Hump Day: The Market’s Midweek Mood Swing! – $ADT $INDP $MODD $LTRN $VIX Rise!

U.S. stocks wavered on August 7, 2024, giving back earlier gains as investors struggled to recover from the week’s significant losses, with the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all experiencing volatility amid ongoing economic concerns. Indeed, the stock market started the day like a sprinter at the Olympics, full of energy and determination, only to end up like a marathon runner who forgot to carbo-load the night before. The initial enthusiasm was fueled by yesterday’s rebound, much like a toddler on a sugar high after Halloween. But alas, the sugar crash came swiftly, and the major indices ended the session with declines.

Stock Market Rollercoaster

Wall Street’s wild ride on August 7, 2024, resembled a financial theme park attraction, complete with thrilling highs and stomach-churning lows. The S&P 500 initially soared 1.7% before plummeting to close 0.8% lower, while its equal-weighted counterpart mirrored this performance with a 1.5% peak followed by a 0.7% decline. This market whiplash was partly influenced by the Bank of Japan’s assurance of stable interest rates during market instability, temporarily weakening the yen against the dollar (USD/JPY +1.9% to 147.10). However, the afternoon saw a broad and orderly retreat as growth concerns, previously sidelined, took center stage once again.

The Dow Jones Industrial Average performed its best impression of a financial yo-yo on August 7, 2024, climbing a respectable 281 points (0.7%) before closing down 234 points (.60%). Meanwhile, Volatility Index (VIX), Wall Street’s “fear gauge,” closed at $27.85,+.51% after hitting an intraday high of $29.48.

The small caps on the Russell 2000 closed at 2,035.11 (-1.41%) & The iShares Micro-Cap ETF (IWC) fell 1.55% closing at $113.08.

Amgen and Disney Earnings

Dow components faced a rough day as Amgen (AMGN) and Walt Disney (DIS) underperformed following their earnings reports. Amgen’s stock tumbled 5.0% to $312.50, while Disney shares dropped 4.5% to $85.96. Despite Disney’s streaming business achieving positive operating income for the first time, the company’s theme parks experienced weakening demand, casting a shadow over its overall performance. Adding to the market’s woes, Airbnb (ABNB) plummeted 13.4% to $113.01 after signaling a slowdown in demand from U.S. guests, further dampening investor sentiment in the travel and hospitality sector..

Sector and Bond Performance

Seven of the S&P 500 sectors closed in negative territory, with four declining more than 1.0%. Consumer discretionary and information technology sectors were among the worst performers, each dropping 1.4% due to losses in mega-cap constituents. In contrast, utilities and energy sectors managed to eke out gains of 0.6% and 0.5% respectively, leading the pack. The bond market also saw movement, with the 10-year note yield climbing 8bps to 3.97% and the 2-year note yield rising 2bps to 4%. Notably, the day’s $42B 10-year note auction was weakly received, indicating potential investor hesitancy in the face of market volatility.

The Macro Reports

The Weekly MBA Mortgage Applications Index came in at 6.9%, while the Weekly EIA Crude Oil Inventories confirmed a 3.73M barrel draw.

Market Outlook

Despite the day’s turbulence, major indices maintained positive year-to-date performance, with the S&P 500 up 9.0% and the Nasdaq Composite up 7.9%. This resilience in the face of volatility is reminiscent of a stubborn cat clinging to a curtain – it might wobble, but it’s not letting go easily. Looking ahead, investors braced themselves for upcoming economic data, including weekly initial claims and wholesale inventories, much like preparing for a surprise party where the guest of honor might show up with good news or a financial hangover.

VP Watchlist Updates

Eupraxia Pharmaceuticals (EPRX, $2.39, -7.36% today and is up +23.01% at $2.94 in the aftermarket), is a clinical-stage biotechnology company focused on the development of locally delivered, extended-release products that have the potential to address therapeutic areas with high unmet medical need. The Company strives to provide improved patient benefit and has developed technology designed to deliver targeted, long-lasting activity with fewer side effects. DiffuSphere™, a proprietary, polymer-based micro-sphere technology, is designed to facilitate targeted drug delivery, with extended duration of effect, and offers multiple, highly tuneable pharmacokinetic (PK) profiles. This investigational technology can be engineered for use with multiple active pharmaceutical ingredients and delivery methods.Note that Eupraxia recently completed a Phase 2b clinical trial (SPRINGBOARD) of EP-104IAR for the treatment of pain due to osteoarthritis of the knee. The trial met its primary endpoint and three of the four secondary endpoints. Eupraxia has expanded the EP-104 platform into gastrointestinl disease with the Phase 1b/2a RESOLVE trial for treating EoE. Eupraxia is also developing a pipeline of later- and earlier-stage long-acting formulations. Potential pipeline indications include candidates for other inflammatory joint indications and oncology, each designed to improve on the activity and tolerability of currently approved drugs.On June 5, Eupraxia announced that results from its Phase 2 study of EP-104IAR for the treatment of osteoarthritis of the knee will be presented at the upcoming European Alliance of Associations for Rheumatology (“EULAR”) European Congress of Rheumatology 2024 (the “Meeting”). The EULAR Meeting is being held in Vienna, Austria from June 12-15, 2024.On May 23, Eupraxia announced that regulators in Australia and Canada have cleared the Company’s request to expand its Phase 1b/2a RESOLVE trial, which is evaluating the safety and efficacy of EP-104GI as a treatment for eosinophilic esophagitis (“EoE”). For further details about Eupraxia, please visit the Company’s website at: www.eupraxiapharma.com.

Shares of Lantern (LTRN), an artificial intelligence (“AI”) company developing targeted and transformative cancer therapies using its proprietary RADR® AI and machine learning (“ML”) platform with multiple clinical stage drug program, closed at $4.03, +12.26% and is up 1.74% at $4.10 in the aftermarket.

Shares of Lantern (LTRN), an artificial intelligence (“AI”) company developing targeted and transformative cancer therapies using its proprietary RADR® AI and machine learning (“ML”) platform with multiple clinical stage drug program, closed at $4.03, +12.26% and is up 1.74% at $4.10 in the aftermarket.

Today, Lantern announced a significant advancement demonstrating the preclinical synergy of LP-184 with checkpoint inhibitors and the ability of LP-184 to resensitize tumors that have become non-responsive to Anti-PD1 therapies. The company will be presenting preliminary data from the recent work done in conjunction with Drs. Yong Du and Shiaw-Yih (Phoebus) Lin at MD Anderson at The Immuno-Oncology Summit 2024 in Philadelphia.

The data will be presented in the form of poster entitled, LP-184, a Novel Acylfulvene, Sensitizes Immuno-Refractory Triple Negative Breast Cancers (TNBCs) To Anti-PD1 Therapy by Affecting the Tumor Microenvironment, (assigned Poster # P17). The poster highlights the following key points:

-

LP-184 seems to potentiate anti-PD1 response in a mouse model of TNBC that is non-hypermutated and resistant to immunotherapy in the absence of LP-184.

-

LP-184 can potentially transform immunologically “cold” tumors (non-responsive to IO therapies) into “hot” tumors (responsive to IO therapies) by modulating T cell activity in the tumor microenvironment and inducing a replication stress response defect.1

-

LP-184 seems to reshape the tumor microenvironment (TME) by significantly reducing the amount of M2 macrophages – which are associated with tumor drug resistance, tumor cell proliferation and are involved in helping the tumor cells escape immune cell death2.

-

LP-184 combined with an anti-PD1 agent elicited a greater anti-tumor response than monotherapies in mouse TNBC tumors that are non-hypermutated and resistant to immune checkpoint inhibitors

LP-184 is being investigated in an ongoing first-in-human Phase 1 trial (NCT05933265) in advanced recurrent solid tumors to establish a maximum tolerated dose and assess its overall safety and suitability in more targeted cancer indications, including TNBC.

Immunotherapy with checkpoint inhibitors (CPI) account for nearly $48 billion in sales annually according to Grand View Research and has profoundly changed the landscape of treatment in oncology since their introduction by providing outstanding durable responses and potential long-term remission in a significant proportion of cancer patients.3 Treatments are now approved for more than thirty cancer indications including melanoma, lung, colon, renal, urothelial, gastric, liver, lymphoma, head and neck but only a minority of patients benefit (10% to 50% depending on the stage and site of the tumor) and often patients will be non-responsive to CPI.

“Our drug-candidate, LP-184 has shown very promising preclinical evidence supporting its role in immuno-oncology to help patients improve response and durability of response to IO therapies. This work in collaboration with MD-Anderson supports our initial AI-driven hypothesis regarding the role of LP-184 to synergize with PD1 and PDL1 drugs and potentially improve the lives of a greater number of cancer patients globally. We look forward to developing combination drug studies and clinical trials with LP-184 and checkpoint inhibitors,” said Lantern Chief Scientific Officer, Kishor Bhatia, PhD, FRCP.

The entirety of the data and poster to be presented at The Immuno-Oncology Summit 2024 in Philadelphia will be available on the Lantern website after 6pm Eastern today, August 7th 2024.

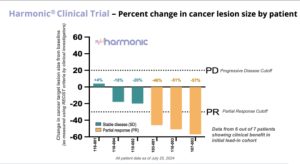

On August 5, Lantern Pharma announced promising preliminary results from its Phase 2 HARMONIC™ clinical trial, evaluating LP-300 in combination with standard chemotherapy for never-smokers with advanced non-small cell lung cancer (NSCLC). As reported earlier today, August 5, the study has shown an impressive 86% clinical benefit rate in the initial patient group, offering hope for a patient population with limited treatment options. The proportion of never-smoking patients with non-small cell lung cancer (NSCLC) has been significantly increasing globally over the past 30 years, from 15% in the 1970s to 33% in the 2000s. The high proportion of never smokers with NSCLC in East Asian countries is of particular note with Japan estimated to be 33 to 40% of new cases and Taiwan at over 50% of new cases. Lantern has received regulatory approval to initiate the LP-300 clinical trial in multiple Asian countries, and has started activation of sites in Japan and Taiwan, including the National Cancer Center in Tokyo, a globally recognized center of cancer research excellence. Read the balance of the story.

On July 10, Lantern announced a significant advancement towards the development of a diagnostic for its drug candidate LP-184. The diagnostic is currently based on qRT-PCR (quantitative real-time polymerase chain reaction) technology and is focused on quantifying the amount of PTGR1 RNA in patient tumor samples to assess the potential for sensitivity to Lantern’s drug candidate LP-184. The company plans to further develop and validate the assay for its use as a potential tool for patient selection in later stage clinical trials across a broad range of solid tumors that have shown sensitivity to LP-184. Panna Sharma, CEO of Lantern Pharma stated, “This milestone represents a significant leap forward in our precision oncology approach and in ensuring that we enrich our future LP-184 clinical trials with the patients we believe will be most likely to benefit. By working to develop a companion diagnostic for LP-184, we’re not just advancing a drug candidate; we’re paving the way for more personalized and effective cancer treatments for patients that have the highest likelihood of benefitting from the therapy. The planned use of biomarkers like PTGR1 in our clinical trials exemplifies our commitment to data-driven, patient-centric drug development.”Panna Sharma, CEO of Lantern, was interviewed recently on the ‘Today In Nashville’, a program hosted by Carole Sullivan and associated with Nashville’s WSMV 4, an NBC affiliate. Watch it here to learn more.On June 12, Lantern announced that the Japan Patent Office (JPO) has issued a Certificate of Patent for patent application no. 2021-513267 / registration no. 7489966 directed to Lantern Pharma’s drug candidate LP-284 ((+)N-hydroxy-N-(methylacylfulvene)urea). The Certificate of Patent entitled “Illudin Analogs, Uses Thereof, and Methods for Synthesizing the Same” covers molecule LP-284, including claims covering the new molecular entity. A Certificate of Patent is issued after JPO examinations have confirmed the merits of a patent request. Lantern values the broad protection this latest patent provides. Lantern estimates that LP-284 can have the potential to improve outcomes for 40,000 to 80,000 patients with blood cancers annually, with a global annual market potential of $4 Billion USD.

Shares of Indaptus Therapeutics, Inc. (Nasdaq: INDP) closed at $1.71, +.59% and is up +.58% at $1.72 in the aftermarket. Indaptus is a company with the ability to harness both the body’s innate and adaptive immune responses, believes that they are uniquely positioned to revolutionize the treatment of cancer and certain infectious diseases. Indaptus Therapeutics has evolved from more than a century of immunotherapy advances. The Company’s novel approach is based on the hypothesis that efficient activation of both innate and adaptive immune cells and pathways and associated anti-tumor and anti-viral immune responses will require a multi-targeted package of immune system-activating signals that can be administered safely intravenously (i.v.). Indaptus’ patented technology is composed of single strains of attenuated and killed, non-pathogenic, Gram-negative bacteria producing a multiple Toll-like receptor (TLR), Nucleotide oligomerization domain (Nod)-like receptor (NLR) and Stimulator of interferon genes (STING) agonist Decoy platform. The products are designed to have reduced i.v. toxicity, but largely uncompromised ability to prime or activate many of the cells and pathways of innate and adaptive immunity. Decoy products represent an antigen-agnostic technology that have produced single-agent activity against metastatic pancreatic and orthotopic colorectal carcinomas, single agent eradication of established antigen-expressing breast carcinoma, as well as combination-mediated eradication of established hepatocellular carcinomas and non-Hodgkin’s lymphomas in standard pre-clinical models, including syngeneic mouse tumors and human tumor xenografts.

Shares of Indaptus Therapeutics, Inc. (Nasdaq: INDP) closed at $1.71, +.59% and is up +.58% at $1.72 in the aftermarket. Indaptus is a company with the ability to harness both the body’s innate and adaptive immune responses, believes that they are uniquely positioned to revolutionize the treatment of cancer and certain infectious diseases. Indaptus Therapeutics has evolved from more than a century of immunotherapy advances. The Company’s novel approach is based on the hypothesis that efficient activation of both innate and adaptive immune cells and pathways and associated anti-tumor and anti-viral immune responses will require a multi-targeted package of immune system-activating signals that can be administered safely intravenously (i.v.). Indaptus’ patented technology is composed of single strains of attenuated and killed, non-pathogenic, Gram-negative bacteria producing a multiple Toll-like receptor (TLR), Nucleotide oligomerization domain (Nod)-like receptor (NLR) and Stimulator of interferon genes (STING) agonist Decoy platform. The products are designed to have reduced i.v. toxicity, but largely uncompromised ability to prime or activate many of the cells and pathways of innate and adaptive immunity. Decoy products represent an antigen-agnostic technology that have produced single-agent activity against metastatic pancreatic and orthotopic colorectal carcinomas, single agent eradication of established antigen-expressing breast carcinoma, as well as combination-mediated eradication of established hepatocellular carcinomas and non-Hodgkin’s lymphomas in standard pre-clinical models, including syngeneic mouse tumors and human tumor xenografts.

Today, Indaptus announced that it has entered into securities purchase agreements with investors, including an officer of Indaptus, for the issuance and sale of an aggregate of 1,643,837 of its shares of common stock. In a concurrent private placement, Indaptus has also agreed to issue and sell unregistered warrants to purchase up to an aggregate of 1,643,837 of its shares of common stock. The combined effective purchase price for each share of common stock and associated warrants is $1.825. The warrants will have an exercise price of $1.70 per share, will be immediately exercisable upon issuance and have a term of five years from the date of issuance. The closing of the offering is expected to take place on or about August 8, 2024, subject to the satisfaction of customary closing conditions. Paulson Investment Company, LLC is acting as the exclusive placement agent in connection with the offering. The gross proceeds to Indaptus from the offering are expected to be approximately $3.0 million, before deducting the placement agent’s fees and other offering expenses payable by Indaptus. Indaptus intends to use the net proceeds from the offering to fund its research and development activities and for working capital and general corporate purposes.

Shares of ADT Inc. (ADT), a leading provider of monitored security and automation solutions for residential and small business customers in the United States and Canada, closed at $7.09, +.28% after establishing a new 52-wk high of $7.92 during intraday trading recently.

On Aug. 1, ADT reported its second quarter results for 2024 that read like a thrilling spy novel, complete with mysterious numbers and covert operations. The company reported a 3% increase in total revenue, reaching $1.2 billion – apparently, securing homes is more lucrative than ever in our paranoid future. Their recurring monthly revenue (RMR) grew by 2% to $355 million, proving that once ADT gets its foot in your door, it’s there to stay

The company boasted “strong customer retention” with a gross revenue attrition of 12.9%, which in ADT speak means they’re only hemorrhaging about 1 in 8 customers. Their “revenue payback” sits at 2.2 years, suggesting it takes that long for customers to stop regretting their decision to sign up.

In a plot twist worthy of a summer blockbuster, ADT’s GAAP income from continuing operations dropped by $54 million. But fear not, shareholders! Their “adjusted” income increased by $3 million. It seems ADT has mastered the art of financial alchemy, turning red numbers green faster than you can say “creative accounting”.

CEO Jim DeVries, channeling his inner motivational speaker, declared that ADT’s success is “powered by our employees’ dedication to the proposition that every second counts.” One can only imagine the intense pressure of working in an environment where bathroom breaks are timed to the millisecond.[

Modular Medical, Inc. (NASDAQ: MODD, $1.48, +1.37%), is a development-stage, insulin delivery technology company seeking to launch the next generation of user-friendly and affordable insulin pump technology. Using its patented technologies, the company seeks to eliminate the tradeoff between complexity and efficacy, thereby making top quality insulin delivery both affordable and simple to learn. Their mission is to improve access to the highest standard of glycemic control for people with diabetes taking it beyond “superusers” and providing “diabetes care for the rest of us.” Modular Medical was founded by Paul DiPerna, a seasoned medical device professional and microfluidics engineer. Prior to founding Modular Medical, Mr. DiPerna was the founder (in 2005) of Tandem Diabetes and invented and designed its t:slim insulin pump. More information is available at https://modular-medical.com.

In a move that’s sure to spice up the insulin pump manufacturing scene, Modular Medical announced today, August 7, that it is packing its bags and heading south of the border. The company has begun transferring its pilot line manufacturing operations to a Phillips Medisize site in Queretaro, Mexico. Trusted for nearly 60 years, Phillips Medisize, a Molex company, is a global leader in front-end design, development and manufacturing solutions for highly regulated industries — pharma, in vitro diagnostics, med tech, consumer, automotive and defense. Operating as a single integrated collaborator, they help their customers reduce risk and achieve product realization quickly and efficiently. Their innovation, quality and reliability enhance the lives of millions of people around the world. Modular Medical’s relocation is happening alongside the FDA’s ongoing 510(k) review of the MODD1 Insulin Delivery System. Chief Operating Officer Kevin Schmid confidently predicts that the manufacturing operation will be validated and ready for human-use production by early next year. The MODD1 system will be manufactured in a clean room in Queretaro, while the printed circuit board assembly will be crafted in Guadalajara, showcasing a truly international effort in diabetes care technology. Phillips Medisize, a Molex company, has been a crucial partner in developing Modular Medical’s platform product, supply chain, and manufacturing operations. Their collaboration extends beyond basic manufacturing, providing expertise in injection molding, packaging, electronics design, and assembly operations. This partnership has been instrumental as Modular Medical transitions from pre-commercial production to high-volume device manufacturing. The collaboration leverages Phillips Medisize’s global and diversified supplier base, enabling the design and development of manufacturing capabilities specifically tailored for the MODD1 Insulin Delivery System. Phillips Medicine was founded in 1964 in Phillips, WI, employs 6 thousand employees worldwide, has 24 manufacturing locations in 11 countries, including 5 R&D centers globally 2.5M+ square feet of manufacturing space, & maintains Class 7 & 8 cleanrooms and tool building sites. The insulin pump market is experiencing robust growth, with a valuation of USD 6.05 billion in 2023 and a projected compound annual growth rate (CAGR) of 8.22% from 2024 to 2030. This expansion is driven by technological advancements, increasing diabetes prevalence, and a growing elderly population. Key players in the market include Medtronic (MDT), Abbott Laboratories (ABT), Roche Diagnostics & Tandem Diabetes Care, Inc (TNDM). The global diabetes care devices market is expected to reach USD 52.34 billion by 2029, growing at a CAGR of 12.22% from 2024 to 2029. This growth is fueled by rising healthcare spending, increased awareness about diabetes management, and the development of innovative devices like continuous glucose monitors and automated insulin delivery systems.

Gain Further Insights From The CEO of Modular Medical…

On Friday, August 9, our sister organization, Tribe Public (www.TribePublic.com), will be hosting a brief CEO Presentation and Q&A Webinar-based event at 8:30am PT /11:30am ET with Jeb Besser, CEO of Modular Medical (NASDAQ: MODD). The event is titled “Diabetes Care Innovator Modular Medical Takes Next Steps.”

You may register for this free event at MODDAugust92024.TribePublic.com and submit your questions ahead of the event at research@tribepublic.com or during the event via the zoom chat feature.

Quote of the Day

Economic Reports

On Monday, the ISM Non-Manufacturing Index for July came in hotter than a summer sidewalk, causing buyers to vanish faster than free samples at Costco. The Final July S&P Global US Services PMI Report also came in lower at 55.

On Wednesday, The Weekly MBA Mortgage Applications Index came in at 6.9%, while the Weekly EIA Crude Oil Inventories confirmed a 3.73M barrel draw.

Videos

Post View Count : 501