points closing at 12,961.89 (-2.01%). The S&P 500 closed at 3,889.14 (-.55%) after rising as much as .8% in the early going’s today. The Dow ended up fairing the best as it closed at 32,420.06 (-.01%) as gained strength from the energy sector which closed up 2.5%, the industrials & the materials sectors which equally rose .7% and the financials sector which added .4%.

The yields keep somewhat in check today as the 10-yr yield fell 3 basis points to end at 1.61% while the U.S. dollar ticked up .3% to end at 92.58. The short term 2-yr yield fell 1 basis point to end at .14%.

Tomorrow, the macroeconomic schedule will deliver the Initial and Continuing Claims report & the third estimate for Q4 GDP.

BIOTECH/HEALTHCARE

The iShares Nasdaq Biotechnology ETF (IBB) closed at 147.31, -2.84 (now 6.77% in 2-days) while the NYSE ARCA Biotech Index (^BTK) closed at 5,329.50, -2.16%.

GOLD, SILVER, ITRO

The iShares Silver Trust ETF (SLV) closed at $23.24, +.09% & the SPDR Gold Shares (GLD) closed at $162.37, +.35%. Silver prices closed at $25.13/oz, -.02. Gold prices closed at 1,735, +$7.

Itronics (ITRO) shot up +64% to close at $2.05/share after it reported that it has initiated planning for a Rock Kleen processing project to demonstrate the revolutionary technology for recovering silver, gold, copper, iron, and industrial minerals from mine tailings. The Company describes itself as an emerging “Cleantech Materials” growth Company that manufactures GOLD’n GRO Multi-Nutrient Fertilizers and produces silver, gold, zinc, and critical minerals recovered from industrial and mining waste. The company now clocks in with a $5.206B market cap.

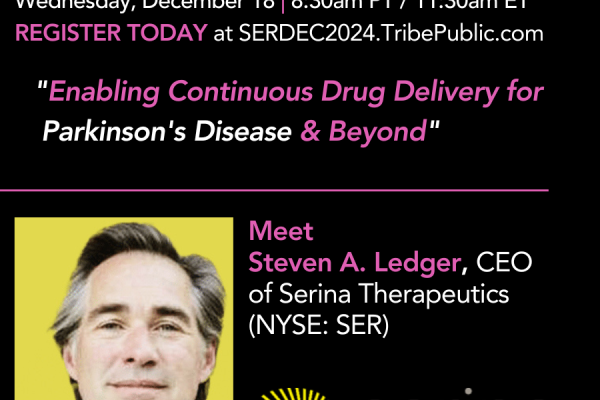

INTEL DROPS 20 LARGE

Tech giant and Dow 30 component Intel (INTC) ($62.04, -2.3%) announced that they will be investing $20B to build two semiconductor manufacturing facilities in Arizona.

VP WATCHLIST HIGHLIGHTS

- Shares of next generation of gene silencing therapy firm NeuBase Therapeutics (NBSE) closed trading at $7.54, -4.56% after recently reaching a new all-time high of $12.89. Recently, Neubase reported its financial results for the three-month period ended December 31, 2020. Review the story here.

-

- Oppenheimer’s analyst Hartaj Singh recently reiterated his OUTPERFORM Rating and his Price Target of $17.

-

- Recently, NeuBase announced the execution of a binding agreement to acquire infrastructure, programs and intellectual property for several peptide-nucleic acid (PNA) scaffolds from Vera Therapeutics, formerly known as TruCode Gene Repair, Inc. The technology has demonstrated the ability to resolve disease in genetic models of several human indications. The acquisition was reported to bolster NeuBase’s capabilities and reinforces the Company’s position as a leader in the field of genetic medicine. Read the complete story.

-

- NeuBase is developing the next generation of gene silencing therapies with its flexible, highly specific synthetic antisense oligonucleotides. The proprietary NeuBase peptide-nucleic acid (PNA) antisense oligonucleotide (PATrOL™) platform allows for the rapid development of targeted drugs, increasing the treatment opportunities for the hundreds of millions of people affected by rare genetic diseases, including those that can only be treated through accessing of secondary RNA structures. Using PATrOL technology, NeuBase aims to first tackle rare, genetic neurological disorders.

-

- Largest shareholders include David Einhorn’s Greenlight Capital Inc (9%).

-

- We expect to see the company to announce an update on its work in Huntington’s Disease and also sign a corporate deal of some kind prior to the end of April 2021 based on recent conversations & expectations of management.

-

Natural-Killer cell (NKcell) focused biopharmaceutical firm Fate Therapeutics (FATE) closed at $81.98/share, -5.98% after recently establishing a new all-time high of $121.16.

- Recently, Fate Therapeutics (FATE) reported business highlights and financial results for the fourth quarter ended December 31, 2020.

-

FATE also recently announced the pricing of an underwritten public offering of ~$432 million at $85.50/share. Jefferies, BofA Securities, SVB Leerink and Barclays acted as joint book-running managers for the offering.

-

We started with Fate over 3 years ago when it was in the $3 range.

-

Recently, Fate presented a patient case study from the Company’s Phase 1 clinical trial of FT596, its universal, off-the-shelf, CD19-targeted chimeric antigen receptor (CAR) natural killer (NK) cell product candidate, at the 62nd Annual Society of Hematology Annual Meeting and Exposition and the street loved it. NK cells are the body’s first line of defense against viral infections and cancerous cells with an innate ability to rapidly seek and destroy transformed cells. NK cell therapy has the potential to 1) target multiple pathogenic antigens with measurably more efficient cytotoxicity, 2) be better controlled to reduce risk of cytokine storms and 3) be produced from a variety of sources without relying on patient-specific immune cells. Dr. Wayne Chu, Senior Vice President, Clinical Development of Fate Therapeutics stated, “The safety, pharmacokinetics and clinical activity observed following both the first and second single-dose treatment cycles of FT596 are compelling, especially when considering that the administered cell dose was significantly lower than the recommended cell dose of FDA-approved autologous CD19-targeted CAR T-cell therapies and that the heavily pre-treated patient was refractory to last prior therapy. We are excited the CAR component of FT596 has shown clinical activity at this low dose level, and we continue to enroll patients in dose escalation with FT596 as a monotherapy and in combination with rituximab.”

- Shares of infertility treatment innovator, INVO Bioscience (NASDAQ: INVO) closed at $4.39 with an average daily volume of 1.97M. The trading session took shares down to $4.19 today, but then the stock walked back up to $4.46 in the aftermarkets as the stock swung nicely. INVO’s Management Issued a letter to shareholders on Jan. 7 that spoke to their key developments and future initiatives that have positioned their product INVOcell® within the severely underserved fertility market. PLEASE read the story here.

-

- Last week, INVO announced the signing of a 50/50 joint venture agreement in partnership with reproductive specialists Dr. Nicholas Cataldo, MD, MPH, Dr. Karen R. Hammond, DNP, CRNP, and Lisa Ray, MS, ELD, to open the first Joint Venture INVO-exclusive clinic in the United States.

-

- Recently, INVO announced that they has agreed to an amendment of their agreement with Ferring Pharmaceuticals that provides for an increase in the number of INVO company-owned US-based clinics initially allowable under the agreement and removes certain geographical restrictions. The amendment also adjusted the remaining annual 2020 minimum contractual product purchase requirement, whereby Ferring will place a $501,000 order, which will be recognized as revenue by INVO Bioscience in the first quarter of 2021. READ STORY.

-

- Recently, INVO announced the Company has received approval by COFEPRIS to import INVOcell into Mexico. In late 2020, INVO Bioscience established a joint venture focused on establishing fertility centers dedicated to offering INVOcell, with the initial center, called Positib Fertility, to be located in the city of Monterrey, Mexico. Steve Shum, CEO of INVO Bioscience, commented, “We are extremely pleased to have received approval by COFEPRIS to begin importing INVOcell into Mexico. This was a key step in the process to open our first joint venture owned clinic in the large and growing Mexico market for infertility services. Our internal team along with our JV partners have and continue to work aggressively and with a relentless focus to bring the INVOcell treatment option to the many patients in need of care within Mexico.”

-

- Recently, INVO announced that it has advanced its commercialization efforts into the European fertility market by securing initial orders of INVOcell in Madrid and Barcelona, Spain. INVOcell will initially be available at three separate existing fertility clinics which have placed orders and commenced training. Please read the story here.

-

- INVO is a medical device company focused on creating alternative treatments for patients diagnosed with infertility and developers of INVOcell®, the world’s only in vivo Intravaginal Culture System. Industry forecasts suggest that only 1% to 2% of the estimated 150 million infertile couples worldwide are currently being treated. INVO’s mission is to increase access to care and expand infertility treatment across the globe with a goal of improving patient affordability and industry capacity. Since January 2019, INVO Bioscience has signed commercialization agreements in the United States, India, as well as parts of Africa and Eurasia and Mexico for the INVOcell device.

- INVO is a medical device company focused on creating alternative treatments for patients diagnosed with infertility and developers of INVOcell®, the world’s only in vivo Intravaginal Culture System. Industry forecasts suggest that only 1% to 2% of the estimated 150 million infertile couples worldwide are currently being treated. INVO’s mission is to increase access to care and expand infertility treatment across the globe with a goal of improving patient affordability and industry capacity. Since January 2019, INVO Bioscience has signed commercialization agreements in the United States, India, as well as parts of Africa and Eurasia and Mexico for the INVOcell device.

- Shares of Chinook Therapeutics (KDNY), a clinical-stage biotechnology company developing precision medicines for kidney diseases, closed today at $18.04/share, -2.35% and has been steadily rising from the $14 range over the last 4-weeks.

-

-

On March 16, Chinook announced that the first patient with IgA nephropathy (IgAN) has been enrolled in the ALIGN Study, a pivotal phase 3 clinical trial evaluating the efficacy and safety of atrasentan, a potent and selective inhibitor of the endothelin A receptor. “The initiation of the phase 3 ALIGN Study is an important milestone for Chinook as we advance our pipeline of programs for rare, severe chronic kidney diseases,” said Alan Glicklich, M.D., chief medical officer of Chinook. “Atrasentan has been studied in over 5,300 diabetic kidney disease patients in the phase 2 RADAR and phase 3 SONAR studies, demonstrating rapid, sustained proteinuria reductions of approximately 30 to 35 percent as well as improved eGFR. Importantly, treatment with atrasentan also resulted in a reduction in clinical outcomes of development of end-stage kidney disease and doubling of serum creatinine. We look forward to exploring the proteinuria-lowering, anti-inflammatory and anti-fibrotic effects of atrasentan in patients with IgA nephropathy, a serious progressive disease for which there are no approved therapies.”

- On March 1, Chinook and Evotec SE announced a strategic collaboration focused on the discovery and development of novel precision medicine therapies for patients with chronic kidney diseases. Based on Evotec’s proprietary comprehensive molecular datasets from thousands of patients across chronic kidney diseases of multiple underlying etiologies, Chinook and Evotec will jointly identify, characterize and validate novel mechanisms and discover precision medicines for PKD, lupus nephritis, IgA nephropathy and other primary glomerular diseases. The collaboration will also involve further characterization of pathways and patient stratification strategies for programs currently in Chinook’s clinical and preclinical pipeline. “We are excited to embark on this strategic collaboration with Evotec, the leading drug discovery alliance and development partner in nephrology,” said Andrew King, D.V.M., Ph.D., Head of Renal Discovery and Translational Medicine at Chinook. “Gaining access to the NURTuRE cohort study and other proprietary patient biobanks, along with Evotec’s multi-omics integration platform, will enable us to define the molecular drivers of kidney diseases, identify novel targets for drug development in selected patient sub-populations and continue to build the foundation for our precision medicine approach. With a focus on comprehensive molecular disease classification, combined with prospective clinical outcomes, Chinook has the opportunity to potentially deliver targeted therapies to the right patient populations.”

-

-

- Recently, Chinook announced that the U.S. Food and Drug Administration (FDA) has granted rare pediatric disease designation for CHK-336, an investigational oral small molecule inhibitor of lactate dehydrogenase A (LDHA) for primary hyperoxaluria (PH). PH is a group (PH1, PH2 and PH3) of ultra-rare genetic diseases caused by enzyme mutations that result in excess oxalate production in the liver, and in its most severe forms, can lead to end-stage kidney disease at a young age. Inhibition of LDHA with CHK-336 allows for the potential to treat all forms of PH and other disorders arising from excess oxalate, while its liver-targeted tissue distribution profile enables maximal inhibition of liver oxalate production with minimal systemic exposure. Please read the story here.

- Shares of Seattle-based Atossa Therapeutics, Inc. (Nasdaq: ATOS), a clinical stage biopharmaceutical company seeking to discover and develop innovative medicines in areas of significant unmet medical need with a current focus on breast cancer and COVID-19, closed at $2.16, -9.62%.

-

- On Monday, March 22, Atossa announced that it had entered into a securities purchase agreement with institutional investors to purchase $50 million of its shares of common stock and warrants in a registered direct offering priced at-the-market under Nasdaq rules. Read Story. Atossa has now raised ~$141M in gross proceeds (via registered directs and warrant exercises) since Dec. 2020 affording the company a significant development runway and many more options to be considering including acquisitions.

-

- On March 11, Atossa announced the FDA has issued a “Safe to Proceed” letter under their Expanded Access Pathway, permitting the use of Atossa’s oral Endoxifen as a treatment in an ovarian cancer patient. The patient is being treated at the University of Washington Medical Center by Dr. Barbara Goff, Surgeon-in-Chief. Under the FDA expanded access program, the use of Atossa’s proprietary oral Endoxifen is restricted solely to this patient. Approval from the Institutional Review Board (IRB) must be obtained prior to providing oral Endoxifen to this patient. READ today’s story.

-

- On Feb. 25, Atossa announced final results from its Phase 1 double-blinded, randomized, placebo-controlled clinical study using Atossa’s proprietary drug candidate AT-301 administered by nasal spray. AT-301 was considered to be safe and well tolerated in healthy male and female participants in this study at two different dose levels over 14 days. AT-301 is being developed for at home use for patients recently diagnosed with COVID-19. There are currently no FDA-approved therapies to treat COVID-19 at home. Steven Quay, M.D., Ph.D., Atossa’s President and CEO stated, “The results from this study are very encouraging and we look forward to quickly commencing the next study of AT-301. We recently received input from the FDA on this program and based in part on that input, we are now preparing to conduct an additional pre-clinical study, which we expect to start this quarter. Following that, we expect to apply to the FDA to commence a Phase 2 study here in the United States.”

-

- Early in February, Atossa’s President and CEO Dr. Steven C. Quay issued his annual Letter to Stockholders highlighting key accomplishments and strategy for 2021. Please view it here.

Please review our complete VP Watchlist that includes nine highlighted companies. The pages will allow you to learn more and keep up with these companies daily.

Also, please make sure that you check out the interesting quotes and selected videos that we have highlighted below.

Economic Reports

- On Monday, the macroeconomic schedule produced the Existing home sales report, which showed a significant drop of 6.6% month/month in February now showing a seasonally adjusted annual rate of 6.22M. However, the Total sales report in February confirmed a rise of 9.1% over a year ago.

- On Tuesday, the new home sales report confirmed an 18.2% month/month drop in February to a seasonally adjusted annual rate of 775k.

- On Wednesday, the Durable goods orders report confirmed a 1.1% drop month/month in February. The IHS final Markit Manufacturing PMI for March came in at 59 while the final Services PMI for March was 60. The weekly MBA Mortgage Applications Index dropped by 2.5%.

Investing & Inspiration

- “Investing puts money to work. The only reason to save money is to invest it.” – Grant Cardone

- “As time goes on, I get more and more convinced that the right method of investment is to put fairly large sums into enterprises which one thinks one knows something about and in the management of which one thoroughly believes.” — John Maynard Keynes

- “Given a 10% chance of a 100 times payoff, you should take that bet every time.” — Jeff Bezos

- “Money is always eager and ready to work for anyone who is ready to employ it.” ― Idowu Koyenikan

- “The secret to investing is to figure out the value of something – and then pay a lot less.” – Joel Greenblatt

- “We don’t have an analytical advantage, we just look in the right place.” – Seth Klarman

- “Men, it has been well said, think in herds. It will be seen that they go mad in herds, while they only recover their senses slowly, and one by one.” – Charles Mackay

- “It’s not whether you’re right or wrong that’s important, but how much money you make when you’re right and how much you lose when you’re wrong.” – George Soros

- “No Price is too low for a bear or too high for a bull.” — Anonymous

- “Investment is an asset or item that is purchased with the hope that it will generate income or appreciate in the future.” Anonymous

- “Behind every stock is a company. Find out what it’s doing.” — Peter Lynch

- “Wise spending is part of wise investing. And it’s never too late to start.” –Rhonda Katz

- “It amazes me how people are often more willing to act based on little or no data than to use data that is a challenge to assemble.” ― Robert Shiller

- “A bull market is like sex. It feels best just before it ends.” — Barton Biggs

- “The investor’s chief problem — even his worst enemy — is likely to be himself.” — Benjamin Graham

- “No profession requires more hard work, intelligence, patience, and mental discipline than successful speculation.” – Robert Rhea

- “Money is like a sixth sense – and you can’t make use of the other five without it.” – William Somerset Maugham

- “Compound interest is the eighth wonder of the world. He who understands it, earns it. He who doesn’t, pays it.” — Albert Einstein

- “Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good results” — Warren Buffett

- “The stock market is a device for transferring money from the impatient to the patient.” – Warren Buffett

- “Thousands of experts study overbought indicators, head-and-shoulder patterns, put-call ratios, the Fed’s policy on money supply…and they can’t predict markets with any useful consistency, any more than the gizzard squeezers could tell the Roman emperors when the Huns would attack.” – Peter Lynch

- “Investing puts money to work. The only reason to save money is to invest it.” – Grant Cardone

- “You cannot save time for your future use however you can invest time for your future.” – John F. Heerdink, Jr.

- “Know what you own, and know why you own it.” – Peter Lynch

- “Liquidity is only there when you don’t need it.” -Old Proverb

- “If you want to be a millionaire, start with a billion dollars and launch a new airline.” – Richard Branson

- “Fear incites human action far more urgently than does the impressive weight of historical evidence.” – Jeremy Siegel

- “In investing, what is comfortable is rarely profitable.” – Robert Arnott

- “Spend each day trying to be a little wiser than you were when you woke up.” – Charlie Munger

- “The entrance strategy is actually more important than the exit strategy.” – Edward Lampert

- “The rivers don’t drink their own water; Trees don’t eat their own fruits. The sun does not shine for itself, And flowers do not spread their fragrance For themselves. Living for others is a rule of nature” – Pope Francis

- “It is impossible to produce superior performance unless you do something different from the majority.” – John Templeton

- “An investment in knowledge pays the best interest.” – Benjamin Franklin.

- “I believe the returns on investment in the poor are just as exciting as successes achieved in the business arena, and they are even more meaningful!” -Bill Gates

- “Every portfolio benefits from bonds; they provide a cushion when the stock market hits a rough patch. But avoiding stocks completely could mean your investment won’t grow any faster than the rate of inflation.” – Suze Orman

- “The tax on capital gains directly affects investment decisions, the mobility, and flow of risk capital… the ease or difficulty experienced by new ventures in obtaining capital, and thereby the strength and potential for growth in the economy.” – John F. Kennedy

- “If all the economists were laid end to end, they’d never reach a conclusion. -George Bernard Shaw

- “There are old traders and there are bold traders, but there are very few old, bold traders.”-Ed Seykota

- “Let this scenario play out on its own, in its own fashion. As you watch it unfold, you will soon be grateful that you choose the peaceful path. Remember — those who live by the sword, die by the sword.”

- “As long as you enjoy investing, you’ll be willing to do the homework and stay in the game.” -Jim Cramer

- “I rarely think the market is right. I believe non-dividend stocks aren’t much more than baseball cards. They are worth what you can convince someone to pay for it.” -Mark Cuban

- “Michael Marcus taught me one other thing that is absolutely critical: You have to be willing to make mistakes regularly; there is nothing wrong with it. Michael taught me about making your best judgment, being wrong, making your next best judgment, being wrong, making your third best judgment, and then doubling your money.” -Bruce Kovner

- “The policy of being too cautious is the greatest risk of all.” -Jawaharlal Nehru

- “The only true test of whether a stock is “cheap” or “high” is not its current price in relation to some former price, no matter how accustomed we may have become to that former price, but whether the company’s fundamentals are significantly more or less favorable than the current financial-community appraisal of that stock.” -Philip Fisher

- “I learned to avoid trying to catch up or double up to recoup losses. I also learned that a certain amount of loss will affect your judgment, so you have to put some time between that loss and the next trade.” -Richard Dennis

- “The four most dangerous words in investing are: ‘this time it’s different.” -Sir John Templeton

- “Money doesn’t make you happy. I now have $50 million but I was just as happy when I had $48 million.” -Arnold Schwarzenegger

Videos

Please consider viewing these interesting videos:

Post View Count : 501