Interest Rates Move Higher As Stocks Drift Again On Thursday – $BTC $COIN $GPC $ELV $META $MODD $SHIP Rise!

Happy Thursday!

I hope that the day moved on in grand fashion for you and yours.

As for the broad market stock indices, stocks drifted lower again widely as interest worries persist, except the Dow 30, which edged higher. The macroeconomic schedule offered up a number of reports that included the Weekly Initial Claims report that came below expectations at 212k, while the Weekly Continuing Claims came at 1.812M. The March Existing Home Sales report clocked in slightly lower than expected at 4.19M, while the March Leading Indicators report was at -.3%. In turn, the yield curve moved higher with the 2-yr note yield closing at 4.995%, up 5bps and the 10-yr note yield closing at 4.65%, +6bps.

Oil prices closed lower again at $82.53, -.19%. Gold prices closed at $2,382, +$17/oz. & silver closed at $28.26, +$.06/oz. on the day. The SPDR Gold Shares ETF (GLD) closed at $220.34, +.34% today and up 18.30% over the last year. The US Dollar Index also closed at $106.17, +.21%, while the CBOE Volatility Index (^VIX) closed at $18.00, -1.15% and hit a high of $18.30 during intraday trading.

At the end of today’s session the Dow 30 closed at 37,775.38 (+.06%).

The S&P 500 closed at 5,011.12 (-.22%) and drifting lower for the 5th consecutive day. Of note, Genuine Parts (GPC) closed at $160.23, +11.2% after beating earnings expectations and highlighting Sales of $5.8 billion, Up 0.3%, Diluted EPS of $1.78, Down 16.8%, Adjusted Diluted EPS of $2.22, Up 3.7% & Updates 2024 Outlook: Reaffirms Revenue Growth of 3% to 5% & Updates Adjusted Diluted EPS to $9.80 to $9.95 from $9.70 to $9.90.

The Nasdaq closed at 15,601.50 (-.52%), while Cathie Wood’s ARK Innovation ETF (ARKK) closed at $42.91, -.26%. The market leading mega cap Magnificent Seven closed as follows: Alphabet (GOOG) closed at $157.46, +.37%, Amazon (AMZN) closing at $179.22, -1.14%, Apple (AAPL) closing at $167.04, -.57%, Meta Platforms (META) closing at $501.80, +1.54%, Microsoft (MSFT) closing at $4040.27, -1.84%, NVIDIA (NVDA) closing at $846.71, +.76%, & Tesla (TSLA) closed at $149.93, -3.55%.

The small caps on the Russell 2000 closed at 11,942.96 (-.26%).

Biotech stocks on the SPDR S&P Biotech ETF (XBI) closed at $83.48, -1.38% and now off 10.19% over the last month. The 52-wk range is $63.80-$103.52. The iShares Biotechnology ETF (IBB) closed at $124.64, -.99%. The 52-range is $111.83 – $141.16. The iShares U.S. Healthcare ETF (IYH) closed at $58.05, -.02%. Elevance Health (ELV) closed at $525.19, +3.2% after beating earnings expectations highlighting 1Q 2024 operating revenue of $42.3 billion, up 0.9% from 1Q 2023, 1Q 2024 diluted EPS1 of $9.59, up 15.5% from 1Q 2023 and adjusted diluted EPS2 of $10.64, up 12.5%, FY 2024 diluted EPS and adjusted diluted EPS guidance raised to greater than $34.05 and $37.20, respectively & Launching strategic partnership to advance primary care and physician enablement. Netflix (NFLX $610.56, -.51%) stock has dropped post and aftermarket earnings report & subscriber growth beat the streets’ expectations, however Q2 revenue guidance disappointed.

The SPDR S&P Regional Banking ETF (KRE) closed at $46.11, +.61% and the SPDR S&P Bank ETF (KBE) closed at $43.40, +.70%.

Around the crypto and precious metals’ tree, Bitcoin (BTC) traded to $63,517.75, +3.94% over the last 24 hours at the time of this writing & Coinbase Global (COIN) closed at $218.08, +2.01%.

VP WATCHLIST UPDATES

Shares of Lantern (LTRN), an artificial intelligence (“AI”) company developing targeted and transformative cancer therapies using its proprietary RADR® AI and machine learning (“ML”) platform with multiple clinical stage drug program, closed at $5.77, -3.67%.

On March 18 after the close, Lantern announced operational highlights and financial results for the fourth quarter and fiscal year ended December 31, 2023. Panna Sharma, President and CEO of Lantern Pharma started, “This past quarter and the entire year of 2023 was a period of meaningful and remarkable progress for our programs and our AI platform at Lantern Pharma. Our team demonstrated how combining emerging AI technologies, cancer biology models and experiments, chemical, molecular, and multiomic biomarker data, along with large-scale patient data holds the promise of transforming timelines and costs in drug development for oncology. We are very enthusiastic about 2024 and will be actively focused on meeting and possibly exceeding the milestones ahead of us, which include potential initial data from our LP-184 Phase 1A trial; advancing the new company born from AI – Starlight Therapeutics, which is focused wholly on CNS cancers; and progressing our ADC oncology program. Computational and AI-driven approaches are increasing their value-driving impact on oncology drug development, and our team continues to increase the capabilities and usefulness of our platform while also helping to de-risk and sharpen the focus of our existing clinical drug candidates. Our leadership in the innovative use of AI and machine learning to transform costs and timelines in the development of precision oncology therapies has guided three drug development programs in active clinical trials. We believe this pace of development with our focused team and resources should yield significant future benefits for investors and patients as our industry matures, adopts and accepts a data and AI-centric approach to drug development.”

On March 7, Lantern presented at a virtual conference being hosted by HCW. Lantern Pharma’s CEO, Mr. Panna Sharma, presentied via a fireside chat format at The 1st Annual Artificial Intelligence Based Drug Discovery & Development Virtual Conference, while addressing AI in drug discovery. Mr. Sharma spoke about how RADR®, Lantern’s proprietary AI platform, is transforming the cost, pace, and timeline of oncology drug development.

On March 5, Lantern announced a series of important milestones related to the development, size, and advancement of RADR® — its proprietary AI platform focused on transforming the cost, pace, and timeline of oncology drug development. Lantern highlighted the following:

- The rapid growth of Lantern Pharma’s AI platform could lead to accelerated development of better treatments, greater precision in clinical development, and improved combination regimens with the potential for longer and more durable patient responses.

- Lantern’s RADR® platform recently surpassed 60 billion data points and is planned to exceed 100 billion data points during 2024 and has been crucial in the expansion of the indications for drug candidate LP-184 and in the accelerated development of LP-284.

- Lantern seeks to focus additional data growth efforts of the RADR® platform on: drug sensitivity data, combination treatment outcome data, and biomarker data in rare cancers, and on emerging synthetic lethal targets that are aimed at accelerating the development of new therapies for Lantern and its partners.

- Lantern will also enhance the RADR® platform’s generative AI capabilities, focusing on molecular optimization and automated feature extraction to improve understanding and prediction of molecular dynamics, safety, and drug-drug interactions.

You can now view “How AI Has Lit A Revolution In Healthcare, Medicine, & Human Longevity “ on The Tribe Public Channel as Panna Sharma CEO Lantern Pharma was interviewed on Feb. 29.

On Feb. 15, Lantern announced an important milestone in its antibody-drug conjugate (ADC) program. In collaboration with Bielefeld University, Lantern has generated a new class of highly specific and highly potent ADCs with a cryptophycin drug-payload.

This novel approach utilizes cysteine-engineered antibodies which allows for the development of uniform and homogenous ADCs with precise control of the drug to antibody ratio (DAR). The drug-payload, cryptophycin, has the potential to improve upon existing ADCs used in the clinical setting by: 1) improving the anti-tumor potency of the ADC molecule, and 2) overcoming drug resistance tumors can frequently develop to existing drug-payloads such as MMAE (Monomethyl auristatin E). The cryptophycin drug-payload and cryptophycin-ADC (CpADC) averaged an 80% cancer cell kill rate across the tested cancer cell lines and significantly outperformed MMAE.

In a broad range of preclinical studies, the cryptophycin-ADC (Cp-ADC) demonstrated promising picomolar level potency and anti-tumor activity in a wide range of solid tumors, including six cancer indications that are being further evaluated. These six indications include: breast, bladder, colorectal, gastric, pancreatic and ovarian cancer. Initial results (Figure 1) have also shown that in high Her2 expressing tumors, Cp-ADC with a DAR of 8 (Tras(C8)-Cp) and DAR of 4 (Tras(C4)-Cp) is more potent than an MMAE ADC with a DAR of 8. MMAE payloads are used in several commercially available anti-cancer ADCs, including Adcetris®, Polivy® and Enhertu®. Additionally, the Cp-ADC with a lower DAR (Tras(C2)-Cp) provides an equivalent tumor kill-rate to that of an MMAE-ADC with a DAR of 8. In a moderate Her2 expressing cell line, the Cp-ADC with a DAR of 8 (Tras(C8)-Cp) was about 10 times more potent than a DAR 8 MMAE-ADC.

The newly developed Cp-ADC showed highly efficient anti-tumor activity in all six cancer cell lines with EC-50 values in the picomolar to single-digit nanomolar range. Additional studies are now being developed to further validate and expand these findings and to obtain a better understanding of the genomic and biomarker correlates of payload efficacy across these tumors.

Kishor Bhatia, Ph.D., Lantern’s Chief Scientific Officer commented, “Our strategic, data-driven approach of utilizing cryptophycin as a highly potent and novel payload alongside the prioritization of biologically novel and relevant targets with scalable and efficient drug conjugate formats will help expand the repertoire and diversity of ADC opportunities.”

Lantern is also utilizing its AI platform, RADR® to further refine and understand other cancer targets, with a focus on prioritizing targets that are expressed across multiple tumor types or subtypes and have few or no therapeutic ADC options. Given the promise of cryptophycin as a payload, Lantern is also focused on the development and testing of two other cryptophycin-ADC molecules. For these selected targets, Lantern is in advanced discussions with potential partners and collaborators with the goal of generating proof-of-concept data for these additional ADCs and potentially other novel drug conjugate formats. Lantern expects to provide additional details on these studies and collaborations in the coming quarters. These efforts aim to improve ADC development for specific patient populations and potentially guide more effective future clinical treatments with less cost and greater efficiency than historical ADC drug development.

On Jan. 17, Starlight Therapeutics— a Lantern Pharma (Nasdaq: LTRN) subsidiary focused exclusively on the clinical development of therapies for central nervous system and brain cancers with limited or no effective therapeutic options— announced that Marc Chamberlain, M.D. has joined Starlight as its Chief Medical Officer. Dr. Chamberlain will oversee Starlight’s clinical operations, which currently include planned clinical trials for glioblastoma and other high-grade gliomas, brain metastases in adults, and atypical teratoid rhabdoid tumors (ATRT), and diffuse pontine glioma (DIPG) in children. In his role, Dr. Chamberlain will apply his significant medical, clinical, and pharmaceutical development expertise to advance Starlight’s AI-enabled and accelerated drug development portfolio. Dr. Chamberlain is a leading medical oncologist with an extensive and distinct background in therapeutic development, clinical practice, and academic research with a focus in adult and pediatric neurology and neuro-oncology. His experience before joining Starlight has included serving as the co-director of the neuro-oncology programs at 4 NCI designated cancer centers— Moores Cancer Center at UC San Diego, Norris Cancer Center at USC, Moffit Cancer Center at the University of South Florida, and Fred Hutchinson Cancer Center at the University of Washington. He has also served as medical director for Cascadian Therapeutics, Seattle Genetics, SystImmune, Angiochem, and Pionyr Immunotherapeutics. Dr. Chamberlain has published more than 300 neurology-focused papers in peer-reviewed journals. “Starlight Therapeutics and Lantern Pharma are poised to transform oncology with AI-enabled drug development aimed at providing advanced precision therapeutics for cancers in areas of severely unmet need, such as multiple types of pediatric and adult brain cancers, for which there is currently no cure,” said Panna Sharma, CEO and President of Lantern Pharma. “Dr. Chamberlain’s insight and expertise in neuro-oncology and therapeutic development will be invaluable to the further development of treatments already in the pipeline, and the discovery and development of new future treatments that are so desperately needed by cancer patients, especially in neuro-oncology.” Dr. Chamberlain earned his medical degree at the Columbia University College of Physicians and Surgeons, followed by pediatric and neurology residencies at the University of California, Los Angeles, and a neuro-oncology fellowship at the University of California, San Francisco. “Starlight, in collaboration with Lantern Pharma, is poised to advance its novel central nervous system (CNS) penetrant wholly synthetic acylfulvene, LP-184 (referred to as “STAR-001″ for CNS indications), to target tumors in the brain. We are now preparing for two recurrent glioblastoma studies as part of a larger planned expansion study to assess STAR-001 in subjects who have failed standard-of-care temozolomide and involved field radiotherapy. The development of STAR-001 for use in brain tumors has utilized Lantern’s proprietary RADR® platform of in silico modeling as well as extensive preclinical experimentation in multiple in-vitro and in-vivo models,” said Dr. Chamberlain. “I’m looking forward to working alongside the talented researchers and experts at Lantern and its collaborators at Starlight who have already done so much to advance these treatments. I look forward to working together with our collaborators and clinicians to bring these and many more innovative neuro-oncology treatments to the patients who need them.” Formed in Q1 of 2023, Starlight Therapeutics is leveraging RADR®— Lantern Pharma’s proprietary artificial intelligence and machine learning platform focused on transforming the cost, pace and timeline of oncology drug discovery and development— to research, develop and clinically advance therapeutics for CNS and brain cancers.

Shares of Indaptus Therapeutics, Inc. (Nasdaq: INDP) closed at $2.52, -1.18%. Indaptus is a company with the ability to harness both the body’s innate and adaptive immune responses, believes that they are uniquely positioned to revolutionize the treatment of cancer and certain infectious diseases. Indaptus Therapeutics has evolved from more than a century of immunotherapy advances. The Company’s novel approach is based on the hypothesis that efficient activation of both innate and adaptive immune cells and pathways and associated anti-tumor and anti-viral immune responses will require a multi-targeted package of immune system-activating signals that can be administered safely intravenously (i.v.). Indaptus’ patented technology is composed of single strains of attenuated and killed, non-pathogenic, Gram-negative bacteria producing a multiple Toll-like receptor (TLR), Nucleotide oligomerization domain (Nod)-like receptor (NLR) and Stimulator of interferon genes (STING) agonist Decoy platform. The products are designed to have reduced i.v. toxicity, but largely uncompromised ability to prime or activate many of the cells and pathways of innate and adaptive immunity. Decoy products represent an antigen-agnostic technology that have produced single-agent activity against metastatic pancreatic and orthotopic colorectal carcinomas, single agent eradication of established antigen-expressing breast carcinoma, as well as combination-mediated eradication of established hepatocellular carcinomas and non-Hodgkin’s lymphomas in standard pre-clinical models, including syngeneic mouse tumors and human tumor xenografts.

On April 11, Indaptus announced it was proud to unveil its poster at the 2024 Annual Meeting of the American Association for Cancer Research (AACR) in San Diego on Wednesday, April 10th. The poster details mechanism of action data that demonstrates the Company’s Decoy platform successfully induces, matures or activates multiple immune cell types involved in anti-tumor responses. The latest findings significantly enhance the Company’s understanding of its “Decoy” platform technology, which uses killed, non-pathogenic bacteria engineered to activate the immune system to attack tumors. The study highlights the platform’s effectiveness in engaging key innate and adaptive immune cells, including, natural killer cells, natural killer T cells, dendritic cells, CD4+, and CD8+ T cells. In some settings, the platform also produced additive or synergistic activity in combination with IL-2, an approved cancer drug. Additionally, the data reveal that the Decoy platform may not only boost the immune system’s ability to recognize and kill tumor cells, but potentially also overcome a mechanism that suppresses the immune response. The results suggest that the Company’s Decoy bacteria can both directly and indirectly prime the immune system to more effectively fight cancer.

Dr. Michael Newman, Indaptus’ Founder, Chief Scientific Officer, and lead author, commented, “The new data are consistent with our preclinical animal tumor model studies and provide evidence for our hypothesis that patented Decoy bacteria can activate a wide range of innate and adaptive human immune cells involved in fighting tumors. This aligns with what we’ve observed in our ongoing Phase 1 clinical trial of Decoy20 – broad immune activation, as evidenced by transiently increased levels of many key cytokines and chemokines following single dose administration. These findings bolster our confidence in Decoy20’s potential as a multifaceted immunotherapy.”

The Company recently initiated the multi-dose cohort of its Phase 1 clinical trial in solid tumors.

Jeffrey Meckler, Indaptus’ Chief Executive Officer, added, “We are encouraged by the promising results observed in our preclinical studies and our ongoing Phase 1 clinical trial. The recognition and validation from prestigious organizations such as the AACR, coupled with the support and insights we are receiving from medical experts, partners and investors at the conference, inspire us to continue advancing our technology and demonstrating its significant therapeutic potential for the treatment of solid tumors.” The full poster can be accessed on the Indaptus Therapeutics website by clicking here.

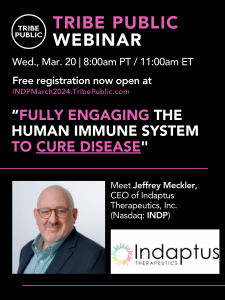

Indaptus CEO presented in an open Q&A on Tribe Public’s Webinar titled, “Fully Engaging The Human Immune System To Cure Disease” on Wednesday, March 20, 2024. You can now watch the event video at the Tribe Public YouTube Channel at this link.

On March 13, Indaptus announced financial results for the fourth quarter and fiscal year ended December 31, 2023 and provided a corporate update. Jeffrey Meckler, Chief Executive Officer of Indaptus, commented, “We are thrilled with the progress we made in 2023, which was capped off in November when we announced that our lead candidate, Decoy20, demonstrated a broad immune response in patients following a single dose in the first cohort of our ongoing phase 1 study. More recently, in March 2024, we announced positive results from our second cohort. In close consultation with an independent Safety Review Committee, we are now initiating a multi-dose cohort. Our objective in this next part of the Phase 1 trial is to determine the safety of Decoy20, with multiple doses administered to the same patient, which we believe could also potentially enhance anti-tumor activity across various tumor types. As we are encouraged by these initial findings and by the anti-cancer activity we observed from multi-dosing in our pre-clinical models, we look forward to continuing our efforts to demonstrate safety and efficacy. We remain prudent in managing our cash position and furthering our research in a cost effective and efficient manner.”

On Feb. 8, Indaptus announced the launch of a new social media initiative to provide education and updates about the company. Recognizing the importance of engaging with all stakeholders, Indaptus will generate content on a variety of digital platforms, including X (formerly known as Twitter) and LinkedIn. The launch of these channels signifies Indaptus Therapeutics’ commitment to transparency, knowledge-sharing, and a desire to stay connected with its stakeholders. The company will utilize these platforms to provide updates on its research, share educational content about cancer immunotherapy, and offer a behind-the-scenes look at its team and scientific progress. The company invites all interested parties, including patients, researchers, and the general public, to join the conversation and stay informed about the company’s promising strides in cancer and viral infection treatment.

On Jan. 4, Indaptus announced that the European Patent Office (EPO) has informed the company that it will grant a European patent related to the company’s platform technology, covering a composition that can be used in the prevention or treatment of viral infections. The patent, titled “Methods of Treatment of Infections Using Bacteria,” (Application 19 866 580.4) provides protections for the application of the Company’s Decoy technology platform alone or in combination with standards of care for the prevention or treatment of any viral infection. The EPO patent will be the second patent granted to Indaptus outside the United States for this application. Jeffrey Meckler, Indaptus Therapeutics CEO, commented, “The continued protection of our intellectual property both in the U.S. and abroad will provide a competitive advantage for the Company, which should ultimately drive significant shareholder value over time. We continue to explore the applications of our technology platform beyond solid tumors, for which we are currently engaged in a Phase 1 clinical trial, and look forward to updating our shareholders on scientific progress.”

On March 6, ADT announced the pricing of a secondary public offering of 65,000,000 shares of the Company’s common stock held by certain entities managed by affiliates of Apollo Global Management, Inc. (the “Selling Stockholders”) at a price to the public of $6.50 per share. The offering is expected to close on March 11, 2024, subject to satisfaction of customary conditions.The underwriters will have a 30-day option to purchase up to an additional 9,750,000 shares of common stock from the Selling Stockholders. The Company is not selling any shares and will not receive any proceeds from the offering. In addition, ADT has authorized the concurrent purchase from the underwriters of 15,000,000 shares of common stock as part of the secondary public offering (the “Share Repurchase”) subject to the completion of the offering. The Share Repurchase is part of the Company’s existing $350 million share repurchase program. The underwriters will not receive any underwriting fees for the shares being repurchased by the Company. Morgan Stanley, Barclays, Apollo Global Securities and RBC Capital Markets are acting as book-running managers for the offering. BNP PARIBAS, Deutsche Bank Securities, Mizuho, Goldman Sachs & Co. LLC, MUFG, BMO Capital Markets, BTIG and Raymond James are acting as joint book-runners for the offering. Berenberg, Fifth Third Securities, Academy Securities, Bancroft Capital and Siebert Williams Shank are acting as co-managers for the offering.

On Jan. 19, Modular Medical announced the premarket submission of its MODD1 next-generation insulin pump to the FDA for 510(k) clearance. “This is an exciting milestone for the Company, as we seek to change the diabetes market. Almost 30 years after the introduction of the first insulin pump, more than three quarters of those who could benefit from wearing a pump do not wear one. It is our belief that our simplified design will encourage many “almost-pumpers” to adopt technology to aid in their diabetes management, without the complexity and expense required by many of the current solutions,” said Paul DiPerna, Chairman and CTO of Modular Medical.

Jeb Besser, CEO of Modular Medical, stated “Getting a person who requires daily insulin to adopt a pump instead of multiple daily injections can reduce healthcare costs and improve long-term patient outcomes. Pump adoption has been impeded by the ‘three-Cs:’ they are too complex, cumbersome and costly. The MODD1 was designed to be simple and affordable with an attractive form factor. We believe our two-part patch pump design, easy to learn interface and scalable manufacturing will all contribute to a differentiated and lower cost marketing approach. On behalf of the board of directors, I would like to thank the entire Modular Medical team, and all of our stakeholders and shareholders for their support in reaching this point. We expect to receive initial questions from the FDA during the quarter ending June 30, 2023, and we will provide updates, as appropriate. While working with the FDA to gain US clearance, our regulatory effort will now turn to preparing applications to obtain the UKCA mark to enable us to market the MODD1 in the United Kingdom. Operationally, we will move our pilot production line to our manufacturing partner to prepare for commercial launch.”

On Dec. 21, Modular Medical announced a collaboration agreement with Glooko, Inc., a global leader specializing in connected care and remote patient monitoring for diabetes. Integrating with Glooko will allow clinicians and patients to easily review insulin dosing data from the MODD1 pump, when commercially available. In addition, through Glooko’s platform, Dexcom CGMS users will be able to view their glucose levels in the same accessible format in conjunction with their pump data. Glooko’s platform has a broad installed base, which has been deployed in over 30 countries and 8,000 clinical locations. Jeb Besser, CEO of Modular Medical stated, “We are extremely pleased to add the Glooko technology platform to our diabetes care system making it even easier and more cost effective for us to provide this important capability to our clinical and patient base. Glooko’s mission to improve health outcomes of people with chronic conditions through its personalized, intelligent, connected care platform fits perfectly with our vision of providing an easy to use, affordable delivery technology to give more patients access to better care.”

On Jan, 23, NAYA Biosciences Inc., a company which has recently signed a definitive merger agreement with INVO Bioscience (INVO, $1.4655) to establish an expanded, publicly-traded life science company dedicated to increasing patient access to breakthrough treatments in oncology, regenerative medicine, and fertility, today announced that it has entered into a binding letter of intent to acquire Florida Biotechnologies, Inc. a gene therapy company focusing on the treatment of mitochondrial diseases.announced that it has entered into a binding letter of intent to acquire Florida Biotechnologies, Inc. a gene therapy company focusing on the treatment of mitochondrial diseases. “We are delighted to contribute to the emergence of a strong biotech ecosystem leveraging Florida’s academic medical excellence,” commented Florida Biotechnologies cofounder Dr. Peter Kash. “The NAYA leadership team brings an agile entrepreneurial platform, broad development and commercialization experience, and access to public capital, which will unlock the potential of our promising AAV gene therapy platform for mitochondrial genetic diseases. As it expands its clinical pipeline to additional regenerative medicine as well as oncology and fertility programs, NAYA is poised to build a world-class Miami-based biopharmaceutical company.” “We are impressed by the initial safety and efficacy of the AAV gene therapy developed by Florida Biotechnologies and the University of Miami for the treatment of LHON, a rare and debilitating genetic disease with no currently approved therapeutic regimen,” commented NAYA Chairman & CEO Dr. Daniel Teper. “NAYA is committed to accelerating clinical development and Early Patient Access to this breakthrough therapy, which has the potential to achieve curative results in patients with progressive vision loss and blindness.”

On Jan 17, INVO Bioscience, announced that it has filed S-4 registration and preliminary joint proxy statements in connection with the upcoming merger. NAYA has also announced that five new board directors have joined its leadership team effective January 1st, 2024. The additions to the board join Chairman and Chief Executive Officer Dr. Daniel Teper, Vice Chairman Dr. Peter Kash, and Director Gilles Seydoux and will continue post-merger as part of the combined company alongside current INVO CEO Steve Shum. “NAYA is thrilled to welcome new board members with outstanding executive and entrepreneurial track records,” commented NAYA CEO Dr. Daniel Teper. “As we prepare for our merger with INVO, their experience will be key in helping the management team structure our group of companies and secure financing to advance our ambitious growth strategy for 2024 and beyond. Upon closing of the merger with INVO, the NAYA leadership team will focus on scaling up the fertility business through clinic acquisitions and revamped commercialization of INVOcell®, advancing the clinical development of our oncology assets, and building our regenerative medicine portfolio.”

Today, April 16 after the close, INVO Bioscience, Inc. (Nasdaq: INVO), a healthcare services fertility company focused on expanding access to advanced treatment worldwide through the establishment and acquisition of fertility clinics, and with the intravaginal culture (“IVC”) procedure enabled by its INVOcell® medical device, today announced financial results for the fourth quarter and fiscal year ended December 31, 2023 and provided a business update.

Q4 2023 Financial Highlights (all metrics compared to Q4 2022 unless otherwise noted)

Revenue was $1,381,754, an increase of 397% compared to $278,142.

Clinic revenue increased 519% to $1,362,938, compared to $220,253. All reported clinic revenue is derived from the Company’s INVO Center in Atlanta, Georgia, and fertility clinic in Madison, Wisconsin which are consolidated in the Company’s financial statements.

Revenue from all clinics, inclusive of both those accounted for as consolidated and under the equity method, was $1,634,912, an increase of 140% compared to $682,055.

Total operating expenses were $2.9 million, a $0.1 million decrease compared to $3.0 million. Included in the Q4 2023 operating expenses were approximately $250,000 pertaining to the definitive merger agreement with NAYA Biosciences, Inc. (“NAYA”) to acquire NAYA in an all-stock transaction.

Net loss was $(2.0) million compared to $(2.8) million.

Adjusted EBITDA (see table included) was $(1.2) million, including transaction costs related to the potential merger, compared to $(2.2) million in the prior year.

Economic Reports

On Monday, the March Retail Sales report came in higher than expected at .7%, while March Retail Sales, sans automotive, clocked in higher at 1.1% as Americans continued to spend. The February Business Inventories report also came in higher at .4%, while the April NAHB Housing Market Index report clocked at the previous level of 51.

On Tuesday, the March Housing Starts report clocked in lower at 1.321M & the March Building Permits report that came lower at 1.458M. The March Industrial Production report came in as expected at .4%, while the March Capacity Utilization report came in basically in line at 78.4%.

On Wednesday, the Weekly MBA Mortgage Applications Index report clocked in higher at 3.3% & the Weekly crude oil inventories report the showed a 2.74M barrel increase.

On Thursday, the Weekly Initial Claims report came below expectations at 212k, while the Weekly Continuing Claims came at 1.812M. The March Existing Home Sales report clocked in slightly lower than expected at 4.19M, while the March Leading Indicators report was at -.3%.