Disinflation Beliefs & Stock Values Grow During #JPM2023 Week – $AMZN $ATOS $BRQS $GME $INM $INVO $SHIP $TSLA Rise!

- Published Jan 14, 2023

- Agriculture & Energy

- Atossa Therapeutics, Inc.

- Biotech & Healthcare

- Consumer Goods & Trends

- Current Coverage

- Disney

- Fate Therapeutics, Inc.

- Financials & Fintech

- InMed Pharmaceuticals Inc.

- Investing & Inspiration

- INVO Bioscience

- Market News

- Materials & Natural Resources

- Technology & Beyond

- Tesla

Happy Saturday!

I hope that you had a wonderful week and that you are out enjoying yourself this long MLK holiday weekend. This week, I spent a great deal of my days trying to unsuccessfully stay dry in San Francisco at and around the 41st Annual JPMorgan Healthcare Conference, which was held for the first time since 2020 in person again at the Westin on Union Square as it had once again become politically correct to meet in very large groups in The City. The week did not disappoint and was was action packed as significant mergers were announced & a number of business development deals progressed within the biotech and healthcare sector, while countless meetings were conducted all over San Francisco. As a proof point, CinCor Pharma, Inc. (NASDAQ: CINC), a clinical-stage biopharmaceutical company with a mission to bring innovation to the pharmaceutical treatment of cardio-renal diseases, announced that it entered into a definitive agreement with AstraZeneca (AZN) under which AstraZeneca has agreed to acquire CinCor. Total consideration including the contingent value right, if the milestone is achieved, would be approximately $1.8 billion and a 206% premium over CinCor’s closing market price on January 6, 2023. We also saw that Chiesi Farmaceutici S.p.A., an international, research-focused biopharmaceuticals and healthcare group, and Amryt Pharma Plc (Nasdaq: AMYT), a global, commercial-stage biopharmaceutical company dedicated to acquiring, developing, and commercializing novel treatments for rare diseases, announce that the companies have entered into a definitive agreement under which Chiesi will acquire Amryt. The Transaction was unanimously approved by both Chiesi and Amryt Boards of Directors and is anticipated to close by the end of the first half of 2023, subject to the satisfaction of all closing conditions. Under the terms of the Transaction, Chiesi will purchase all outstanding shares of Amryt for a purchase price per American Depositary Share (“ADS”) of Amryt, which each represent 5 Amryt ordinary shares, of US$14.50 (or US$2.90 per ordinary share) in cash, plus Contingent Value Rights (“CVRs”) of up to US$2.50 per ADS (or up to US$0.50 per ordinary share) payable if certain milestones related to Amryt’s product Filsuvez® are achieved. The total Transaction value implied by the Transaction at close is approximately US$1.25 billion in upfront consideration, representing a 107% premium based on Amryt ADS’ closing price of US$7.00 on January 6, 2023, plus CVRs representing an additional approximately US$225 million of potential consideration. Overall, biotech stocks rose significantly this week as the Nasdaq Biotechnology ETF (IBB) moved up and closed at $136.23, +2.32% and is up 3.76% YTD, the NYSE ARCA Biotech Index (^BTK) closed at 5,524.61, +2.42% over the last 5-days and is now up 4.61% YTD, & the SPDR S&P Biotech ETF (XBI) closed at $87.88, up a very solid +5.68% over the last 5-days & is now up 5.88% YTD. The 52-week range is is now $61.78-$100.69. The iShares U.S. Healthcare ETF (IYH) closed at $283.72, +.05% over the last 5-days and is now flat YTD.

As for the broad markets this week, we also experienced a decidedly positive week with all indices charging forward and in general the more growth-oriented the issuer’s nature the larger the realized gain. The yield curve also pulled back again this week, with the 2-yr note yield falling 5 basis points to close at 4.22% & the 10-yr note yield moving down by 5 basis points to close at at 3.51%. The U.S. Dollar Index also dropped 1.6% to close at 102.18. Disinflation beliefs grew in investors minds as the macroeconomic schedule overall helped support investors’ growth appetite in the stock market and position that the Fed may slow its pace of interest rate increases. On Monday, the Consumer Credit report confirmed a $27.9B rise in November. On Tuesday, the December NFIB Small Business Optimism came in lower at 89.8, while the November Wholesale Inventories repot came in higher at 1.0%. On Wednesday, the Weekly MBA Mortgage Applications Index report moved up 1.2% & the Weekly EIA Crude Oil Inventories that confirmed an 18.96M barrel build. On Thursday, the December CPI report served further evidence of disinflation coming in at -.1% and confirming that we have now seen 3 consecutive months where it has dropped. The Weekly Initial Claims report that came in lower than expected at 205k, while weekly Continuing Claims came in lower at 1.634M. The Weekly EIA Natural Gas Inventories report confirmed a 11 bcf build. On Friday, the December Import Prices report came in at .4% & the December Export Prices came in at -2.6%. The January Univ. of Michigan Consumer Sentiment came in higher with a preliminary reading of 64.6.

At the end of the week, the S&P 500 closed at 3,999.09 (+2.7%) for the week and is now up 4.2% YTD. 9 of the 11 sectors again closed in the green with 2 sectors leading the overall upward charge including the highly weighted consumer discretionary sector’s +5.8% jump & the information technology sector’s 4.6% upward move. The laggards included the consumer staples (-1.5%) and the health care sector off .2%. The 6.82% weighting of the shares of Apple (AAPL) helped the markets move strongly higher as it closed at $134.76,+3.97% over the last 5-days. The shares of EV giant Tesla (TSLA) recovered this week as it closed at $122.40, +8.26% over the last 5-days as the EV company reduced prices of some of its cars nearly 20%. The Dow 30 closed higher at 34,302.60 (+2%) and is now up +3.5% YTD. The Nasdaq also clocked in with an even more impressive win ending the week at 11,079.10 (+4.8%) for the week and is up 5.9% YTD. With the positive market swing, the CBOE Volatility Index (^VIX) and vocatively lovers lost significantly as it closed at $18.35, off 13.16% over the last 5-days and is now down 15,32% YTD. However, the clear winner this week came from the small caps on the Russell 2000 which closed at 1,887.03 (+5.3%) for the week and is no up a solid +7.1% YTD. The MicroCaps also showed particularly relative strength again this week as the iShares Micro-Cap ETF (IWC) closed at $116.59, up a more than respectable 6.70%.

EV, TECH, CONSUMER, FINANCIALS

Apple (AAPL) closed at $134.76 +3.97% over the last 5-days. Apple represents a 6.82% weighting in the S&P 500. Interestingly, reports surfaced this week that Apple is looking at making touchscreen Macs a reality.

Shares of JPMorgan (JPM) closed at $143.01, +3.68% over the last 5-days. On January 13, JP Morgan reported its Q4 results. Jamie Dimon, Chairman and CEO, commented on the financial results: “JPMorgan Chase reported strong results in the fourth quarter as we earned $11.0 billion in net income, $34.5 billion in revenue and an ROTCE of 20%, while maintaining a fortress balance sheet and making all necessary investments. This robust earnings generation combined with the execution of our capital strategy allowed us to exceed our CET1 target of 13% one quarter early, and we have the ability to resume stock buybacks this quarter, as we deem appropriate. Looking further ahead, we still await details of the Basel III finalization package, but we will manage to the new requirements as we have demonstrated in the past.Our lines of business performed well in the quarter, and we continued to see momentum in our areas of strategic focus. In Consumer & Community Banking, debit and credit card sales were up 9%, while card loans were up 19% with total revolving balances now back to pre-pandemic levels. In the Corporate & Investment Bank, Markets revenue rose 7% as client activity remained strong in Fixed Income. Global Investment Banking fees were down significantly in a challenging environment, although we maintained our #1 ranking in 2022. Commercial Banking loans were up 14% on new loan originations and higher revolver utilization. And in Asset & Wealth Management, revenue increased 3% as higher net interest income more than offset the impact of lower market levels. The U.S. economy currently remains strong with consumers still spending excess cash and businesses healthy. However, we still do not know the ultimate effect of the headwinds coming from geopolitical tensions including the war in Ukraine, the vulnerable state of energy and food supplies, persistent inflation that is eroding purchasing power and has pushed interest rates higher, and the unprecedented quantitative tightening. We remain vigilant and are prepared for whatever happens, so we can serve our customers, clients and communities around the world across a broad range of economic environments. As a result of the investments we have made over the years and our dedication to clients, the Firm is in a position of strength as the market leader in U.S. retail deposits, credit cards, business banking, Payments, Markets, investment banking and multifamily lending as some examples. But we will not rest here, and we remain committed to investing in the franchise and innovating. The importance of these investments and investing through cycles was particularly evident this year, as we generated a robust ROTCE of 18% even after sharply accelerating our investments in the business. In 2022, we extended credit and raised $2.4 trillion in capital for small and large businesses, governments and U.S. consumers. Finally, I want to reiterate how proud I am of our employees and how they work to support our customers and communities and earn their trust every single day.”

Shares of Amazon.com, Inc. (AMZN) closed $98.12, +13.99% over the last 5-days. On Jan. 10, Amazon announced that Buy with Prime, the company’s direct-to-consumer offering for merchants’ own online stores, has been shown to increase shopper conversion by an average of 25%. Launched in April, Buy with Prime empowers merchants to extend the proven and trusted benefits of Prime—fast, free delivery, a seamless checkout experience, and easy returns—on their own online stores to build their brands and establish direct customer relationships. Amazon also announced that Buy with Prime will be widely available to U.S.-based merchants by January 31. Previously, Buy with Prime was available to merchants by invitation only. The company also announced the launch of Reviews from Amazon, a new capability to help Buy with Prime merchants increase shopper trust and conversion and better inform purchase decisions on their own online stores.

Last week, Amazon already announced plans to lay off 10k corporate employees in November & now has announced another 8k.

Shares of Microsoft Corp. (MSFT) closed at $239.23, +.30% over the last 5-days.

Shares of Salesforce, Inc. (CRM) closed at $149.51, +6.41% over the last five days. On Jan. 9, Salesforce released its 2022 holiday shopping recap, analyzing November and December shopping data from over 1.5 billion shoppers on retail sites using Salesforce Customer 360 (including 24 of the top 30 U.S. online retailers). Last week, CEO Marc Benioff stated at the he is seeking to cut costs by $3-$5B. as he seeks to restructure the business starting with a 10% workforce reduction and reducing their real estate footprint that spans 100 offices in 89 cities.

Shares of NVIDIA (NVDA), a pioneer in accelerated computing, closed at $168.99, +13.73% over the last 5-days. Last week, NVIDIA and Hon Hai Technology Group (Foxconn), the world’s largest technology manufacturer, announced a strategic partnership to develop automated and autonomous vehicle platforms.

Cathie Wood’s ARK Innovation ETF (ARKK) closed at $35.99, +14.73% over the last 5-days.

The Technology Select Sector SPDR Fund (XLK) closed at $130.49, +4.62% over the last 5-days.

Shares of McDonald’s (MCD) closed at $268.89, -.22% over the last 5-days.

GOLD & SILVER

Gold prices closed at $1922/oz., +$54/oz. & silver prices closed at $24.31/oz., +$.44/oz. for the week.

Hecla Mining (HL) closed at $6.23, +5.24% over the last 5-days after announcing this week that they have realized a 10% increase in silver production over 2021 & that Keno Hill is expected to produce more than 2.5 million ounces in 2023. First Majestic (AG) closed at $8.77, -1.90% over the last 5-days.

MEMES CENTRAL

AMC Entertainment (AMC) closed at $5.06, 31.43% & (APE) closed at $1.52, +11.76% over the last 5-days. On Jan. 12, AMC Theatres® announced that in celebration of National Popcorn Day on January 19, 2023, AMC is slashing prices by 50% on AMC’s delicious Perfectly Popcorn at all its U.S. locations. The discount will be given at the register or online via the mobile concession order process. All AMC guests qualify for this special promotion. In addition to 50% off traditional popcorn on National Popcorn Day, all AMC Stubs members receive a free refill with the purchase of a large popcorn every day of the year. AMC Stubs A-List members and Premiere members can also receive a free upsize on all popcorn and fountain soda purchases. On National Popcorn Day, moviegoers can enjoy recent hit films like AVATAR: THE WAY OF WATER, PUSS IN BOOTS: THE LAST WISH, and M3GAN, as well as new releases like A MAN CALLED OTTO, PLANE, and HOUSE PARTY.

GameStop (GME) closed at $20.48, +24.48% over the last 5-days as the shorts lost it big this week.

Seanergy Maritime Holdings Corp. (SHIP) closed at $.5722, +5.96% over the last 5-days. On Jan. 11, Seanergy announced the preliminary results of its tender offer to purchase all outstanding Class E Warrants at a price of $0.20 per warrant, net to the seller in cash, less any applicable withholding taxes and without interest. The tender offer expired at 5:00 P.M., Eastern Time, on January 10, 2023. Based on a preliminary count by Continental Stock Transfer & Trust Company, the depositary for the tender offer, the total number of warrants tendered in the tender offer was 4,038,114 warrants, representing approximately 47% of the outstanding Class E Warrants. No warrants were tendered pursuant to the guaranteed delivery procedure described in the tender offer documents.

CRYPTO & BITCOIN

Bitcoin (BTC) closed at $19,837.51, +15.36% over the last 5-days at the time this report was prepared.

ENERGY

The Energy Select Sector SPDR Fund or ETF (XLE) closed at $89.95, +2.73% over the last 5-days. Chevron (CVX) closed at $177.56, +.57% over the last 5-days. On Jan. 9, Raven SR Inc., a renewable fuels company, Chevron New Energies, a division of Chevron U.S.A. Inc., and Hyzon Motors Inc. (NASDAQ: HYZN) announced they are collaborating to commercialize operations of a green waste-to-hydrogen production facility in Richmond intended to supply hydrogen fuel to transportation markets in Northern California. The facility will be owned by a newly formed company, Raven SR S1 LLC (Raven SR S1). Raven SR will be the operator of the facility, which is targeted to come online in the first quarter of 2024. Chevron holds a 50% equity stake in Raven SR 1. Raven SR holds a 30% stake and Hyzon owns the remaining 20%. To produce the hydrogen, the project is expected to divert up to 99 wet tons of green and food waste per day from Republic Services’ West Contra Costa Sanitary Landfill into its non-combustion Steam/CO2 Reforming process, producing up to 2,400 metric-tons per year of renewable hydrogen. Diversion of this organic waste will help fulfill SB 1383 mandates, and will potentially avoid up to 7,200 metric-tons per year of CO2 emissions from the landfill. In addition, Raven’s technology uses no fresh water, an important element given drought risks in California, and uses less electricity to power its units than competing processes. The project is expected to produce at least 60% of its own electricity by upgrading the currently permitted and zoned landfill gas electric generators at the landfill, further reducing both the current air emissions and the need for grid power for its non-combustion process. Chevron plans to market its share of the hydrogen in Bay Area and Northern California fueling stations, enabling the energy transition to zero emission vehicles. Hyzon, a global supplier of fuel cell electric commercial vehicles, plans to provide refueling for hydrogen fuel cell trucks at a hydrogen hub in Richmond.

Warren Buffet’s pick in the sector, Occidental Petroleum (OXY) closed at $65.31, +2.45% over the last 5-days.

Oil prices closed on Friday to end at $79,98/bbl and up 8.4% over the last 5-days. and is now down .3% YTD.

NEXT WEEK

The markets will be up and running for only 4 full trading sessions in the stock market next week beginning on Tuesday with the markets being closed on Martin Luther King Day (MLK Day) being observed on Monday. By mid-week will be receiving the PPI index report and the Retail Sales Growth Report on the macroeconpminc side of things as the quarterly earnings season begins to ramp up again.

VP WATCHLIST UPDATES

Please review a select group of emerging names below and their updates below:

- Shares of Atossa Therapeutics, Inc. (Nasdaq: ATOS), a clinical-stage biopharmaceutical company seeking to discover and develop innovative medicines in areas of significant unmet medical need in oncology, with a current focus on breast cancer and radiation-induced lung injury, closed at $.8533, up +18.51% over the last 5-days and now up a whopping 61% YTD.

-

- On Dec. 7, Atossa announced the appointment of Eric Van Zanten as Vice President of Investor and Public Relations. Mr. Van Zanten brings over 25 years of corporate communications experience working within the biopharmaceutical, finance, and healthcare industries. He will oversee corporate, executive, and digital communications, investor relations, thought leadership, and branding for the Company. Prior to joining Atossa, Mr. Van Zanten led corporate affairs at Faron Pharmaceuticals, a clinical stage biopharmaceutical company focused on tackling difficult-to-treat cancers via precision macrophage immunotherapy and Urogen Pharma, a commercial stage biotech delivering innovative solutions that treat specialty cancers. He was also formerly Head of Commercial and Medical Communications and Director of Oncology Communications at Bristol-Myers Squibb where he helped launch Opdivo, one of the most successful oncology brands ever. Earlier in his career he held communications leadership roles at Deloitte, Booz Allen & Hamilton, Children’s Hospital of Philadelphia and Unisys Corporation.“We are excited to welcome Eric to Atossa as we sharpen our focus on developing new therapies for cancer patients,” said Steven Quay, M.D., Ph.D., President and Chief Executive Officer of Atossa. “His extensive industry experience and oncology background make him particularly well-suited to help us share the Atossa story with investors, researchers, media, industry partners and other stakeholders.”

-

-

On Nov. 7, Atossa announced its financial results for the fiscal quarter ended September 30, 2022, and provided an update on recent company developments. Atossa is a clinical-stage biopharmaceutical company seeking to develop innovative medicines in areas of significant unmet medical need in oncology with a current focus on breast cancer and lung injury caused by cancer treatments. Key developments from Q3 2022 and to date included:

- Received FDA authorization from FDA to initiate its Phase 2 study of neoadjuvant (Z)-endoxifen in premenopausal women with ER+/HER2- breast cancer.

- Invested in a privately-held Dynamic Cell Therapies, a company focused on CAR-T therapies as an important step in pursuing its strategy to develop CAR-T therapies or adjacent opportunities within the immuno-oncology space.

- Completed dosing in both Part B and Part C (of four parts) of Phase 1/2a Clinical Trial of AT-H201 in healthy volunteers, which the Company is now developing for patients with compromised lung function due to the damaging effects of cancer treatment.

-

-

-

On November 1, Atossa announced that it is investing in privately-held developer of CAR-T therapies, Dynamic Cell Therapies, Inc. (DCT), a venture capital backed company that is based in Boston, MA. DCT is in the pre-clinical phase of developing controllable CAR-T cells to address difficult-to-treat cancers. Its platform technology of dynamic control of engineered T-cells is designed to improve the safety, efficacy, and durability of CAR-T cell therapies. This system should find initial applications in hematological cancers, with future approaches in solid tumors and autoimmune diseases. The company’s platform technology uncouples tumor targeting from CAR-T cell activation. Each CAR-T cell recognizes an inert small molecule. This small molecule is conjugated to a tumor-specific antibody. By dosing a small molecule-antibody conjugate, the physician could dynamically control CAR-T cell activity and potentially minimize the risk of life-threatening side effects. Increasing the dose of the small molecule-antibody conjugate should strengthen the immune attack against tumor cells. In addition, the same small molecule can be coupled to different tumor targeting antibodies, allowing the physician to maximize on-target on-tumor efficacy and reduce off-tumor toxicities. To learn more, please visit www.dynamiccelltherapies.com. Steven Quay, M.D., Ph.D., Atossa’s CEO, Chairman and President stated, “This investment in DCT is an important step in pursuing our strategy to develop CAR-T therapies or adjacent opportunities within the immuno-oncology space. We believe that as an active investor in the development of DCT we will be well positioned to evaluate future opportunities while strategically managing our cash position.” Atossa will acquire shares equal to 19.99% of the outstanding capital stock of DCT as of today for a cash payment of $2 million (in addition to $3 million previously paid to DCT). The transaction is expected to close in the fourth quarter.

- On October 25, Atossa announced that it has retained Richard Graydon, M.D., Ph.D. as interim chief medical officer. Dr. Graydon will devote all of his professional time to the Atossa clinical programs. Prior to joining Atossa, Dr. Graydon served as Senior Director of Clinical Development at Johnson and Johnson (JNJ) where he was responsible for leading compound development and clinical trial programs for Janssen Pharmaceuticals. At Janssen, he oversaw the early to late-stage development and the 2022 approval of BCMA-directed CAR T-Cell therapy (cilta-cel) for Multiple Myeloma, as well as daratumumab, imbruvica, siltuximab and other compounds for solid tumor and hematological malignancies. Previously, he held the role of Director of Clinical Development at Daiichi Sankyo, Inc., where he led the early and late-stage development of the small molecule targeted therapy quizartinib for FLT3-positive Acute Myeloid Leukemia. Additionally, he led the early-stage development of the MDM2 inhibitor milademetan in hematological malignancies and liposarcomas. Dr. Graydon spent time in clinical practice following completion of his specialty training in hematology and oncology at Harvard Massachusetts General Hospital. He earned his M.D. and Ph.D. at Stanford University, and undergraduate degree in Chemical Engineering at Cornell University. Dr. Graydon is the author of The Genetic Risks of Cancer: The Effects of DNA, Genomics and Inheritance on Aging and Survival.

-

On Oct. 24, Atossa announced that the U.S. Food and Drug Administration (FDA) has lifted the clinical hold and authorized initiation of its Phase 2 neoadjuvant clinical study of (Z)-endoxifen in premenopausal women with early-stage estrogen receptor positive (ER+) and human epidermal growth factor receptor 2 negative (HER2-) breast cancer. This is the first study of Atossa’s proprietary (Z)-endoxifen in the United States. At this time, Atossa also announced that it is discontinuing its COVID-19 program (AT-301) so that it can refocus resources on this critical study in breast cancer. “Continuing the development of our proprietary (Z)-endoxifen here in the United States has been a key goal which builds on the recent issuance of a U.S. patent for our proprietary (Z)-endoxifen and results from our Phase 2 “window-of-opportunity” study in Australia,” commented Steven Quay, M.D., Ph.D., Atossa’s CEO, Chairman and President. “We are excited to have engaged Dr. Matthew Goetz, the Erivan K. Haub Family Professor of Cancer Research Honoring Richard F. Emslander, M.D. at Mayo Clinic and Director of the Mayo Clinic Breast Cancer SPORE, as the lead principal investigator for this multi-center study. We look forward to opening the study in the fourth quarter.”

-

- The multi-billion-dollar global fertility market is predicted to reach approximately US$47.9 billion by 2030, yet remains severely underserved with many patients (upwards of 90% by many estimates) unable to access affordable treatment. INVO Bioscience, Inc. (NASDAQ: INVO) offers the INVOcell solution which provides an advanced, effective and affordable infertility treatment to help increase access to care. INVO is commercially advancing INVOcell through the opening of INVO Centers, opportunistically now pursuing acquisitions of established fertility (IVF) clinics in the U.S., and continuing to offer the technology to existing fertility practices. Shares INVO closed at $.5175, +3.50% over the last 5-days and +22.05% YTD. The 52-wk range is $.3290 – $3.79.

- On Jan. 5, INVO Bioscience announced it has entered an exclusive distribution agreement with Ming Mei Technology Co. Ltd (“Ming Mei”) for Taiwan. The agreement will have an initial 1-year term with renewals. Ming Mei is a leading distributor of fertility-based devices and components in Taiwan helping to bring the latest and most advanced medical equipment into the region. Ming Mei estimates it has approximately 90% coverage of reagents and consumables in the reproductive medicine market in Taiwan. With strong customer relationships in the region, and their familiarity with the field of reproductive medicine, Ming Mei is ideally suited to expand distribution of INVOcell in Taiwan. Taiwan is a destination for assisted reproductive technology (ART) throughout Asia and also has the lowest birthrate in the world. Taiwan’s birth rate has dropped as a result of similar trends elsewhere in Asia, such as later marriage and increasing cost of living. Further, the average age of patients requiring therapy is rising. Fortunately, according to the statistics published by “ICMART”, the overall implantation rate of therapy in Taiwan ranked second worldwide, almost equal to the level in the U.S., and a leading country in Asia. The stable high success rate derives from updated medical research and enriched clinical experience from the physicians, advanced laboratory facilities and technology as well as patient-centered customized treatment plans (depending on their age, ovarian functions and causes of infertility, etc.). Prior to the pandemic, in 2019 there were approximately 55,000 ART cases in Taiwan, an increase of approximately 55% compared to 2016. In July 2021, the government in Taiwan implemented a subsidy plan for ART with the goal of encouraging more local married couples to undergo ART treatments. The subsidies are also available to transnational couples in which one spouse holds a Taiwanese ID card.

- On Jan. 3, INVO announced it has signed an agreement with Shelly W. Holmström, M.D. FACOG, to serve as the physician operator for the Company’s soon to be opened Tampa, Florida INVO Center.

READ our recently published story that is gaining traction titled “INVO Bioscience (NASDAQ: $INVO), A Company Seeking To Address A Massively Underserved Fertility Market.”

-

-

On Nov. 30, INVO announced the birth of the first baby in Malaysia utilizing the INVOcell solution. The healthy baby boy weighed 3.53 kg and was born on November 11, 2022 at Tuanku Mizan Military Hospital in Kuala Lumpur. Physicians at Advanced Reproductive Centre (ARC), at Hospital Canselor Tuanku Muhriz (HCTM), at the National University of Malaysia conducted the IVC procedure. The patient was part of a prospective peer reviewed study of INVOcell compared to conventional IVF (“cIVF”) that took place at ARC at HCTM. The study, titled “Comparison of Treatment Outcomes among Sibling Oocytes Using Different Culture Systems—Conventional IVF versus INVOcell Device—And Evaluation of INVOcell User Satisfaction: The INVOcIVF Study,” was published in the International Journal of Environmental Research and Public Health. “We couldn’t be more pleased to have been a part of this family’s journey towards parenthood,” commented Steve Shum, CEO of INVO Bioscience. “The INVOcell solution is playing a key role in providing families across the world an alternative method to parenthood by leveraging its innovative medical device to allow fertilization and early embryo development to take place in vivo within the woman’s body; an approach that provides for affordable, high-quality, patient-centered fertility care.” Key findings of the study included:

- The fertilization rate and good embryo quality were comparable (not significantly different) between INVOcell and cIVF.

- Although both methods produce similar fertilization rates and good-quality embryos, the blastulation rates were better in the INVOcell group.

- INVOcell can be used as an alternative method for reproductive treatment in carefully selected patients without jeopardizing outcomes.

- cIVF is costly and not applicable in most rural and district areas, therefore, the INVOcell can be utilized as a cost-effective alternative to cIVF without sacrificing comfort and outcomes.

-

-

- On Monday, November 14, INVO announced financial results for the third quarter ended September 30, 2022 and provided a business update. Revenue (excluding license revenue) was $235,321 compared to $40,303 in the third quarter of the prior year, an increase of 484% and up 61% sequentially compared to the second quarter of 2022. Clinic revenue increased to $176,395, or 370%, compared to the same period last year, and was up 57% sequentially compared to Q2 2022. All reported clinic revenue is derived from the Company’s Atlanta, Georgia-based INVO Center which is consolidated in the financial statements. Revenue from clinics, inclusive of both those accounted for as consolidated and under the equity method, was $450,131, an increase of 1,100% compared to last year and up 111% sequentially compared to the second quarter of 2022. Product sales increased to $58,926 during Q3 2022, an increase of 2,012% compared to the same quarter last year and were up 74% sequentially compared to the second quarter of 2022. INVO has completed due diligence on the previously announced fertility clinic acquisition target and is working to finalize definitive agreements..

-

- ***INSIDER BUYING ALERT***– On Friday June 3, after the close, a number of Form 4’s were filed c. at www.sec.gov confirming that the CEO, COO, CFO and 5 members of the board of directors purchased shares at $.95/share on June 1, 2022. Here’s the link to view all of the share purchases.

-

- On Nov. 10, Chinook provided a business update and reported financial results for the quarter and nine months ended September 30, 2022. “During the third quarter of 2022, we continued advancing our pipeline of clinical and preclinical programs for rare, severe chronic kidney diseases. We are pleased with the strong data presented at ASN Kidney Weekend 2022 from both our lead programs, atrasentan and BION-1301, in IgA nephropathy (IgAN), as well as from CHK-336 and our preclinical research approach,” said Eric Dobmeier, president and chief executive officer of Chinook Therapeutics. “We look forward to 2023, when we plan to initiate a phase 3 study of BION-1301 in patients with IgAN, present data from the ongoing phase 1 clinical trial of CHK-336 in healthy volunteers in the first half and report topline proteinuria data from the ongoing phase 3 ALIGN study of atrasentan in the third quarter.”

- Borqs Technologies, Inc. (Nasdaq: BRQS, $.2670, flat over the last 5-days, but up 28.37% YTD), a global provider of 5G wireless solutions, Internet of Things (IoT) solutions, and innovative clean energy, recently provided the following updates on the Company.

-

On Dec. 19, Borqs announced the Company has received a letter dated December 13, 2022 (the “Letter”) from the Department of the Treasury on behalf of the Committee on Foreign Investment in the United States (“CFIUS”) stating that the Company is required to negotiate with CFIUS to fully divest its ownership interests and rights in Holu Hou Energy LLC (“HHE”) due to HHE solar energy storage system and EnergyShare technology for Multi-Dwelling Residential Units (“MDU’s”) being deemed a critical technology and therefore a potential national security risk. As stated in the Letter, HHE is considered a top ten solar energy storage supplier in Hawaii, has only been increasing its dominant market share, expects to grow at an exponential rate, and focuses on multi-family dwelling units which are common in military housing. Due to Borqs’ IoT software development and hardware sourcing capabilities in China, CFIUS is concerned that through Borqs, the PRC could gain significant visibility and exert influence over HHE’s business operations and get access to HHE critical technology. CFIUS is requiring the Company to design a plan to mitigate all identified national security risks to the satisfaction of CFIUS. Borqs intends to comply to the requirements from CFIUS and enter into a National Security Agreement with various departments of the U.S. Government with a plan that is effective, monitorable and verifiable to voluntarily divest Borqs’ investment interests and rights in HHE (the “Plan”). HHE’s commercialization of its solar energy storage system and novel EnergyShare technology for MDU’s has enabled the company to open up a new market segment for renewable energy in the USA – likely worth several billions of dollars. In the last year the Company’s MDU development pipeline has reached thousands of individual units in Hawaii alone, with California MDU potential being at least one to two orders of magnitude higher in the coming years. One segment of this new market is for communities of military and other government personnel. The overall MDU opportunity is significant for the company and significant for the USA. Since Borqs’ financial support in HHE starting from October 2021, HHE has signed approximately $50 million in contracts and has a growing pipeline approaching half a billion dollars. We believe this voluntary mitigation will enable the tremendous inherent value of HHE to be realized and that the divestment can be a profitable transaction for Borqs’ shareholders. The Plan to mitigate will include engaging a nationally recognized investment bank with experience in administering competitive sales and auction processes, assigning and hiring of security and monitoring personnel to directly communicate with CFIUS, immediate and complete removal of all Borqs administrative and technical influence over HHE, immediate voluntary reduction of Borqs ownership of HHE from a majority to a minority position and with the target of divesting all. The Company believes such points will enable the Company to accomplish the divestment in an orderly manner.

- On Dec.8, Borqs announced its subsidiary, Holu Hou Energy (HHE), has received multiple purchase orders for its HoluPower xP solar energy storage systems for installation at homeowner locations in the Greater San Diego area in California. These orders represent the first for the Company in California. Whereas in Hawaii HHE works to develop and construct Single-Family Residential projects as an “end to end” provider, the Company will target the California homeowner market through already existing channel partners that will sell and construct the projects. For Multi-Dwelling Unit (MDU) Residential properties in the State, the Company will initially target apartment owners, REITs and other MDU stakeholders directly, then partner with existing licensed contractors for system construction. HHE has been focused on the Hawaii market since it began commercial shipments in 2020, in order to become successfully established in the largest market in the United States based upon solar installation penetration. Now it is turning to California, the largest market in terms of size of available opportunity. HHE recently completed the testing and documentation required for the HoluPower xP to be listed as an approved product by the California Energy Commission. The Company expects to be listed by early January 2023, after which permitting and installations can commence. In Hawaii, Holu Hou Energy has quickly become a leader for solar energy storage systems in the Single-Family Residential market, and has essentially created the previously untapped Multi-Dwelling Unit (“MDU”) Residential market for renewable energy by virtue of its “EnergyShare” technology. The same leading product attributes will benefit MDU property owners and homeowners in California. The potential available MDU market in California is believed to be in the billions of dollars. EnergyShare enables networked systems to share excess generation behind their respective utility meters, a game-changer for improving the project economics for the MDU market, including for low-income housing, rental property units and Home Owners Association managed condominiums and town homes. EnergyShare enables more energy to be delivered to load, and fewer batteries to be installed than the standard approach of a unit-by-unit installation.

- On Dec. 8, Borqs announced its subsidiary, Holu Hou Energy (HHE), has received multiple purchase orders for its HoluPower xP solar energy storage systems for installation at homeowner locations in the Greater San Diego area in California. These orders represent the first for the Company in California. Whereas in Hawaii HHE works to develop and construct Single-Family Residential projects as an “end to end” provider, the Company will target the California homeowner market through already existing channel partners that will sell and construct the projects. For Multi-Dwelling Unit (MDU) Residential properties in the State, the Company will initially target apartment owners, REITs and other MDU stakeholders directly, then partner with existing licensed contractors for system construction. HHE has been focused on the Hawaii market since it began commercial shipments in 2020, in order to become successfully established in the largest market in the United States based upon solar installation penetration. Now it is turning to California, the largest market in terms of size of available opportunity. HHE recently completed the testing and documentation required for the HoluPower xP to be listed as an approved product by the California Energy Commission. The Company expects to be listed by early January 2023, after which permitting and installations can commence. In Hawaii, Holu Hou Energy has quickly become a leader for solar energy storage systems in the Single-Family Residential market, and has essentially created the previously untapped Multi-Dwelling Unit (“MDU”) Residential market for renewable energy by virtue of its “EnergyShare” technology. The same leading product attributes will benefit MDU property owners and homeowners in California. The potential available MDU market in California is believed to be in the billions of dollars. EnergyShare enables networked systems to share excess generation behind their respective utility meters, a game-changer for improving the project economics for the MDU market, including for low-income housing, rental property units and Home Owners Association managed condominiums and town homes. EnergyShare enables more energy to be delivered to load, and fewer batteries to be installed than the standard approach of a unit-by-unit installation.

- To view a video clip of a recently completed HHE Multi-Unit Residential project go to: https://www.youtube.com/watch?v=kakbynGM-fQ

Shares of InMed Pharmaceuticals Inc. (INM), a leader in the research, development and manufacturing of rare cannabinoids, closed at $1.89, +15.24% over the last 5-days.

- On Dec. 16, InMed confirmed that, at its annual general meeting of shareholders held on December 15, 2022 (the “Meeting”), all of the matters put forward before shareholders for consideration and approval as set out in InMed’s notice of meeting and management information circular, dated October 28, 2022, were approved by the shareholders. In particular, shareholders approved the election of all director nominees to hold office until the next annual meeting of shareholders or until their successors are elected or appointed. See results.

-

On Dec. 12, InMed announced the Company has entered into a service contract with Brio Financial Group to provide senior financial leadership and bookkeeping services. Pursuant to the Contract, Mr. Jonathan Tegge, a member of Brio, will assume the role of Interim Chief Financial Officer for the Company effective December 12, 2022. Brio is a financial and management consulting group based in Bridgewater, New Jersey. The firm provides outsourced financial management and financial reporting support to small and middle market entities. Currently, the team provides consulting services to over 50 private and publicly traded companies. Additionally, the Company announces that its auditor, KPMG, has resigned effective as of December 8, 2022, and that the Audit Committee of the Board of Directors of the Company approved the engagement of Marcum LLP as its auditor, subject to Marcum’s completion of their client acceptance procedures. Marcum will stand for appointment at the Company’s Annual General Meeting, currently scheduled for Thursday, December 15, 2022. KPMG has confirmed that there are no reportable events (as such term is defined in National Instrument 51-102 – Continuous Disclosure Obligations (“NI 51-102”)).

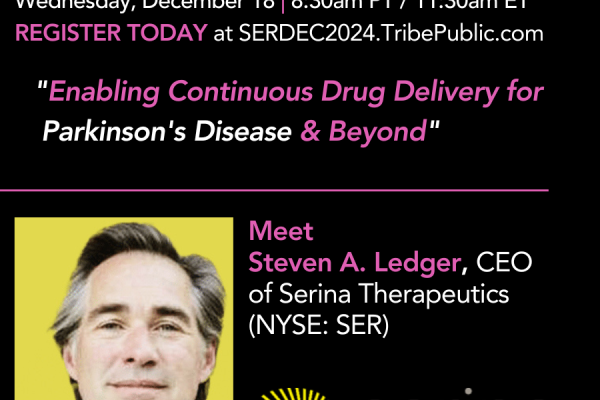

- On Nov. 17, Tribe Public’s Webinar Presentation and Q&A Event was co-hosted by Eric A. Adams, CEO & Eric C. Hsu, PhD, Senior Vice President, Pre-Clinical Research & Development of InMed Pharmaceuticals (NASDAQ: INM. They delivered a presentation titled “Exploring The Neuroprotective Qualities of Rare Cannabinoids”& addressed a Q&A session at the end of the presentation. You may now watch the event video art the Tribe Public YouTube Channel at this link.

Thanks again for your attention this week. Please continue to share your thoughts, questions, & ideas as we move forward.

In the meantime, please enjoy the balance of the weekly newsletter’s videos, quotes, updates and let’s find ways to crush it again this year!

Investing & Inspiration

- “If one does not know to which port one is sailing, no wind is favorable.” – Lucius Annaeus Seneca

- “There is little that can withstand a man who can conquer himself.” – Louis XIV

- “The limits of the possible can only be defined by going beyond them into the impossible.” – Arthur C. Clarke

- “Be faithful in small things because it is in them that your strength lies.” – Mother Teresa

- “The future rewards those who press on. I don’t have time to feel sorry for myself. I don’t have time to complain. I’m going to press on.” – Barack Obama

- “By three methods we may learn wisdom: First, by reflection, which is noblest; Second, by imitation, which is easiest; and third by experience, which is the bitterest.” – Confucius

- “No man was ever wise by chance.” – Lucius Annaeus Seneca

- “Progress is man’s ability to complicate simplicity.” – Thor Heyerdahl

- “It is not in the stars to hold our destiny but in ourselves.” – William Shakespeare

-

“It does not matter how slowly you go as long as you do not stop.” – Confucius

-

“I want to put a ding in the universe.” – Steve Jobs

-

“Research is creating new knowledge.” – Neil Armstrong

- “The reward for work well done is the opportunity to do more.” – Jonas Salk

- “Man is a creative retrospection of nature upon itself.” – Karl Wilhelm Friedrich Schlegel

- “There’s something about taking a plow and breaking new ground. It gives you energy.” – Ken Kesey

-

“Success seems to be largely a matter of hanging on after others have let go.” – William Feather

- “The essential conditions of everything you do must be choice, love, passion.” – Nadia Boulanger

-

“More business is lost every year through neglect than through any other cause.” – Rose Kennedy

-

“Give me a lever long enough and a fulcrum on which to place it, and I shall move the world.” – Archimedes

- “A person who won’t read has no advantage over one who can’t read.” – Mark Twain

-

“The best way out is always through.” – Robert Frost

- “Start by doing what’s necessary; then do what’s possible; and suddenly you are doing the impossible.” – Francis of Assisi

-

“Without labor nothing prospers.” – Sophocles

- “Intellectuals solve problems, geniuses prevent them.” – Albert Einstein

-

“This is the precept by which I have lived: Prepare for the worst; expect the best; and take what comes.” – Hannah Arendt

-

“The best and most beautiful things in the world cannot be seen or even touched – they must be felt with the heart.” – Helen Keller

- “He who is brave is free.” – Lucius Annaeus Seneca

-

“When something is important enough, you do it even if the odds are not in your favor.” – Elon Musk

-

“I choose a block of marble and chop off whatever I don’t need.” – Auguste Rodin

-

“Hope is the only bee that makes honey without flowers.” – Robert Green Ingersoll

-

“He who knows that enough is enough will always have enough.” – Lao Tzu

- “Plans to protect air and water, wilderness and wildlife are in fact plans to protect man.” – Stewart Udall

-

“In order to carry a positive action we must develop here a positive vision.” – Dalai Lama

- “A hero is someone who understands the responsibility that comes with his freedom.” – Bob Dylan

- “Inflation destroys savings, impedes planning, and discourages investment. That means less productivity and a lower standard of living.” – Kevin Brady

- “If we give something positive to others, it will return to us. If we give negative, that negativity will be returned.” – Allu Arjun

- “A good plan violently executed now is better than a perfect plan executed next week.” ~ George S. Patton

- “You must do the things you think you cannot do.”- Eleanor Roosevelt

- “Success is dependent on effort.” – Sophocles

- “Nobody who ever gave his best regretted it.” – George Halas

- “Lots of people want to ride with you in the limo, but what you want is someone who will take the bus with you when the limo breaks down.” ~ Oprah Winfrey

- “And when I breathed, my breath was lightning.” – Black Elk

- “Moderation is the silken string running through the pearl chain of all virtues.” – Joseph Hall

- “You are the sum total of everything you’ve ever seen, heard, eaten, smelled, been told, forgot – it’s all there. Everything influences each of us, and because of that I try to make sure that my experiences are positive.” – Maya Angelou

- “If you want a guarantee, buy a toaster.” – Clint Eastwood

- “We are an impossibility in an impossible universe.” – Ray Bradbury

- “If you think in terms of a year, plant a seed; if in terms of ten years, plant trees; if in terms of 100 years, teach the people.” – Confucius

- “I’d rather attempt to do something great and fail than to attempt to do nothing and succeed.” – Robert H. Schuller

- “Do your little bit of good where you are; it’s those little bits of good put together that overwhelm the world.” Desmond Tutu

- “It takes considerable knowledge just to realize the extent of your own ignorance.” – Thomas Sowell

- “Do not dwell in the past, do not dream of the future, concentrate the mind on the present moment.” – Buddha”

- Surprise is the greatest gift which life can grant us.” – Boris Pasternak

- “Trust in dreams, for in them is hidden the gate to eternity.” – Khalil Gibran

- “Always be yourself, express yourself, have faith in yourself, do not go out and look for a successful personality and duplicate it.” – Bruce Lee

- “All life is an experiment. The more experiments you make the better.” – Ralph Waldo Emerson

- “There are no secrets to success. It is the result of preparation, hard work, and learning from failure.” – Colin Powell

- “There is more to life than increasing its speed.” – Mahatma Gandhi

- “Your attitude is like a box of crayons that color your world. Constantly color your picture gray, and your picture will always be bleak. Try adding some bright colors to the picture by including humor, and your picture begins to lighten up.” – Allen Klein

- “Definiteness of purpose is the starting point of all achievement.” – W. Clement Stone

- “Success usually comes to those who are too busy to be looking for it.” – Henry David Thoreau

- “In matters of truth and justice, there is no difference between large and small problems, for issues concerning the treatment of people are all the same.” – Albert Einstein

- “Life is too short for long-term grudges.” – Elon Musk

- “There cannot be a crisis next week. My schedule is already full.” – Henry Kissinger

- “Success consists of getting up just one more time than you fall.” – Oliver Goldsmith

- “The Earth is the cradle of humanity, but mankind cannot stay in the cradle forever.” – Konstantin Tsiolkovsky

- “Ours is a world of nuclear giants and ethical infants. We know more about war that we know about peace, more about killing that we know about living.” – Omar N. Bradley

- “Beauty surrounds us, but usually we need to be walking in a garden to know it.” – Rumi

- “But man is not made for defeat. A man can be destroyed but not defeated.” – Ernest Hemingway

- “Don’t watch the clock; do what it does. Keep going.” – Sam Levenson

- “Let there be work, bread, water and salt for all.” – Nelson Mandela

- “The social object of skilled investment should be to defeat the dark forces of time and ignorance which envelope our future.” – John Maynard Keynes

- “A successful society is characterized by a rising living standard for its population, increasing investment in factories and basic infrastructure, and the generation of additional surplus, which is invested in generating new discoveries in science and technology.” – Robert Trout

- “I know not with what weapons World War III will be fought, but World War IV will be fought with sticks and stones.” – Albert Einstein

- “It is the fight alone that pleases us, not the victory.” – Blaise Pascal

- “If you can’t describe what you are doing as a process, you don’t know what you’re doing.” – W. Edwards Deming

- “Never interrupt your enemy when he is making a mistake.” – Napoleon Bonaparte

- “Be sure you put your feet in the right place, then stand firm.” – Abraham Lincoln

- “Without investment there will not be growth, and without growth there will not be employment.” – Muhtar Kent

- “You have to do your own growing no matter how tall your grandfather was.” – Abraham Lincoln

- “Victory has a thousand fathers, but defeat is an orphan.” – John F. Kennedy

- “Delete the negative; accentuate the positive!” – Donna Karan

- “It’s crazy how fast time flies and how things progress.” – Nathan Chen

- “The world is a dangerous place to live; not because of the people who are evil, but because of the people who don’t do anything about it.” – Albert Einstein

- “Life isn’t about finding yourself. Life is about creating yourself.” – George Bernard Shaw

- “Everything has beauty, but not everyone sees it.” – Confucius

- “A man must be big enough to admit his mistakes, smart enough to profit from them, and strong enough to correct them.” – John C. Maxwell

- “Walking with a friend in the dark is better than walking alone in the light.” – Helen Keller

- “A man who dares to waste one hour of time has not discovered the value of life.” – Charles Darwin

- “The greater danger for most of us lies not in setting our aim too high and falling short; but in setting our aim too low, and achieving our mark.” – Michelangelo

- “Progress is man’s ability to complicate simplicity.” – Thor Heyerdahl

- “I like to encourage people to realize that any action is a good action if it’s proactive and there is positive intent behind it.” – Michael J. Fox

- “Nothing is impossible, the word itself says ‘I’m possible’!” – Audrey Hepburn

- “But investment in space stimulates society, it stimulates it economically, it stimulates it intellectually, and it gives us all passion.” – Bill Nye

- “Bitcoin, in the short or even long term, may turn out be a good investment in the same way that anything that is rare can be considered valuable. Like baseball cards. Or a Picasso.” – Andrew Ross Sorkin

- “Life is a tragedy when seen in close-up, but a comedy in long-shot.” – Charlie Chaplin

- “No matter what you’re going through, there’s a light at the end of the tunnel and it may seem hard to get to it but you can do it and just keep working towards it and you’ll find the positive side of things.” – Demi Lovato

- “Infrastructure investment in science is an investment in jobs, in health, in economic growth and environmental solutions.” – Oren Etzioni

- “Educating our children and giving them the skills they need to compete in a global economy is a smart investment in our country’s future.” – Sheldon Whitehouse

- “Know thy self, know thy enemy. A thousand battles, a thousand victories.” – Sun Tzu

- “If one does not know to which port one is sailing, no wind is favorable.” – Lucius Annaeus Seneca

- “Beware of missing chances; otherwise it may be altogether too late some day.” – Franz Liszt

- “The sofa is a really important investment for anybody, and I don’t mean financially. You need to find a really great sofa that can transition with you, and you can build from there.” – Jeremiah Brent

- “There is no investment you can make which will pay you so well as the effort to scatter sunshine and good cheer through your establishment.” – Orison Swett Marden

- “Nothing in life is to be feared, it is only to be understood. Now is the time to understand more, so that we may fear less.” – Marie Curie

- “There is little that can withstand a man who can conquer himself.” – Louis XIV

- “In tennis, you strike a ball just after the rebound for the fastest return. It’s the same with investment.” – Masayoshi Son

- “A camel makes an elephant feel like a jet plane.” – Jackie Kennedy

- “The advance of technology is based on making it fit in so that you don’t really even notice it, so it’s part of everyday life.” – Bill Gates

- “Success depends upon previous preparation, and without such preparation there is sure to be failure.” – Confucius, Chinese

- “Coming together is a beginning; keeping together is progress; working together is success.” – Edward Everett Hale

- “Never do anything against conscience even if the state demands it.”– Albert Einstein

- “Education is not only a ladder of opportunity, but it is also an investment in our future.” – Ed Markey

- “The true measure of a man is how he treats someone who can do him absolutely no good.” – Samuel Johnson

- “In my view, the biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. Not only is the mere drop in stock prices not risk, but it is an opportunity. Where else do you look for cheap stocks?” – Li Lu

- “A successful society is characterized by a rising living standard for its population, increasing investment in factories and basic infrastructure, and the generation of additional surplus, which is invested in generating new discoveries in science and technology.” – Robert Trout

- “The best preparation for tomorrow is doing your best today.” – H. Jackson Brown, Jr.

- “Friendship marks a life even more deeply than love. Love risks degenerating into obsession, friendship is never anything but sharing.” – Elie Wiesel

- “Investing in women’s lives is an investment in sustainable development, in human rights, in future generations – and consequently in our own long-term national interests.” – Liya Kebede

- “Success isn’t measured by money or power or social rank. Success is measured by your discipline and inner peace.” – Mike Ditka

- “No matter how many goals you have achieved, you must set your sights on a higher one.” – Jessica Savitch

- “Start where you are. Use what you have. Do what you can.”– Arthur Ashe

- “The secret of getting ahead is getting started.” – Mark Twain

- “The amount of work and the amount of both physical and emotional investment it takes to get to the top.” – Drew Bledsoe

Videos

Post View Count : 501