Powell Steadies, Treasury Yields Back Off, Markets Move Higher on Tuesday – $AAPL $ILMN $INM $INVO $SPIR $VORB Rise!

“The sofa is a really important investment for anybody, and I don’t mean financially. You need to find a really great sofa that can transition with you, and you can build from there.” – Jeremiah Brent, American Celebrity, Born: November 24, 1984

Tuesday’s markets started off with another dip today and then proceeded to rise into the close; very much similar to yesterday’s action. However, today’s move ended, unlike yesterday, with all indices closing strongly in the green. The markets turned positive as the Fed’s “Big Cat” Fed Chair Jerome Powell testified at a confirmation hearing stating his case for another four year term and offered a more ‘market friendly’ narrative than last week. Essentially, he admitted that the Fed had previously predicted that inflation would be “alleviated more quickly than now appears to be the case. Substantially more quickly.” He also added that it was also “expected that more workers would have returned to the workforce than has turned out to be the case.” Looking forward, which was the key today, he added that he expects “some relief” with regard to the “supply front this year” and global supply chains “will loosen up,” but if inflation pressures persist the Fed would push to raise rates at a more rapid pace. In turn, the yield curve backed off from its initial daily surge as the 2-yr yield closed flat at .90% & the 10-yr yield moved lower by 2 basis points to end at 1.75%.

8 of the 11 sectors provided the strength in the market today with the energy sector rising 3.4% and the influential information tech sector moving up 1.2%, while the utilities, real estate and consumer staples sectors drifted lower. The S&P 500 closed at 4,713.07 (+.92%), the Dow 30 closed at 36,252.02 (+.51%), & the Nasdaq closed at 15,153.45 (+1.41%). The small caps on the Russell 2000 closed at 2,194.00 (+1.05%) & the MicroCaps also closed higher with the iShares Micro-Cap ETF (IWC) closing at $136.65, +.88%.

The biotech sector had a better day as the SPDR S&P Biotech ETF (XBI), a barometer of the smaller biotech stocks, rebounded to close the day at $103.89, +.73% after touching $105.05 during intraday trading. The 52-wk range is $100.05 – $174.79.

Only one macroeconomic report surfaced again today as the NFIB Small Business Optimism Index report rose to 98.9 in December.

The U.S. Dollar Index fell .4% to 95.62, gold prices closed at $1,822/oz., +$20/oz., silver closed at $22.81, +$.32, Bitcoin (BTC) closed at $42,781.61, +2.30% over the past 24-hours & oil prices jumped another 3.9% to close at $81.14/bbl.

FURTHER AFIELD

Today, Shares of Illumina, Inc. (NASDAQ:ILMN) closed at $423.80, +16.98% after Chief Executive Officer, Francis deSouza, discussed the company’s strong growth trajectory, including 2021 results and 2022 guidance. deSouza also announced new partnerships and technologies that will advance the company’s mission of improving human health by unlocking the power of the genome. Francis deSouza, CEO of Illumina stated, “We are seeing incredible acceleration of genomics in healthcare, driving an outstanding 2021 for Illumina and strong momentum for 2022 and beyond. With growth opportunities spanning our existing and evolving markets in both clinical and research genomics, we are demonstrating through focused and continued innovation how unlocking the power of the genome improves human health. Across all our markets, we are providing tools that enable today’s researchers and clinicians to usher in the future of personalized medicine for patients around the world.” Illumina delivered a strong finish to 2021, with preliminary consolidated fourth quarter revenue of approximately $1.190 billion, up 25% year-over-year. This record revenue for the quarter reflected records across both instruments and consumables. Illumina also delivered preliminary fiscal year 2021 consolidated revenue of approximately $4.517 billion, up 39% year-over-year, reflecting record revenue across all regions and the highest number of shipments in company history. The company expects another strong year in 2022, with consolidated revenue guidance of $5.15 billion to $5.24 billion, or growth of 14% to 16% year-over-year, as sequencing awareness, demand, and adoption increase.

Shares of Virgin Orbit (Nasdaq: VORB) closed at $10.57, +31.30%. Virgin Orbit operates one of the most flexible and responsive space launch systems ever built. Founded by Sir Richard Branson in 2017, the company began commercial service in 2021, and has already delivered commercial, civil, national security, and international satellites into orbit. Virgin Orbit’s LauncherOne rockets are designed and manufactured in Long Beach, California, and are air-launched from a modified 747- 400 carrier aircraft that allows Virgin Orbit to operate from locations all over the world in order to best serve each customer’s needs. On Jan. 10, Virgin Orbit announced the the launch window for Virgin Orbit’s third commercial flight, Above the Clouds, opens this Wednesday, January 12, 2022. The spacecraft to be launched to Low Earth Orbit at 500 km circular orbit at 45 degrees inclination for this mission includes satellites for the US Department of Defense’s Space Test Program, Polish company SatRevolution, and Spire Global, Inc. (NYSE: SPIR, $2.96, +11.70%). Virgin Orbit’s team is currently progressing through the final pre-flight checklist as they work towards the opening of a launch window on January 12. Anticipated take-off times on January 12 range between approximately 1pm and 3:30pm Pacific (21:00 – 23:30 GMT), with rocket drop and ignition expected to occur roughly one hour after take-off. Virgin Orbit will proceed to launch if all conditions are nominal. Backup windows extend through January. This week’s launch takes place on the heels of successful commercial launches that placed 19 satellites into orbit. Virgin Orbit also recently listed publicly and rang the opening bell on the NASDAQ stock exchange on Friday, January 7, 2022, at Nasdaq in Times Square.

VP WATCHLIST UPDATES

Apple (AAPL) closed at $175.08, +1.68%. According to Reuters, “South Korea’s telecommunications regulator said on Tuesday Apple Inc had submitted plans to allow third-party payment systems on its App Store to comply with a law banning major app store operators from forcing software developers to use their payments systems.”

Tesla (TSLA) closed at $1,064.40, +.59%. Today, Barrons reported that “Tesla delivered almost 71,000 vehicles from its Shanghai plant in December, according to Citigroup analyst Jeff Chung.”

The Walt Disney Company (DIS) closed at $157.89, +.82%. CEO Bob Chapek recently outlined that Disney’s “3 pillars” are storytelling, innovation & a “relentless focus on our audience.” He added,“Over the last two years, we continued to tell the world’s best stories, reorganized, and accelerated our transformation to better serve audiences and guests. We looked inward during a time of social disruption, saw how much was left to do, and made significant change. And of course, we underwent a leadership change — and I am enormously grateful for the tremendous foundation Bob Iger left us.” Disney will hold its annual meeting of shareholders on Wednesday, March 9, 2022 at 1:00 p.m. ET / 10:00 a.m. PT by virtual meeting and will be made available via webcast at www.disney.com/investors.

On the small side, Atossa Therapeutics (NASDAQ: ATOS), a clinical-stage biopharmaceutical company seeking to develop innovative proprietary medicines in oncology and infectious disease with a current focus on breast cancer and COVID-19, rose to an intraday high of $1.5999 prior to closing at $1.54, +2.67% on 1.796M shares of trading volume. On Dec. 22, Atossa announced that it has initiated enrollment of its Phase 2 clinical study of oral Z-Endoxifen in Sweden. Participants in the study will be premenopausal women with elevated mammographic breast density, which is an emerging public health issue affecting more than 10 million women in the United States and many more worldwide. “This is an extremely important milestone as it marks the next phase of developing our proprietary Z-Endoxifen,” said Steven Quay, M.D., Ph.D., Atossa’s Chairman and CEO. “This study will help determine the relationship between daily doses of Endoxifen and reduction in breast density and will help us further assess safety and tolerability. We look forward to providing progress updates as they become available.” Physician-Scientist and CEO of Atossa, Steven Quay, MD, PhD, recently published an e-print on his research into a new coronavirus, named BANAL-236, reported by the Institut Pasteur in September 2021. At the time, BANAL-236 was the first bat coronavirus with high homology to SARS-CoV-2 that could directly infect human cells using the same receptor that SARS-CoV-2 uses. The new research reports that BANAL-236 has evolved the ability to infect human cells by an unknown mechanism that violates over 40 years of coronavirus research. The COVID-19 e-print is available here and has also been submitted to Nature. “When I read the paper from the Institut Pasteur and looked at the virus, I immediately assumed there was an error in either the way the sequence was assembled or a mix up in the lab with another virus to explain the infectivity,” Quay said. “I contacted the Institut Pasteur with my findings and was deeply disturbed to learn that there was not, in fact, some simple mistake had occurred to explain things. I now knew we were in uncharted waters with a virus that is missing eight key elements that have been shown, over 40 years of research, to be required for growth.” Atossa management also recently presented at “A Town Hall Q&A Event With Atossa Therapeutics Management Team” with Tribe Public. You can view it clicking here. Atossa also announced recently that it had completed a pre-investigational new drug (PIND) meeting with the FDA to obtain input from the FDA on pre-clinical, clinical, manufacturing and regulatory matters in the U.S. for Atossa’s proprietary Z-endoxifen to treat breast cancer in the neoadjuvant (prior to surgery) setting.

On Jan. 10, Fate Therapeutics, Inc. (NASDAQ: FATE), a clinical-stage biopharmaceutical company dedicated to the development of programmed cellular immunotherapies for patients with cancer, announced that the U.S. Food and Drug Administration (FDA) has cleared the Company’s Investigational New Drug (IND) application for FT536, an off-the-shelf, multiplexed-engineered, iPSC-derived, chimeric antigen receptor (CAR) NK cell product candidate. FT536 is derived from a clonal master induced pluripotent stem cell (iPSC) line engineered with four functional elements, including a novel CAR that uniquely targets the α3 domain of the major histocompatibility complex (MHC) class I related proteins A (MICA) and B (MICB). MICA and MICB are stress proteins that are expressed at high levels on many solid tumors. The Company plans to initiate clinical investigation of FT536 as a monotherapy and in combination with tumor-targeting monoclonal antibody therapy for the treatment of multiple solid tumor indications. Shares of FATE closed at $47.54, -3.59%.

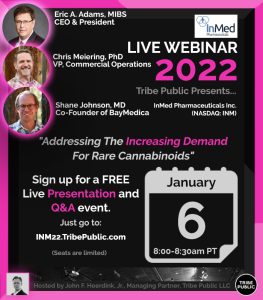

InMed Pharmaceuticals Inc. (NASDAQ: INM), a leader in the development, manufacturing and commercialization of rare cannabinoids, closed at $1.30, +6.56% after hitting an intraday high of $1.33. On Jan. 6, InMed’s CEO Eric A. Adams, Shane Johnson, SVP and General Manager of BayMedica and Chris Meiering, VP of Commercial Operations, presented at Tribe Public’s Webinar Presentation and Q&A Event titled “Addressing The Increasing Demand For Rare Cannabinoids.” On Jan. 5th, InMed issued its Annual Letter to Shareholders from President and CEO Eric A. Adams which stated, “Building on a very strong 2021, we are looking forward to 2022 with the continued advancement of our pharmaceutical drug development programs and, with our acquisition of BayMedica, transitioning to becoming a leading B2B supplier of rare cannabinoids to the consumer health and wellness sector. I’m very excited to provide updates on our progress as we begin to commercialize new products and explore an array of rare cannabinoids for their potential therapeutic applications.” Click here to read the letter.

INmune Bio, Inc. (NASDAQ: INMB), a clinical-stage immunology company focused on developing treatments that harness the patient’s innate immune system to fight disease, recently presented data at the San Antonio Breast Cancer Symposium showing mucin 4 (MUC4) expression predicts worse survival and is a treatment resistance factor in women with triple negative breast cancer (TNBC). INB03, a DN-TNF therapy, can reverse TNBC treatment resistance by decreasing expression of MUC4 and reducing immunosuppression in the tumor microenvironment (TME) by increasing anti-tumor macrophage phagocytosis and increasing lymphocyte function in the TME. The poster will be presented by Dr. Roxana Schillaci, Instituto de Biología y Medicina Experimental, Buenos Aires, on December 10th. RJ. Tesi, M.D, Chief Executive Officer of INmune Bio, commented, “We are excited to have Dr. Schillaci present these data that expand on her previous findings on the role of MUC4 expression which predicts worse survival and resistance to therapy in HER2+ breast cancer therapy. Now, in both TNBC and HER2+ breast cancer, MUC4 predicts resistance to immunotherapy and an immunosuppressive TME that can be overcome with INB03.” Treatment with INB03 in murine models of breast cancer improves macrophage anti-tumor phagocytic activity, lymphocyte infiltration and function suggesting improved response to combination therapies of INB03 with inmunotherapy. Shares of INMB closed trading today at $9.20, -.11% after hitting an intraday high of $9.46.

Shares of INVO Bioscience, Inc. (NASDAQ: INVO), a medical device company focused on commercializing the world’s only in vivo culture system (IVC), INVOcell®, closed at $3.62,+1.69% after hitting $3.66 during intraday trading, but still well off of its 52-wk high of $12.30. A sell side analyst named Kyle Bauser, Ph.D. at Colliers Securities recently published his Buy Rating Report with a $6 Price Target. On Dec. 16, INVO Bioscience, Inc. announced that it has entered into an expanded agreement with Ovoclinic, a group of clinics specialized in assisted reproductive treatments with four locations across Spain (Madrid, Marbella, Málaga, Ceuta) and collaborating centers around Europe, to accelerate adoption of INVOcell within their markets. The agreement includes the expanded adoption of INVOcell within Ovoclinic locations as well as establishing an INVO Center of Excellence for future training for the European Market. Cristina Gonzalez, embryologist and Quality Manager of Ovoclinic laboratories stated, “After several successful trials implementing the exciting INVOcell fertility treatment, Ovoclinic aims to provide its patients with this effective alternative to the processes used so far in Spain in the field of reproductive medicine. We consider INVOcell to be an effective method of natural reproduction that involves the future mother at the very first moment of the process. We are confident that this innovative treatment will help many patients to choose this new alternative solution to achieve their dream of forming a family by actively participating in the reproductive process.” According to the World Bank, Spain, with total population of approximately 47 million people, has one of the lowest fertility rates in Europe, affecting approximately 15% of the population, or one in seven couples of reproductive ages. According to reports, in 2010, there were approximately one million couples requesting assisted reproductive treatment, however only 22% received one or more assisted reproductive treatment cycles. The average waiting time for an IUI or IVF cycle in a public health facility was 339 days. Ovoclinic reports that they maintain the best technical and human resources to deal with all kinds of infertility problems along with the simplest and most natural treatments to the most complex and advanced techniques pioneered in Spain. Ovoclinic also works in partnership with Ovobank, the first European Donor Egg Bank in Europe.

Shares of Hecla Mining Company (NYSE: HL), the largest silver producer in the United States closed at $5.11, +3.86%.

Shares of NeuBase Therapeutics (NASDAQ: NBSE), a biotechnology platform company Drugging the Genome™ to address disease at the base level using a new class of precision genetic medicines, closed at $2.4052, -4.56% after hitting an intraday high of $2.5727. The 52-wk range is $2.30-$12.89. On Jan. 10, NeuBase announced the appointment of Todd P. Branning as Chief Financial Officer (CFO). Mr. Branning has more than 25 years of experience leading corporate finance and accounting, tax, financial planning and analysis, and investor relations for several publicly traded pharmaceutical companies. Prior to joining NeuBase, Mr. Branning was CFO of Phathom Pharmaceuticals, Inc., a publicly traded late clinical-stage biopharmaceutical company. Before that, he was Senior Vice President, CFO of Amneal Pharmaceuticals, Inc., a publicly traded pharmaceutical company, where he helped to build, leverage, and optimize infrastructure following the completion of a transformational merger. Prior to joining Amneal, he was Senior Vice President, CFO of the global generic medicines division at Teva Pharmaceutical Industries Ltd., a multinational generic pharmaceuticals company, where he led the finance function and served on the leadership team responsible for managing the day-to-day operations of Teva’s largest multi-billion-dollar commercial unit. Mr. Branning has also held financial leadership roles at Allergan plc, PricewaterhouseCoopers LLP, PPG Industries, Inc., and Merck & Co., Inc. Mr. Branning received his BBA from the University of Miami and MBA from Carnegie Mellon University. Mr. Branning is also a Certified Public Accountant and has completed a CFO certification program at The Wharton School at the University of Pennsylvania. On Jan. 5, Neubase announced the appointment of Eric J. Ende, M.D., to the Company’s Board of Directors. Dr. Ende has nearly 25 years of experience in advising biotechnology and life sciences companies to optimize corporate strategy and structure and maximize shareholder value. “Dr. Ende has the experience and perspective to recognize the opportunity ahead for NeuBase as it plans for the clinical development of its potentially transformational new class of precision genetic medicines,” said Dietrich A. Stephan, Ph.D., Founder, CEO and Chairman of NeuBase. “We welcome Dr. Ende’s strategic insight as we begin to scale our therapeutic candidate pipeline from our new precision genetic medicines platform technology. In addition to his broad experience, he also shares in our Company’s goal of helping millions of patients with both common and rare conditions that currently have limited or no treatment options.” “I believe NeuBase has a game-changing technology that overcomes the limitations of early precision genetic medicines by delivering mutation selectivity, repeat dosing, and systemic administration in a modular precision medicine platform with the potential to efficiently scale to treat a wide variety of diseases that are currently undruggable,” said Dr. Ende. “I look forward to working closely with NeuBase’s leadership team and Board of Directors to elevate strategy and operations in order to create exceptional value for patients and shareholders.” Dr. Ende currently is the President of Ende BioMedical Consulting Group. He also is a member of the Board of Directors of Matinas BioPharma, where he is the Chairman of the Compensation Committee and serves on the Audit and the Nomination & Governance Committees, and of Avadel plc, where he is the Chairman of the Nomination & Corporate Governance Committee and serves on the Audit and Compensation Committees. Dr. Ende previously served on the Board of Directors of Progenics (acquired by Lantheus Holdings) and Genzyme (acquired by Sanofi-Aventis for $20 billion). During his time on Genzyme’s Board of Directors, Dr. Ende was a member of the Audit and Risk Management Committees. Prior to Genzyme, Dr. Ende was a biotechnology analyst, previously serving at Merrill Lynch, BofA Securities, and Lehman Brothers. Dr. Ende received an M.B.A. from NYU Stern School of Business, an M.D. from the Icahn School of Medicine at Mount Sinai, and a B.S. in biology and psychology from Emory University.

Economic Reports

On Monday, the Wholesale Inventories report confirmed a 1.4% increase M/M.

On Tuesday, the NFIB Small Business Optimism Index report was confirmed to have risen to 98.9 in December.

Investing & Inspiration

- “The sofa is a really important investment for anybody, and I don’t mean financially. You need to find a really great sofa that can transition with you, and you can build from there.” – Jeremiah Brent

- “There is no investment you can make which will pay you so well as the effort to scatter sunshine and good cheer through your establishment.” – Orison Swett Marden

- “Nothing in life is to be feared, it is only to be understood. Now is the time to understand more, so that we may fear less.” – Marie Curie

- “There is little that can withstand a man who can conquer himself.” – Louis XIV

- “In tennis, you strike a ball just after the rebound for the fastest return. It’s the same with investment.” – Masayoshi Son

- “A camel makes an elephant feel like a jet plane.” – Jackie Kennedy

- “The advance of technology is based on making it fit in so that you don’t really even notice it, so it’s part of everyday life.” – Bill Gates

- “Success depends upon previous preparation, and without such preparation there is sure to be failure.” – Confucius, Chinese

- “Coming together is a beginning; keeping together is progress; working together is success.” – Edward Everett Hale

- “Never do anything against conscience even if the state demands it.”– Albert Einstein

- “Education is not only a ladder of opportunity, but it is also an investment in our future.” – Ed Markey

- “The true measure of a man is how he treats someone who can do him absolutely no good.” – Samuel Johnson

- “In my view, the biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. Not only is the mere drop in stock prices not risk, but it is an opportunity. Where else do you look for cheap stocks?” – Li Lu

- “A successful society is characterized by a rising living standard for its population, increasing investment in factories and basic infrastructure, and the generation of additional surplus, which is invested in generating new discoveries in science and technology.” – Robert Trout

- “The best preparation for tomorrow is doing your best today.” – H. Jackson Brown, Jr.

- “Friendship marks a life even more deeply than love. Love risks degenerating into obsession, friendship is never anything but sharing.” – Elie Wiesel

- “Investing in women’s lives is an investment in sustainable development, in human rights, in future generations – and consequently in our own long-term national interests.” – Liya Kebede

- “Success isn’t measured by money or power or social rank. Success is measured by your discipline and inner peace.” – Mike Ditka

- “No matter how many goals you have achieved, you must set your sights on a higher one.” – Jessica Savitch

- “Start where you are. Use what you have. Do what you can.”– Arthur Ashe

- “The secret of getting ahead is getting started.” – Mark Twain

- “The amount of work and the amount of both physical and emotional investment it takes to get to the top.” – Drew Bledsoe

Videos

Post View Count : 501