Magnificent Seven, Interest Rates Charge Higher As Oil Falls This Week – $ADT $AAOL $MRTX $NUVL $META $SHIP $TSA Rise!

- Published Oct 07, 2023

- Agriculture & Energy

- Atossa Therapeutics, Inc.

- Biotech & Healthcare

- Consumer Goods & Trends

- Current Coverage

- Disney

- Fate Therapeutics, Inc.

- Financials & Fintech

- InMed Pharmaceuticals Inc.

- Investing & Inspiration

- INVO Bioscience

- Market News

- Materials & Natural Resources

- Technology & Beyond

- Tesla

Happy Saturday!

I hope all went well for ups and umpire this week.

As for the broad markets this week, the stock indices managed to bounce about throughout the week seemingly riding the fears and comforts surrounding the rise and fall of interest rates and what will the fed be doing next. The CBOE Volatility Index (^VIX) fell .91% closing at $17.45 over the last 5 days as we waffled about in the markets. On positive note, oil prices pulled back considerably as global economic growth concerns appeared and spearheaded by China’s issues and ended at $82.72/bbl down 8.9% this week. Hopefully this will move will be getting us back to a more normal range soon. Accordingly, the yield curve closed with the 2-yr yield moving from 5.o5% up to 5.08% and the 10-yr note moving higher from 4.58% to 4.79%. The U.S. Dollar Index ticked slightly lower this week from 106.20 to 106.10 this week cooling off from its recent ascention.

A number of macroeconomic reports hit the presses again this week that seemed to foster a belief that we will be getting another interest rate hike in November or December, but also that we may be very near a peak as cracks in the inflation armor are believed to be beginning to show. On Monday, the September ISM Manufacturing PMO report confirmed another contraction for the 11th consecutive month as it came in at 49%. The Total construction spending report also confirmed .5% M/M rise in August & The Total private construction report also showed a .5% M/M increase. Lastly, the Total public construction report clocked in with a .6% M/M rise & now on Y/Y basis, total construction spending rose 7.4%. On Tuesday, the Job Openings and Labor Turnover Survey report confirmed a rise in job openings. On Wednesday, The ADP Employment Change Report confirmed private payrolls rose by 89k in September that was below expectations. The weekly MBA Mortgage Applications Index dropped by 6%as purchase applications fell 6% & refinance applications dropped a cool 7%. The ISM Services PMI report came with lower at 53.6% in September & the Factory orders report showed a M/M 1.2% rise in August. The weekly EIA crude oil inventories report also confirmed a 2.22M barrel draw. On Thursday, the Weekly Initial Claims report came in at 207k & the Weekly Continuing Claims clocked in at 1.664M. The August Trade Balance report came in at -$58.3B. On Friday, the September Nonfarm Payrolls report clocked in with 336 in access of expectations, while the September Nonfarm Private Payrolls came in at 263k. The September Average Hourly Earnings report rang in at .2%, while the September Unemployment Rate caw in in line at 3.8%. The September Average Workweek was 34.4hrs. The Consumer credit report showed a $15.6B decline in August.

At the end of the week, the Dow 30 closed at 33,408 (-.3%) this week and is now up just .8% YTD. The S&P 500 closed at 4,309 (+.5%) for the week and is now up 12.2% YTD. The Nasdaq closed at 13,431 (+1.6%) and is now up 28.3% YTD.

The Magnificent Seven closed as follows over the last 5-days: Alphabet (GOOG) closing at $138.73, +5.22%, Amazon (AMZN) closing at $127.96, +.66%, Apple (AAPL, $177.49, +3.67%), Meta Platforms (META) closing at $315.43, +5.07%, Microsoft (MSFT) closing at $327.26, +3.65%, NVIDIA (NVDA) closing at $457.62, +5.20% & Tesla (TSLA) closing at $260.53, +4.12%.

HHE is a Delaware Corporation that brings state-of-the-art renewable energy and energy storage systems to the Multi-Dwelling Unit Residential (MDU) and Residential housing markets. HHE was recognized as the 2023 winner of the Innovative Tech Company of the Year at the 13th annual Pacific Edge Business Achievement Awards Gala in Honolulu, Hawai’i. With operations in California, Hawaii, Wisconsin and Shanghai, HHE engineers proprietary storage system and control platform solutions, including a breakthrough HHE “EnergyCluster” technology that is key to development of the Multi-Dwelling Unit Residential housing market. HHE is a vital partner for investors and asset owners that are seeking MDU renewable energy solutions. Simply put, a solar plus energy storage system from Holu Hou Energy harnesses the power from your solar panels, stores that energy, and has the capability to share it among multiple residential units, thus placing apartment owners in a position to realize significant cash flows, or HOA property owners to save money on their utility bills.

The small caps on the Russell 2000 took a hit this week and closed at 1,745.56 (-2.22%) for the week & is now down .89% YTD. The MicroCaps also moved lower this week as the iShares Micro-Cap ETF (IWC) closed at $98.38, -1.72% this week & is now down 8.76% YTD.

Bank stocks on the SPDR S&P Regional Banking ETF (KRE) moved down 1.63% over the last 5-days to close at $41.09 and is now down 30.05% YTD & the SPDR S&P Bank ETF (KBE) also moved down 1.47% over the last 5-days to close at $36.31.

The Biotech sector had a bit of a seesaw affair of a week establishing a new 52-wk low on the XBI prior to bouncing at the end of week. The Nasdaq Biotechnology ETF (IBB) closed at $122.48, +.16% over the last 5-days and is now down 6.71% YTD, the NYSE ARCA Biotech Index (^BTK) closed at 5,034.85, +.26% over the last 5-days and is now down 4.66% YTD, & the SPDR S&P Biotech ETF (XBI) closed at $72.23, 1.08% over the last 5-days, & is now down 12.98% YTD. The 52-week range is is now $69.09-$92.60 and continues to get tighter. A couple standouts came from:

Shares of Nuvalent, Inc. (Nasdaq: NUVL) closed at $64.52, +40.35% over the last 5-days). Nuvalent, a clinical-stage biopharmaceutical company focused on creating precisely targeted therapies for clinically proven kinase targets in cancer, announced this week preliminary data from the Phase 1 dose-escalation portion of its ongoing ALKOVE-1 Phase 1/2 clinical trial of NVL-655 for patients with advanced ALK-positive non-small cell lung cancer (NSCLC) and other solid tumors as reported in an abstract accepted for presentation at the 35th AACR-NCI-EORTC (ANE) Symposium in Boston, Massachusetts. Updated preliminary data will be presented at the conference and during a live webcast and conference call with management on October 13th at 8:00am EDT. NVL-655 is a novel brain-penetrant ALK-selective tyrosine kinase inhibitor (TKI) created with the aim to simultaneously overcome the clinical challenges of emergent treatment resistance, brain metastases, and off-target central nervous system (CNS) adverse events associated with tropomyosin receptor kinase (TRK) inhibition that may limit the use of currently available ALK TKIs.

Shares of Mirati Therapeutics (MRTX), a commercial stage research and development biotechnology company whose mission is to discover, design and deliver breakthrough therapies to transform the lives of patients with cancer and their loved ones, jumped a cool 38.20% to close at $60.20 this week. This move came in concert with a Bloomberg story that declared that Sanofi (SNY, $53.90, +.48% over the last 5-days) is exploring and acquisition of Mirati. This news came after this week’s announcement that Sanofi and Teva Pharmaceuticals, a U.S. subsidiary of Teva Pharmaceutical Industries Ltd. (TEVA, $9.42) are collaborating to co-develop and co-commercialize asset TEV ‘574, currently in Phase 2b clinical trials for the treatment of Ulcerative Colitis and Crohn’s Disease, two types of inflammatory bowel disease.

Cathie Wood’s ARK Innovation ETF (ARKK) closed at $39.21, -1.16% over the last 5-days and is up 25.51% YTD.

The iShares U.S. Healthcare ETF (IYH) closed at $272.24, +.80% over the last 5-days and is now down 4.04% YTD.

From the world of cryptocurrency, Bitcoin (BTC) moved to $27,995.54 up 1.69% over the course of the last 5-days at the time of the completion of this message.

Gold prices closed at $1,834, -$24/oz over the last 5-days. Silver prices closed at $21.51, -$,94/oz over the last 5-days. The Global X Silver ETF (SIL) closed at $21.765, +1.61%% over the last 5-days.

VP Watchlist Updates

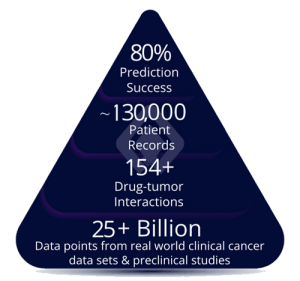

Lantern (LTRN), closed at $3.12, -8.50% over the last 5-days, but rose to $3.35, +7.37% in the aftermarket on Friday. Lantern is an Artificial Intelligence (AI) firm that is transforming the cost, pace, and timeline of oncology drug discovery and development and specifically is developing targeted and transformative cancer therapies using its proprietary RADR® AI and machine learning (“ML”) platform with multiple clinical stage drug programs.

On Oct. 3, Lantern announced that in vivo data highlighting the enhanced efficacy of Lantern’s drug candidate LP-184 in glioblastoma (GBM) were published in Clinical Cancer Research, a journal of the American Association for Cancer Research. LP-184 is a unique small molecule with low nanomolar activity and favorable CNS penetration. LP-184 utilizes its powerful mechanism of action, known as synthetic lethality, to exploit common vulnerabilities in solid tumor and CNS cancers with DNA damage repair (DDR) deficiencies. In addition, Lantern’s AI platform, RADR®, has highlighted overlapping gene dependency profiles between GBM tumorigenesis and sensitivity to LP-184, such as EGFR activation pathways. The article, entitled “Preclinical Efficacy of LP-184, a Tumor Site Activated Synthetic Lethal Therapeutic, in Glioblastoma” can be accessed here.

On September 25, Lantern announced the dosing of the first patient in the Phase 1 clinical trial evaluating Lantern’s investigational new drug LP-184 in patients with advanced solid tumors. LP-184 is being studied in a first-in-human Phase 1 clinical trial, having been developed with guidance from Lantern’s AI Platform, RADR®, as a potential therapy for a wide range of advanced solid tumors. LP-184 is one of two molecules in Lantern’s synthetic-lethal franchise that has been shown to have anti-cancer activity in tumors with DNA damage repair deficiency. Lantern estimates that LP-184 has a global aggregate market potential of approximately $11-13 billion, consisting of $6-7 billion for solid tumors and $5-6 billion for CNS cancers. To learn more click here.

On September 18, Lantern announced that the United States Food and Drug Administration (FDA) has cleared the investigational new drug (IND) application for LP-284. LP-284 is being developed for the treatment of relapsed or refractory non-Hodgkin’s lymphoma (NHL), including mantle cell lymphoma (MCL) and double hit lymphoma (DHL) and other high-grade B-cell lymphomas (HGBL). Lantern expects to commence enrollment of patients for the first-in-human Phase 1 trial for LP-284 during the fourth quarter of 2023. Lantern estimates that LP-284 can have the potential to improve outcomes for 40,000 to 80,000 patients with blood cancers annually, with a global annual market potential of $4 Billion USD.

Panna Sharma is the President, CEO, and Board Member of Lantern Pharma Inc.

“This is now our second novel drug candidate to receive IND clearance from the FDA in the past 100 days, further validating our approach of leveraging AI and machine learning to accelerate the development of our pipeline. LP-284 holds blockbuster potential, and we have been able to expedite its journey from a concept to a first-in-human clinical trial in a highly efficient and cost-effective manner – less than 2.5 years and under approximately $2.7 million – underscoring the power and potential of our AI platform RADR® to accelerate oncology drug discovery and development. RADR® was used to unravel the mechanism of action of LP-284, prioritize its cancer indications, and generate machine-learning biomarker signatures that may be pivotal in selecting patients for future phases of the clinical trials. Our success-to-date with LP-284 reaffirms our commitment to harnessing the power of AI to transform cancer treatment and save lives,” stated Panna Sharma, Lantern’s President and CEO.

On September 8, Lantern’s Chief Executive Officer, Panna Sharma, delivered a presentation titled “How Artificial Intelligence Is Crushing Drug Discovery Times & Costs In Cancer” at a Tribe Public CEO Presentation & Q&A Event. The Event video is now published at the Tribe Public YouTube Channel that you may view now by clicking here.

On September 8, Lantern’s Chief Executive Officer, Panna Sharma, delivered a presentation titled “How Artificial Intelligence Is Crushing Drug Discovery Times & Costs In Cancer” at a Tribe Public CEO Presentation & Q&A Event. The Event video is now published at the Tribe Public YouTube Channel that you may view now by clicking here.

Indaptus is a company with the ability to harness both the body’s innate and adaptive immune responses, believes that they are uniquely positioned to revolutionize the treatment of cancer and certain infectious diseases. Indaptus Therapeutics has evolved from more than a century of immunotherapy advances. The Company’s novel approach is based on the hypothesis that efficient activation of both innate and adaptive immune cells and pathways and associated anti-tumor and anti-viral immune responses will require a multi-targeted package of immune system-activating signals that can be administered safely intravenously (i.v.). Indaptus’ patented technology is composed of single strains of attenuated and killed, non-pathogenic, Gram-negative bacteria producing a multiple Toll-like receptor (TLR), Nucleotide oligomerization domain (Nod)-like receptor (NLR) and Stimulator of interferon genes (STING) agonist Decoy platform. The products are designed to have reduced i.v. toxicity, but largely uncompromised ability to prime or activate many of the cells and pathways of innate and adaptive immunity. Decoy products represent an antigen-agnostic technology that have produced single-agent activity against metastatic pancreatic and orthotopic colorectal carcinomas, single agent eradication of established antigen-expressing breast carcinoma, as well as combination-mediated eradication of established hepatocellular carcinomas and non-Hodgkin’s lymphomas in standard pre-clinical models, including syngeneic mouse tumors and human tumor xenografts.

In pre-clinical studies tumor eradication was observed with Decoy products in combination with anti-PD-1 checkpoint therapy, low-dose chemotherapy, a non-steroidal anti-inflammatory drug, or an approved, targeted antibody. Combination-based tumor eradication in pre-clinical models produced innate and adaptive immunological memory, involved activation of both innate and adaptive immune cells, and was associated with induction of innate and adaptive immune pathways in tumors after only one i.v. dose of Decoy product, with associated “cold” to “hot” tumor inflammation signature transition. IND-enabling, nonclinical toxicology studies demonstrated safe i.v. administration without sustained induction of hallmark biomarkers of cytokine release syndromes, possibly due to passive targeting to liver, spleen, and tumor, followed by rapid elimination of the product. Indaptus’ Decoy products have also produced significant single agent activity against chronic hepatitis B virus (HBV) and chronic human immunodeficiency virus (HIV) infections in pre-clinical models.

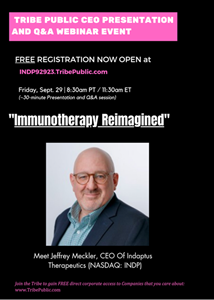

On Sept, 29, Tribe Public hosted a Webinar Presentation and Q&A Event titled “Immunotherapy Reimagined”. Indaptus Therapeutics’ (NASDAQ: INDP) CEO, Jeffrey Meckler delivered a presentation & also addressed a 5-10 minute Q&A session at the end of the presentation. You may view it now by clicking here.

On Sept. 19, Indaptus announced dosing of the first patient in the second cohort of patients to receive a single dose of Decoy20 in the INDP-D101 trial. This cohort dose is a dose reduction from the previous cohort based on the significant pharmacodynamic effect seen with the first cohort and anticipated optimal Decoy20 safety profile for both weekly dosing and combination approaches. Dr. Roger Waltzman, Indaptus’ Chief Medical Officer stated, “This cohort is important to the development of Decoy20 as it may provide sufficient data for us to move Decoy20 to a multi-dosing regimen. To date, we have seen positive signs of an immune response with an anticipated adverse effect profile, and we look forward to seeing whether this lower dose provides similar evidence of increased cytokines that can trigger both innate and adaptive immune responses.” Jeffrey Meckler, Chief Executive Officer stated,“We continue to be encouraged by the initial results of the first cohort and look forward to progressing into the multi-dosing regimen as soon as we have enough data. The study’s objectives are to assess the safety and tolerability of Decoy20, to determine the maximum tolerated dose (MTD) and recommended phase 2 dose (RP2D), as well as to assess Decoy20 pharmacokinetics (PK), pharmacodynamics and clinical activity. The Phase 1 study was initiated with a single dose escalation, which is planned to be followed by an expansion with continuous weekly administration of Decoy20. The study is enrolling patients with advanced/metastatic solid tumors, who have exhausted approved treatment options. More information can be found at www.clinicaltrials.gov.

Jeffrey Meckler, CEO, Indaptus Therapuetics, Inc. (NASDAQ: INDP)

Jeffrey Meckler, Chief Executive Officer of Indaptus stated, “We have recently announced the completion of the first cohort of patients in our INDP-D101 trial evaluating Decoy20 for the treatment of solid tumors and receipt of authorization from the Safety Review Committee to advance into the second cohort. As previously announced, we are pleased to observe evidence of immune activation, along with short-lived adverse events consistent with Decoy20’s mechanism of action. We continue to analyze the data generated and anticipate that the data from the dose finding studies will guide the selection for the recommended Phase 2 dose for subsequent multi-dosing and combination studies, which are planned for 2024. An additional recent accomplishment is the appointment of industry veteran, Roger Waltzman, M.D., as our Chief Medical Officer. We anticipate benefiting from his expertise as we continue our Phase 1 trial and further develop the Decoy platform. In the meantime, we are prudently managing our cash position.”

Recent Corporate Highlights:

- The Company announced the completion of the first cohort of its INDP-D101 trial and receipt of authorization from its Safety Review Committee to proceed into the second cohort of the Phase 1 trial.

- A compound from the Company’s Decoy platform was presented in a poster titled, “A systemically administered killed bacteria-based multiple immune receptor agonist for pulsed anti-tumor immunotherapy,” at the American Association for Cancer Research Conference 2023. The poster highlighted that Decoy10 demonstrated 90% reduction of LPS-endotoxin activity and use of 100% killed, non-pathogenic bacteria.

- The Company’s Chief Scientific Officer, Michael Newman, Ph.D., was named Chair for two of the three days of the 4th STING & TLR-Targeting Therapies Summit held in Boston from May 9 to 11, where he was also a featured speaker.

- The Company received patent allowances for its Decoy immunotherapy platform in Brazil and India. The Indian patent allowance brought the number of countries in which the Company holds patent protection to 32.

- Roger Waltzman, M.D. was appointed the Chief Medical Officer of Indaptus, effective August 7, 2023.

On Aug. 14, INVO Bioscience, Inc. (Nasdaq: INVO, $.79), a healthcare services fertility company focused on expanding access to advanced treatment worldwide with its INVOcell® medical device and the intravaginal culture (“IVC”) procedure it enables, announced financial results for the second quarter ended June 30, 2023 and provided a business update. Q2 2023 Financial Highlights (all metrics compared to Q2 2022 unless otherwise noted):

- Revenue was $315,902, an increase of 116% compared to $146,135.

- Clinic revenue increased 126% to $254,364, compared to $112,358. All reported clinic revenue is derived from the Company’s INVO Center in Atlanta, Georgia, which is consolidated in the Company’s financial statements.

- Revenue from all clinics, inclusive of both those accounted for as consolidated and under the equity method, was $712,433, an increase of 145% compared to $290,517.

- Recent Operational and Strategic Highlights

- Acquired Wisconsin Fertility Institute (WFI), a profitable Madison-based fertility center that primarily offers conventional IVF procedures and generated approximately $5.4 million in revenue and approximately $1.7 million of net income in 2022.

- Acquisition further accelerates INVO’s transition to a healthcare services company and provides an opportunity to advance IVC volume and the ability to secure a greater share of total fertility cycle revenue.

- Implemented expense reductions as part of go-forward plan to focus on its healthcare service strategy and a near-term path to profitability.

- Buildout of the Company’s new Tampa, Florida clinic – Tampa Fertility Institute, an INVO Center – is nearing completion.

- Raised approximately $4.5 million in gross proceeds in a public offering of common stock and warrants. The Company used approximately $2.15 million of proceeds for the initial payment for the WFI acquisition.

- Received 510(k) FDA clearance for expanded use of the INVOcell device.

Q2 2023 Financial Highlights (all metrics compared to Q2 2022 unless otherwise noted)

-

Revenue was $315,902, an increase of 116% compared to $146,135.

-

Clinic revenue increased 126% to $254,364, compared to $112,358. All reported clinic revenue is derived from the Company’s INVO Center in Atlanta, Georgia, which is consolidated in the Company’s financial statements.

-

Revenue from all clinics, inclusive of both those accounted for as consolidated and under the equity method, was $712,433, an increase of 145% compared to $290,517.

Recent Operational and Strategic Highlights

-

Acquired Wisconsin Fertility Institute (WFI), a profitable Madison-based fertility center that primarily offers conventional IVF procedures and generated approximately $5.4 million in revenue and approximately $1.7 million of net income in 2022.

-

Acquisition further accelerates INVO’s transition to a healthcare services company and provides an opportunity to advance IVC volume and the ability to secure a greater share of total fertility cycle revenue.

-

Implemented expense reductions as part of go-forward plan to focus on its healthcare service strategy and a near-term path to profitability.

-

Buildout of the Company’s new Tampa, Florida clinic – Tampa Fertility Institute, an INVO Center – is nearing completion.

-

Raised approximately $4.5 million in gross proceeds in a public offering of common stock and warrants. The Company used approximately $2.15 millionof proceeds for the initial payment for the WFI acquisition.

-

Received 510(k) FDA clearance for expanded use of the INVOcell device.

Management Commentary

“We believe we have successfully transformed INVO into a rapidly growing, innovative healthcare services company which allows us to help accelerate IVC volume and obtain a greater share of the total fertility cycle revenue,” commented Steve Shum, CEO of INVO. “The closing of the WFI acquisition last week, coupled with the rapid 145% revenue growth in our existing INVO Center’s during this past quarter, should position our clinic operations to be cash flow positive in the third quarter of this year. Further, we have implemented a number of expense reductions as part of our go-forward plan to focus on our healthcare service strategy, which when coupled with the elimination of substantive costs associated with our successful 510(k) submission, should drive the business towards overall positive operating cash flow in 2024.”

On August 11, INVO announced it has closed the previously announced acquisition of Wisconsin Fertility Institute. The acquisition is reported to provide operational scale, positive cash flow and complements the Company’s new-build INVO Center strategy. The Madison-based fertility center primarily offers conventional IVF procedures having generated approximately $5.1 million in revenue and net income of $1.6 million for the trailing 12-month period ended March 31, 2023. INVO will look to further expand the center through the introduction of the IVC procedure as an added service offering to patients. Wisconsin Fertility Institute, led by internationally renowned and well-respected fertility expert, Dr. Elizabeth Pritts, is one of the state’s preeminent fertility centers, having helped to welcome over 5,000 babies since opening its doors in 2007 with approximately 550 conventional IVF procedures completed in 2022. Steve Shum, CEO of INVO stated, “The acquisition of Wisconsin Fertility Institute accelerates the transformation of INVO to a healthcare services company, with an ability to leverage our unique and innovative INVOcell device to help democratize the fertility industry. The acquisition immediately adds scale and positive cash flow to our operations, with incremental growth expected to be driven at the clinic through the synergistic introduction of our INVOcell solution. We are extremely excited to have now closed this important acquisition and look forward to incorporating the clinic within our operations moving forward.”

On Aug. 4 INVO announced the pricing of its public offering of 1,580,000 units, with each unit consisting of one share of common stock and two warrants, each to purchase one share of common stock. Each unit is being sold at a public offering price of $2.85. The warrants will be immediately exercisable at a price of $2.85 per share and will expire five years from the date of issuance. The shares of common stock and accompanying warrants can only be purchased together in this offering, but will be issued separately and will be immediately separable upon issuance.

On July 28, INVO effected a 1-for-20 reverse split of its issued and outstanding and authorized common stock effective as of 12:01 a.m. Eastern Time on July 28, 2023. Commencing with the opening of trading on The Nasdaq Capital Market on July 28, 2023, the Company’s common stock traded on a post-split basis under the same trading symbol, “INVO”. The company now has approximately 842,017 shares of common stock issued and outstanding. In addition, a proportionate adjustment was made to the company’s authorized shares of common stock such that the Company shall have 6,250,000 shares of authorized common stock after the effective time of the reverse stock split.

On June 27, INVO announced it has received U.S. Food and Drug Administration (FDA) 510(k) clearance to expand the labeling on the INVOcell device and its indication for use to provide for a 5-day incubation period. The data supporting the expanded 5-day incubation clearance demonstrated improved patient outcomes. Steve Shum, CEO of INVO stated, “This is a momentous day for INVO as the FDA has provided clearance for us to expand our labeling to cover a 5-day incubation period for INVOcell. This has been a multi-year effort to demonstrate INVOcell’s ability to improve patient outcomes using a longer incubation period, similar to conventional IVF results. We believe our ability to now communicate the improved success rates using INVOcell to patients and physicians will have a positive effect on the overall confidence and adoption of the technology going forward. The global fertility services market is a substantial, multi-billion-dollar industry and growing, with a significant underserved patient population. INVO’s commercial strategy remains focused on helping to expand affordable care to the underserved patients in need. The Company’s market approach includes the opening of dedicated “INVO Centers” offering INVOcell® and IVC procedure (three centers in North America now operational), the acquisition of existing profitable IVF clinics (signed binding agreements to acquire Wisconsin Fertility Institute), and the continued global distribution and sale of the INVOcell technology solution into existing fertility clinics. We believe the recent 510(k) clearance will help further support our overall commercial activities.”

On Jan. 16, BioSpectrum published an article titled “INVO Bioscience introduces next-gen technologies to fertility market in Taiwan.”

Shares of Borqs Technologies, Inc. (Nasdaq: BRQS), a global provider of 5G wireless solutions, Internet of Things (IoT) solutions, and innovative clean energy, with global operations in the U.S., India, and China, closed at $.1020 and announced a 1-for-12 reverse split that is anticipated to take effect on October 10, 2023.

- On Sept 28, Borqs announced that together with Silicon Valley based SkyCentrics, Borqs will launch the next generation Modbus adaptor products in Q4 2023 and start commercial shipments to customers. The product is intended to be used by Smart Grid appliance manufacturers and OEMs in the U.S. to enable Demand Response signal delivery to and/or data acquisition from Modbus-enabled equipment such as water heating or thermostatic control systems. The products will support cellular and PoE connectivity and provide a certified CTA-2045 EcoPort and OpenADR 2.0b and 3.0 to the OEM, instantly enabling them for grid-interactivity.

- On Aug. 22, Borqs announced the Committee on Foreign Investment in the United States (CFIUS) has granted the Company an extension from the original deadline of September 15, 2023 to January 1, 2024 to complete the divestment of its subsidiary, Holu Hou Energy LLC (HHE). As previously announced, the Company was mandated by CFIUS to divest its ownership in the solar energy storage subsidiary, HHE, due to national security concerns. Subsequently, Cantor Fitzgerald & Co., a nationally reputable investment firm, was engaged by the Company to initiate and manage the sales process of the Company’s ownership in HHE and has received considerable interest from potential buyers. Over the coming months, the Company anticipates that the due diligence process will be completed, and the said transaction is targeted to be finalized by the end of the year. Mr. Pat Chan, CEO of Borqs stated, “Once we receive the funds from selling our interest in HHE, Borqs will continue to invest into futuristic technologies, especially in artificial intelligence based IoT products. We will also consider a share buyback program and/or a special dividend payout depending on the amount of cash to be received in order to enhance our shareholder value. We will provide further updates to our shareholders with regards to the HHE divestment during the next few months.”

- On July 17, Borqs announced its plans to develop an AI-enabled smart watch as part of its expansion strategy into artificial intelligence (AI) for the U.S. market. The AI-enabled smart watch is positioned as an Edge AI device. According to NVIDIA, “Edge AI is the deployment of AI applications in devices throughout the physical world. It’s called “edge AI” because the AI computation is done near the user at the edge of the network, close to where the data is located, rather than centrally in a cloud.” (https://resources.nvidia.com/en-us-it-resources-blogs/what-is-edge-ai) Borqs AI-enabled smart watch will be based on Android and is wirelessly connected via Wifi/BT and cellular networks. It will make use of the AI capability on the watch chipset platform to perform the training and inference of machine learning for the sensors on the watch. The watch will also support ChatGPT or similar AGI capabilities as an intelligent voice assistant. Read more here.

Shares of Atossa Therapeutics, Inc. (Nasdaq: ATOS), a clinical-stage biopharmaceutical company seeking to discover and develop innovative medicines in areas of significant unmet medical need in oncology, with a current focus on breast cancer and radiation-induced lung injury, closed at $.7245, -2.09% over the last 5-days and is up 36.70% YTD.

On Aug. 14, Atossa announced financial results for the quarter ended June 30, 2023, and provides an update on recent company developments highlighted by the following: Achieved significant enrollment milestones in three ongoing Phase 2 clinical trials, Broadened patent protection for proprietary (Z)-endoxifen, Strengthened management team with appointment of Greg Weaver as Chief Financial Officer, & Ended second quarter 2023 with $99.4 million of cash and cash equivalents.

Shares of ADT Inc. (ADT), the most trusted brand in smart home and small business security, closed at $6.45, +7.50% over the last 5-days.

On Oct. 2, GTCR, a leading private equity firm, announced that it has closed the acquisition of ADT’s commercial security, fire and life safety security businessfrom ADT Inc. (“ADT”, NYSE: ADT). Moving forward as a standalone organization, ADT Commercial will rebrand as Everon. GTCR will partner with former Protection1 executives Dan Bresingham and Tim Whall, along with other members of ADTC leadership, to acquire the Company, one of the leading national providers of electronic security and fire safety services to commercial enterprises and multi-site national accounts. Mr. Bresingham, former leader of ADT’s commercial security, fire and life safety business, will become Chief Executive Officer of Everon and Mr. Whall will serve as an active director on the Company’s Board.

Shares of Seanergy Maritime Holdings Corp. (SHIP), the only pure-play Capesize ship-owner publicly listed in the U.S. closed at $5.95, +7.79% over the last 5 days. On Aug. 2, Seanergy announced its financial results for the second quarter and six months ended June 30, 2023. They highlighted that Fleet Time Charter Equivalent (“TCE” 3) overperformance of Baltic Capesize Index (“BCI”) by 20% in 2Q23 & 1H23, a Quarterly cash dividend of $0.025 per share for Q2 2023 – total cash dividends of $1.325 per share or $23.9 million declared since March 2022, a stock buyback of $1.6 million, or approximately 2% of its issued and outstanding shares – total repurchases of securities (common shares, convertible notes and warrants) of approximately $39.6 million since November 2021, an Agreement to acquire a 2011-built Newcastlemax dry bulk vessel through a 12-month bareboat charter with a purchase option, & $53.8 million in refinancings during the second quarter, on improved terms, adding $15.0 million of extra liquidity and removing any loan maturities until Q2 2025.

Thanks again for your attention this week. Please continue to share your thoughts, questions, & ideas as we move forward.

In the meantime, please enjoy the balance of the weekly newsletter’s videos, quotes, updates and let’s find ways to crush it again as we move forward!

Investing & Inspiration

- “Our deeds determine us, as much as we determine our deeds.” – George Eliot

- “The Universe is under no obligation to make sense to you.” – Neil deGrasse Tyson

- “Care and diligence bring luck.” – Thomas Fuller

- “Nobody made a greater mistake than he who did nothing because he could do only a little.” – Edmund Burke

- “A man who is a master of patience is master of everything else.” – George Savile

- “Once you replace negative thoughts with positive ones, you’ll start having positive results.” – Willie Nelson

- “Endurance is nobler than strength, and patience than beauty.” – John Ruskin

- “Act as if what you do makes a difference. It does.” – William James

- “Let us be grateful to people who make us happy, they are the charming gardeners who make our souls blossom.” – Marcel Proust

- “Strength and growth come only through continuous effort and struggle.” – Napoleon Hill

- “Science may never come up with a better office communication system than the coffee break.” – Earl Wilson

- “If everyone is moving forward together, then success takes care of itself.” – Henry Ford

- “Hope is like the sun, which, as we journey toward it, casts the shadow of our burden behind us.”– Samuel Smiles

- “Patriotism is supporting your country all the time, and your government when it deserves it.” – Mark Twain

- “What would life be if we had no courage to attempt anything?” – Vincent Van Gogh

- “The biggest risk is not taking any risk… In a world that is changing really quickly, the only strategy that is guaranteed to fail is not taking risks.” – Mark Zuckerberg

- “Our lives improve only when we take chances – and the first and most difficult risk we can take is to be honest with ourselves.” – Walter Anderson

- “Action is the foundational key to all success.” – Pablo Picasso

- “Success is never final, failure is never fatal. It’s courage that counts.” – John Wooden

- “Innovation distinguishes between a leader and a follower.” – Steve Jobs

- “All the art of living lies in a fine mingling of letting go and holding on.” – Havelock Ellis

- “The size of your success is measured by the strength of your desire; the size of your dream; and how you handle disappointment along the way.” – Robert Kiyosaki

- “O, wind, if winter comes, can spring be far behind?” – Percy Bysshe Shelley

- “Patience is a virtue, and I’m learning patience. It’s a tough lesson.” – Elon Musk

- “Be true to your work, your word, and your friend.” – John Boyle O’Reilly

- “Believe in yourself! Have faith in your abilities! Without a humble but reasonable confidence in your own powers you cannot be successful or happy.” – Norman Vincent Peale

- “Surprise is the greatest gift which life can grant us.” – Boris Pasternak

- “Logic will get you from A to B. Imagination will take you everywhere.” – Albert Einstein

- “It is the fight alone that pleases us, not the victory.” – Blaise Pascal

- “Do exactly what you would do if you felt most secure.” – Meister Eckhart

- “Life lived for tomorrow will always be just a day away from being realized.” – Leo Buscaglia

- “Wisdom is oftentimes nearer when we stoop than when we soar.” – Wordsworth

- “Take chances, make mistakes. That’s how you grow. Pain nourishes your courage. You have to fail in order to practice being brave.” – Mary Tyler Moore

- “A single twig breaks, but the bundle of twigs is strong.” – Tecumseh

- “If one does not know to which port one is sailing, no wind is favorable.” – Lucius Annaeus Seneca

- “There is little that can withstand a man who can conquer himself.” – Louis XIV

- “The limits of the possible can only be defined by going beyond them into the impossible.” – Arthur C. Clarke

- “Be faithful in small things because it is in them that your strength lies.” – Mother Teresa

- “The future rewards those who press on. I don’t have time to feel sorry for myself. I don’t have time to complain. I’m going to press on.” – Barack Obama

- “By three methods we may learn wisdom: First, by reflection, which is noblest; Second, by imitation, which is easiest; and third by experience, which is the bitterest.” – Confucius

- “No man was ever wise by chance.” – Lucius Annaeus Seneca

- “Progress is man’s ability to complicate simplicity.” – Thor Heyerdahl

- “It is not in the stars to hold our destiny but in ourselves.” – William Shakespeare

-

“It does not matter how slowly you go as long as you do not stop.” – Confucius

-

“I want to put a ding in the universe.” – Steve Jobs

-

“Research is creating new knowledge.” – Neil Armstrong

- “The reward for work well done is the opportunity to do more.” – Jonas Salk

- “Man is a creative retrospection of nature upon itself.” – Karl Wilhelm Friedrich Schlegel

- “There’s something about taking a plow and breaking new ground. It gives you energy.” – Ken Kesey

-

“Success seems to be largely a matter of hanging on after others have let go.” – William Feather

- “The essential conditions of everything you do must be choice, love, passion.” – Nadia Boulanger

-

“More business is lost every year through neglect than through any other cause.” – Rose Kennedy

-

“Give me a lever long enough and a fulcrum on which to place it, and I shall move the world.” – Archimedes

- “A person who won’t read has no advantage over one who can’t read.” – Mark Twain

-

“The best way out is always through.” – Robert Frost

- “Start by doing what’s necessary; then do what’s possible; and suddenly you are doing the impossible.” – Francis of Assisi

-

“Without labor nothing prospers.” – Sophocles

- “Intellectuals solve problems, geniuses prevent them.” – Albert Einstein

-

“This is the precept by which I have lived: Prepare for the worst; expect the best; and take what comes.” – Hannah Arendt

-

“The best and most beautiful things in the world cannot be seen or even touched – they must be felt with the heart.” – Helen Keller

- “He who is brave is free.” – Lucius Annaeus Seneca

-

“When something is important enough, you do it even if the odds are not in your favor.” – Elon Musk

-

“I choose a block of marble and chop off whatever I don’t need.” – Auguste Rodin

-

“Hope is the only bee that makes honey without flowers.” – Robert Green Ingersoll

-

“He who knows that enough is enough will always have enough.” – Lao Tzu

- “Plans to protect air and water, wilderness and wildlife are in fact plans to protect man.” – Stewart Udall

-

“In order to carry a positive action we must develop here a positive vision.” – Dalai Lama

- “A hero is someone who understands the responsibility that comes with his freedom.” – Bob Dylan

- “Inflation destroys savings, impedes planning, and discourages investment. That means less productivity and a lower standard of living.” – Kevin Brady

- “If we give something positive to others, it will return to us. If we give negative, that negativity will be returned.” – Allu Arjun

- “A good plan violently executed now is better than a perfect plan executed next week.” ~ George S. Patton

- “You must do the things you think you cannot do.”- Eleanor Roosevelt

- “Success is dependent on effort.” – Sophocles

- “Nobody who ever gave his best regretted it.” – George Halas

- “Lots of people want to ride with you in the limo, but what you want is someone who will take the bus with you when the limo breaks down.” ~ Oprah Winfrey

- “And when I breathed, my breath was lightning.” – Black Elk

- “Moderation is the silken string running through the pearl chain of all virtues.” – Joseph Hall

- “You are the sum total of everything you’ve ever seen, heard, eaten, smelled, been told, forgot – it’s all there. Everything influences each of us, and because of that I try to make sure that my experiences are positive.” – Maya Angelou

- “If you want a guarantee, buy a toaster.” – Clint Eastwood

- “We are an impossibility in an impossible universe.” – Ray Bradbury

- “If you think in terms of a year, plant a seed; if in terms of ten years, plant trees; if in terms of 100 years, teach the people.” – Confucius

- “I’d rather attempt to do something great and fail than to attempt to do nothing and succeed.” – Robert H. Schuller

- “Do your little bit of good where you are; it’s those little bits of good put together that overwhelm the world.” Desmond Tutu

- “It takes considerable knowledge just to realize the extent of your own ignorance.” – Thomas Sowell

- “Do not dwell in the past, do not dream of the future, concentrate the mind on the present moment.” – Buddha”

- Surprise is the greatest gift which life can grant us.” – Boris Pasternak

- “Trust in dreams, for in them is hidden the gate to eternity.” – Khalil Gibran

- “Always be yourself, express yourself, have faith in yourself, do not go out and look for a successful personality and duplicate it.” – Bruce Lee

- “All life is an experiment. The more experiments you make the better.” – Ralph Waldo Emerson

- “There are no secrets to success. It is the result of preparation, hard work, and learning from failure.” – Colin Powell

- “There is more to life than increasing its speed.” – Mahatma Gandhi

- “Your attitude is like a box of crayons that color your world. Constantly color your picture gray, and your picture will always be bleak. Try adding some bright colors to the picture by including humor, and your picture begins to lighten up.” – Allen Klein

- “Definiteness of purpose is the starting point of all achievement.” – W. Clement Stone

- “Success usually comes to those who are too busy to be looking for it.” – Henry David Thoreau

- “In matters of truth and justice, there is no difference between large and small problems, for issues concerning the treatment of people are all the same.” – Albert Einstein

- “Life is too short for long-term grudges.” – Elon Musk

- “There cannot be a crisis next week. My schedule is already full.” – Henry Kissinger

- “Success consists of getting up just one more time than you fall.” – Oliver Goldsmith

- “The Earth is the cradle of humanity, but mankind cannot stay in the cradle forever.” – Konstantin Tsiolkovsky

- “Ours is a world of nuclear giants and ethical infants. We know more about war that we know about peace, more about killing that we know about living.” – Omar N. Bradley

- “Beauty surrounds us, but usually we need to be walking in a garden to know it.” – Rumi

- “But man is not made for defeat. A man can be destroyed but not defeated.” – Ernest Hemingway

- “Don’t watch the clock; do what it does. Keep going.” – Sam Levenson

- “Let there be work, bread, water and salt for all.” – Nelson Mandela

- “The social object of skilled investment should be to defeat the dark forces of time and ignorance which envelope our future.” – John Maynard Keynes

- “A successful society is characterized by a rising living standard for its population, increasing investment in factories and basic infrastructure, and the generation of additional surplus, which is invested in generating new discoveries in science and technology.” – Robert Trout

- “I know not with what weapons World War III will be fought, but World War IV will be fought with sticks and stones.” – Albert Einstein

- “It is the fight alone that pleases us, not the victory.” – Blaise Pascal

- “If you can’t describe what you are doing as a process, you don’t know what you’re doing.” – W. Edwards Deming

- “Never interrupt your enemy when he is making a mistake.” – Napoleon Bonaparte

- “Be sure you put your feet in the right place, then stand firm.” – Abraham Lincoln

- “Without investment there will not be growth, and without growth there will not be employment.” – Muhtar Kent

- “You have to do your own growing no matter how tall your grandfather was.” – Abraham Lincoln

- “Victory has a thousand fathers, but defeat is an orphan.” – John F. Kennedy

- “Delete the negative; accentuate the positive!” – Donna Karan

- “It’s crazy how fast time flies and how things progress.” – Nathan Chen

- “The world is a dangerous place to live; not because of the people who are evil, but because of the people who don’t do anything about it.” – Albert Einstein

- “Life isn’t about finding yourself. Life is about creating yourself.” – George Bernard Shaw

- “Everything has beauty, but not everyone sees it.” – Confucius

- “A man must be big enough to admit his mistakes, smart enough to profit from them, and strong enough to correct them.” – John C. Maxwell

- “Walking with a friend in the dark is better than walking alone in the light.” – Helen Keller

- “A man who dares to waste one hour of time has not discovered the value of life.” – Charles Darwin

- “The greater danger for most of us lies not in setting our aim too high and falling short; but in setting our aim too low, and achieving our mark.” – Michelangelo

- “Progress is man’s ability to complicate simplicity.” – Thor Heyerdahl

- “I like to encourage people to realize that any action is a good action if it’s proactive and there is positive intent behind it.” – Michael J. Fox

- “Nothing is impossible, the word itself says ‘I’m possible’!” – Audrey Hepburn

- “But investment in space stimulates society, it stimulates it economically, it stimulates it intellectually, and it gives us all passion.” – Bill Nye

- “Bitcoin, in the short or even long term, may turn out be a good investment in the same way that anything that is rare can be considered valuable. Like baseball cards. Or a Picasso.” – Andrew Ross Sorkin

- “Life is a tragedy when seen in close-up, but a comedy in long-shot.” – Charlie Chaplin

- “No matter what you’re going through, there’s a light at the end of the tunnel and it may seem hard to get to it but you can do it and just keep working towards it and you’ll find the positive side of things.” – Demi Lovato

- “Infrastructure investment in science is an investment in jobs, in health, in economic growth and environmental solutions.” – Oren Etzioni

- “Educating our children and giving them the skills they need to compete in a global economy is a smart investment in our country’s future.” – Sheldon Whitehouse

- “Know thy self, know thy enemy. A thousand battles, a thousand victories.” – Sun Tzu

- “If one does not know to which port one is sailing, no wind is favorable.” – Lucius Annaeus Seneca

- “Beware of missing chances; otherwise it may be altogether too late some day.” – Franz Liszt

- “The sofa is a really important investment for anybody, and I don’t mean financially. You need to find a really great sofa that can transition with you, and you can build from there.” – Jeremiah Brent

- “There is no investment you can make which will pay you so well as the effort to scatter sunshine and good cheer through your establishment.” – Orison Swett Marden

- “Nothing in life is to be feared, it is only to be understood. Now is the time to understand more, so that we may fear less.” – Marie Curie

- “There is little that can withstand a man who can conquer himself.” – Louis XIV

- “In tennis, you strike a ball just after the rebound for the fastest return. It’s the same with investment.” – Masayoshi Son

- “A camel makes an elephant feel like a jet plane.” – Jackie Kennedy

- “The advance of technology is based on making it fit in so that you don’t really even notice it, so it’s part of everyday life.” – Bill Gates

- “Success depends upon previous preparation, and without such preparation there is sure to be failure.” – Confucius, Chinese

- “Coming together is a beginning; keeping together is progress; working together is success.” – Edward Everett Hale

- “Never do anything against conscience even if the state demands it.”– Albert Einstein

- “Education is not only a ladder of opportunity, but it is also an investment in our future.” – Ed Markey

- “The true measure of a man is how he treats someone who can do him absolutely no good.” – Samuel Johnson

- “In my view, the biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. Not only is the mere drop in stock prices not risk, but it is an opportunity. Where else do you look for cheap stocks?” – Li Lu

- “A successful society is characterized by a rising living standard for its population, increasing investment in factories and basic infrastructure, and the generation of additional surplus, which is invested in generating new discoveries in science and technology.” – Robert Trout

- “The best preparation for tomorrow is doing your best today.” – H. Jackson Brown, Jr.

- “Friendship marks a life even more deeply than love. Love risks degenerating into obsession, friendship is never anything but sharing.” – Elie Wiesel

- “Investing in women’s lives is an investment in sustainable development, in human rights, in future generations – and consequently in our own long-term national interests.” – Liya Kebede

- “Success isn’t measured by money or power or social rank. Success is measured by your discipline and inner peace.” – Mike Ditka

- “No matter how many goals you have achieved, you must set your sights on a higher one.” – Jessica Savitch

- “Start where you are. Use what you have. Do what you can.”– Arthur Ashe

- “The secret of getting ahead is getting started.” – Mark Twain

- “The amount of work and the amount of both physical and emotional investment it takes to get to the top.” – Drew Bledsoe

Videos

Post View Count : 501