Global Selloff Accelerates On Monday (August 5, 2024) – $EPRX $K $MODD $VIX Rise!

In a financial comedy of errors that would make even Shakespeare cringe, global markets decided to take a synchronized swan dive on Monday, August 5, 2024. In fact, the market’s performance was reminiscent of a high-stakes game of algorithmically charged Jenga, with each index tumbling spectacularly. The party started in Japan, where the Nikkei index plummeted 12%, apparently trying to outdo its famous namesake dive bombers. This Asian market belly flop sent ripples across the Pacific, causing U.S. investors to collectively reach for their antacids. The selloff was primarily triggered by disappointing U.S. employment data, which heightened fears of an economic slowdown and potential recession. Technology and media stocks were particularly hard hit down more than 10% from its recent record high.

Major Indexes Performance

The Dow Jones Industrial Average, not to be outdone, tumbled 2.6%, while the S&P 500 sank 3%, flirting dangerously with correction territory like a nervous teenager at their first dance. The tech-heavy Nasdaq, always one for drama, outdid them both with a 3.43% nosedive, proving that even Silicon Valley’s darlings can’t defy gravity forever. In a plot twist worthy of a Wall Street soap opera, only twenty-two of the S&P 500 components managed to keep their heads above water, while all 30 Dow components decided to take a synchronized dive. Meanwhile, NVIDIA stock took a hit harder than a rejected Tinder date, dropping 6.36%closing at $100.45 on news of a chip delay. In the end, investors were left wondering if they should have invested in rollercoaster manufacturers instead of tech stocks.The small caps on the Russell 2000 closed at 2,039.16 (-3.33%) & The iShares Micro-Cap ETF (IWC) mirrored the performance of its larger counterparts, dropping 3.77% closing at $113.99 and proving that even the smallest fish in the market pond can’t escape the turbulent waters

VIX Fear Gauge

The VIX, Wall Street’s infamous “fear gauge,” notched its biggest jump in recent memory, reflecting the market’s heightened anxiety. Investors were more jittery than a cat in a room full of rocking chairs, as the VIX spiked dramatically closing at $38.57, +64.90%. This surge in volatility underscores the market’s uncertainty and trepidation, with traders scrambling to hedge their bets against further downturns. The sharp rise in the VIX suggests that market participants are bracing for potentially more turbulent times ahead, turning the trading floor into a veritable roller coaster of emotions.

Treasury Yield Tango

In a financial plot twist that would make M. Night Shyamalan proud, the Treasury market decided to play a game of yield curve limbo on Monday. For a brief, heart-stopping moment, the 2-year yield dipped below the 10-year yield, a move not seen since the ancient times of 2022. This inverted yield curve, the bond market’s equivalent of a magic trick, had economists reaching for their crystal balls and investors scratching their heads. However, the excitement was short-lived, as the ISM Non-Manufacturing Index for July came in hotter than a summer sidewalk, causing buyers to vanish faster than free samples at Costco. By day’s end, the bond market settled into a state of zen-like calm, with the 10-year yield lazily dropping one basis point to 3.79%, while the 2-year yield, not to be outdone, inched up by one basis point to 3.88%. It seems even in the world of bonds, no one wants to make any sudden moves in this economy. The Final July S&P Global US Services PMI Report also came in lower at 55.

U.S. Crude Oil Drop As Gas Rises

In a dramatic turn of events, U.S. crude oil prices took a nosedive on August 5, 2024, hitting a six-month low and leaving investors feeling like they were on a roller coaster designed by a particularly mischievous engineer. The benchmark U.S. crude oil for September delivery slipped 58 cents to $72.94 per barrel, as if trying to sneak out the back door of a party without saying goodbye. This oil market performance, worthy of a Hollywood blockbuster, was fueled by recession fears and disappointing economic data, including weak U.S. job growth figures that saw unemployment rise to 4.3%, the highest level since October 2021. While crude oil prices took a tumble, gasoline prices decided to play contrarian on August 5, 2024. Wholesale gasoline for September delivery inched up by 1 cent to $2.33 a gallon, as if trying to remind everyone that not all is doom and gloom in the energy sector. Natural gas, however, joined the downward spiral, falling 3 cents to $1.94 per 1,000 cubic feet, seemingly attempting to win a limbo contest against crude oil.[1] Year-to-date, gasoline prices have risen by 8.03%, while natural gas prices have plummeted by 23.7%, showcasing the divergent trends in different energy commodities.

VP Watchlist Updates

Kellanova (NYSE: K, $73.20, +16.23%), a leader in global snacking, international cereal and noodles, and North America frozen foods with a legacy stretching back more than 100 years, published (Aug. 1) its 2024 second quarter earnings results in documents posted to the company website at https://investor.kellanova.com/financials/quarterly-results/default.aspx.

Eupraxia Pharmaceuticals (EPRX, $2.59, +0.0% today), is a clinical-stage biotechnology company focused on the development of locally delivered, extended-release products that have the potential to address therapeutic areas with high unmet medical need. The Company strives to provide improved patient benefit and has developed technology designed to deliver targeted, long-lasting activity with fewer side effects. DiffuSphere™, a proprietary, polymer-based micro-sphere technology, is designed to facilitate targeted drug delivery, with extended duration of effect, and offers multiple, highly tuneable pharmacokinetic (PK) profiles. This investigational technology can be engineered for use with multiple active pharmaceutical ingredients and delivery methods.Note that Eupraxia recently completed a Phase 2b clinical trial (SPRINGBOARD) of EP-104IAR for the treatment of pain due to osteoarthritis of the knee. The trial met its primary endpoint and three of the four secondary endpoints. Eupraxia has expanded the EP-104 platform into gastrointestinal disease with the Phase 1b/2a RESOLVE trial for treating EoE. Eupraxia is also developing a pipeline of later- and earlier-stage long-acting formulations. Potential pipeline indications include candidates for other inflammatory joint indications and oncology, each designed to improve on the activity and tolerability of currently approved drugs.On June 5, Eupraxia announced that results from its Phase 2 study of EP-104IAR for the treatment of osteoarthritis of the knee will be presented at the upcoming European Alliance of Associations for Rheumatology (“EULAR”) European Congress of Rheumatology 2024 (the “Meeting”). The EULAR Meeting is being held in Vienna, Austria from June 12-15, 2024.On May 23, Eupraxia announced that regulators in Australia and Canada have cleared the Company’s request to expand its Phase 1b/2a RESOLVE trial, which is evaluating the safety and efficacy of EP-104GI as a treatment for eosinophilic esophagitis (“EoE”). For further details about Eupraxia, please visit the Company’s website at: www.eupraxiapharma.com.

Shares of Lantern (LTRN), an artificial intelligence (“AI”) company developing targeted and transformative cancer therapies using its proprietary RADR® AI and machine learning (“ML”) platform with multiple clinical stage drug program, closed at $3.52, -5.88% and is up 3.13% at $3.63 in the aftermarket.

Shares of Lantern (LTRN), an artificial intelligence (“AI”) company developing targeted and transformative cancer therapies using its proprietary RADR® AI and machine learning (“ML”) platform with multiple clinical stage drug program, closed at $3.52, -5.88% and is up 3.13% at $3.63 in the aftermarket.

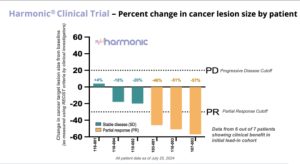

Today, August 5, Lantern Pharma announced promising preliminary results from its Phase 2 HARMONIC™ clinical trial, evaluating LP-300 in combination with standard chemotherapy for never-smokers with advanced non-small cell lung cancer (NSCLC). As reported earlier today, August 5, the study has shown an impressive 86% clinical benefit rate in the initial patient group, offering hope for a patient population with limited treatment options. The proportion of never-smoking patients with non-small cell lung cancer (NSCLC) has been significantly increasing globally over the past 30 years, from 15% in the 1970s to 33% in the 2000s. The high proportion of never smokers with NSCLC in East Asian countries is of particular note with Japan estimated to be 33 to 40% of new cases and Taiwan at over 50% of new cases. Lantern has received regulatory approval to initiate the LP-300 clinical trial in multiple Asian countries, and has started activation of sites in Japan and Taiwan, including the National Cancer Center in Tokyo, a globally recognized center of cancer research excellence. Read the balance of the story.

On July 10, Lantern announced a significant advancement towards the development of a diagnostic for its drug candidate LP-184. The diagnostic is currently based on qRT-PCR (quantitative real-time polymerase chain reaction) technology and is focused on quantifying the amount of PTGR1 RNA in patient tumor samples to assess the potential for sensitivity to Lantern’s drug candidate LP-184. The company plans to further develop and validate the assay for its use as a potential tool for patient selection in later stage clinical trials across a broad range of solid tumors that have shown sensitivity to LP-184. Panna Sharma, CEO of Lantern Pharma stated, “This milestone represents a significant leap forward in our precision oncology approach and in ensuring that we enrich our future LP-184 clinical trials with the patients we believe will be most likely to benefit. By working to develop a companion diagnostic for LP-184, we’re not just advancing a drug candidate; we’re paving the way for more personalized and effective cancer treatments for patients that have the highest likelihood of benefitting from the therapy. The planned use of biomarkers like PTGR1 in our clinical trials exemplifies our commitment to data-driven, patient-centric drug development.”Panna Sharma, CEO of Lantern, was interviewed recently on the ‘Today In Nashville’, a program hosted by Carole Sullivan and associated with Nashville’s WSMV 4, an NBC affiliate. Watch it here to learn more.On June 12, Lantern announced that the Japan Patent Office (JPO) has issued a Certificate of Patent for patent application no. 2021-513267 / registration no. 7489966 directed to Lantern Pharma’s drug candidate LP-284 ((+)N-hydroxy-N-(methylacylfulvene)urea). The Certificate of Patent entitled “Illudin Analogs, Uses Thereof, and Methods for Synthesizing the Same” covers molecule LP-284, including claims covering the new molecular entity. A Certificate of Patent is issued after JPO examinations have confirmed the merits of a patent request. Lantern values the broad protection this latest patent provides. Lantern estimates that LP-284 can have the potential to improve outcomes for 40,000 to 80,000 patients with blood cancers annually, with a global annual market potential of $4 Billion USD.

Shares of Indaptus Therapeutics, Inc. (Nasdaq: INDP) closed at $1.653, -12.59% and is up +10.46% at $1.99 in the aftermarket. Indaptus is a company with the ability to harness both the body’s innate and adaptive immune responses, believes that they are uniquely positioned to revolutionize the treatment of cancer and certain infectious diseases. Indaptus Therapeutics has evolved from more than a century of immunotherapy advances. The Company’s novel approach is based on the hypothesis that efficient activation of both innate and adaptive immune cells and pathways and associated anti-tumor and anti-viral immune responses will require a multi-targeted package of immune system-activating signals that can be administered safely intravenously (i.v.). Indaptus’ patented technology is composed of single strains of attenuated and killed, non-pathogenic, Gram-negative bacteria producing a multiple Toll-like receptor (TLR), Nucleotide oligomerization domain (Nod)-like receptor (NLR) and Stimulator of interferon genes (STING) agonist Decoy platform. The products are designed to have reduced i.v. toxicity, but largely uncompromised ability to prime or activate many of the cells and pathways of innate and adaptive immunity. Decoy products represent an antigen-agnostic technology that have produced single-agent activity against metastatic pancreatic and orthotopic colorectal carcinomas, single agent eradication of established antigen-expressing breast carcinoma, as well as combination-mediated eradication of established hepatocellular carcinomas and non-Hodgkin’s lymphomas in standard pre-clinical models, including syngeneic mouse tumors and human tumor xenografts.On June 4, Indaptus announced that its Chief Medical Officer, Roger Waltzman, M.D., will present an update on the Company’s lead product candidate, Decoy20, at the 7th Annual Next-Gen Immuno-Oncology Conference in Boston on June 20-21, 2024. Dr. Waltzman will present preliminary results from the Company’s ongoing Phase 1 study of Decoy20, an intravenous treatment using killed bacteria designed to broadly stimulate the immune system, in patients with advanced solid tumors.On June 3, Indaptus announced updated data from its ongoing Phase 1 clinical trial of Decoy20 in patients with solid tumors. The data were featured in a poster presentation at the American Society of Clinical Oncology (ASCO) Annual Meeting on June 1 in Chicago, Illinois.

Shares of Indaptus Therapeutics, Inc. (Nasdaq: INDP) closed at $1.653, -12.59% and is up +10.46% at $1.99 in the aftermarket. Indaptus is a company with the ability to harness both the body’s innate and adaptive immune responses, believes that they are uniquely positioned to revolutionize the treatment of cancer and certain infectious diseases. Indaptus Therapeutics has evolved from more than a century of immunotherapy advances. The Company’s novel approach is based on the hypothesis that efficient activation of both innate and adaptive immune cells and pathways and associated anti-tumor and anti-viral immune responses will require a multi-targeted package of immune system-activating signals that can be administered safely intravenously (i.v.). Indaptus’ patented technology is composed of single strains of attenuated and killed, non-pathogenic, Gram-negative bacteria producing a multiple Toll-like receptor (TLR), Nucleotide oligomerization domain (Nod)-like receptor (NLR) and Stimulator of interferon genes (STING) agonist Decoy platform. The products are designed to have reduced i.v. toxicity, but largely uncompromised ability to prime or activate many of the cells and pathways of innate and adaptive immunity. Decoy products represent an antigen-agnostic technology that have produced single-agent activity against metastatic pancreatic and orthotopic colorectal carcinomas, single agent eradication of established antigen-expressing breast carcinoma, as well as combination-mediated eradication of established hepatocellular carcinomas and non-Hodgkin’s lymphomas in standard pre-clinical models, including syngeneic mouse tumors and human tumor xenografts.On June 4, Indaptus announced that its Chief Medical Officer, Roger Waltzman, M.D., will present an update on the Company’s lead product candidate, Decoy20, at the 7th Annual Next-Gen Immuno-Oncology Conference in Boston on June 20-21, 2024. Dr. Waltzman will present preliminary results from the Company’s ongoing Phase 1 study of Decoy20, an intravenous treatment using killed bacteria designed to broadly stimulate the immune system, in patients with advanced solid tumors.On June 3, Indaptus announced updated data from its ongoing Phase 1 clinical trial of Decoy20 in patients with solid tumors. The data were featured in a poster presentation at the American Society of Clinical Oncology (ASCO) Annual Meeting on June 1 in Chicago, Illinois.

Shares of ADT Inc. (ADT), a leading provider of monitored security and automation solutions for residential and small business customers in the United States and Canada, closed at $6.87, -.87% after establishing a new 52-wk high of $7.92 during intraday trading recently.

On Aug. 1, ADT reported its second quarter results for 2024 that read like a thrilling spy novel, complete with mysterious numbers and covert operations. The company reported a 3% increase in total revenue, reaching $1.2 billion – apparently, securing homes is more lucrative than ever in our paranoid future. Their recurring monthly revenue (RMR) grew by 2% to $355 million, proving that once ADT gets its foot in your door, it’s there to stay

The company boasted “strong customer retention” with a gross revenue attrition of 12.9%, which in ADT speak means they’re only hemorrhaging about 1 in 8 customers. Their “revenue payback” sits at 2.2 years, suggesting it takes that long for customers to stop regretting their decision to sign up.

In a plot twist worthy of a summer blockbuster, ADT’s GAAP income from continuing operations dropped by $54 million. But fear not, shareholders! Their “adjusted” income increased by $3 million. It seems ADT has mastered the art of financial alchemy, turning red numbers green faster than you can say “creative accounting”.

CEO Jim DeVries, channeling his inner motivational speaker, declared that ADT’s success is “powered by our employees’ dedication to the proposition that every second counts.” One can only imagine the intense pressure of working in an environment where bathroom breaks are timed to the millisecond.[

Modular Medical, Inc. (NASDAQ: MODD, $1.46, +2.82%), is a development-stage, insulin delivery technology company seeking to launch the next generation of user-friendly and affordable insulin pump technology. Using its patented technologies, the company seeks to eliminate the tradeoff between complexity and efficacy, thereby making top quality insulin delivery both affordable and simple to learn. Their mission is to improve access to the highest standard of glycemic control for people with diabetes taking it beyond “superusers” and providing “diabetes care for the rest of us.” Modular Medical was founded by Paul DiPerna, a seasoned medical device professional and microfluidics engineer. Prior to founding Modular Medical, Mr. DiPerna was the founder (in 2005) of Tandem Diabetes and invented and designed its t:slim insulin pump. More information is available at https://modular-medical.com.

Quote of the Day

Economic Reports

On Monday, the ISM Non-Manufacturing Index for July came in hotter than a summer sidewalk, causing buyers to vanish faster than free samples at Costco. The Final July S&P Global US Services PMI Report also came in lower at 55.

Videos

Post View Count : 501