U.S. Stock Markets End Mixed On Tuesday, July 8, 2025

- Published Jul 08, 2025

- Market News

The U.S. equity markets concluded Tuesday’s session with a mixed tone as investors weighed renewed tariff anxieties and shifting macroeconomic signals. The S&P 500 edged lower by 4.46 points (0.1%) to close at 6,225.52, while the Dow Jones Industrial Average dropped 165.60 points (0.4%) to 44,240.76. The Nasdaq Composite managed a modest gain, rising 5.95 points to 20,418.46, reflecting resilience in select technology names. The Russell 2000 index of small-cap stocks rose 14.51 points (0.7%) to 2,228.74, outperforming its large-cap peers despite the broader risk-off environment.

Macroeconomic Reports

Macroeconomic data on Tuesday reflected a cautious outlook. A Federal Reserve Bank of Dallas study indicated that recent immigration restrictions and deportation measures could trim U.S. GDP growth by nearly a full percentage point in 2025, with economists now projecting annual growth to cool to 1.5%, down from close to 3% in previous years. The policy shift is also expected to nudge inflation slightly higher this year.

S&P 500, Dow 30, Nasdaq, and Russell Index Highlights

-

S&P 500: Down 0.1% to 6,225.52.

-

Dow 30: Down 0.4% to 44,240.76.

-

Nasdaq: Up less than 0.1% to 20,418.46.

-

Russell 2000: Up 0.7% to 2,228.74.

Key Stock Highlights

NVIDIA (NVDA)

NVIDIA shares remained resilient despite mounting pressure from new U.S. trade restrictions, including expanded tariffs and tighter AI chip export controls. The stock recently hit an all-time high, buoyed by robust AI demand and positive analyst commentary. Citi raised its price target, citing a growing addressable market and strong sovereign AI demand, which could drive billions in revenue in 2025. The company’s Blackwell chip ramp-up continues smoothly, alleviating earlier supply concerns.

Tesla (TSLA)

Tesla shares endured a sharp decline, falling nearly 7% as CEO Elon Musk announced the formation of a new political party, the “America Party.” This move reignited investor concerns about Musk’s focus and leadership at a time when Tesla is already grappling with declining vehicle deliveries and narrowing margins. Year-to-date, Tesla stock is down 22.5% and now trades 38.5% below its December 2024 peak.

Oracle (ORCL)

Oracle shares slipped 2.1%, underperforming the broader market, as investors rotated out of technology stocks amid tariff uncertainty. The company continues to face headwinds from shifting global trade dynamics.

Tariffs and Trade Developments

Tariff uncertainty dominated market sentiment after President Trump postponed the implementation of reciprocal tariffs from July 9 to August 1. Letters sent to 14 countries outlined potential import duties ranging from 25% to 40%, with additional levies possible for BRICS nations. The market remains focused on whether ongoing negotiations can defuse trade tensions before the new deadline. The delay adds complexity for the Federal Reserve as it assesses inflation risks and for retailers preparing for the holiday season.

Yield Curve and Interest Rates

Treasury yields climbed, with the benchmark 10-year note rising to 4.396%. Investors braced for the impact of upcoming government debt auctions and the potential inflationary effects of new tariffs.

Vista Partners Watchlist Highlights & Updates

Eupraxia Pharmaceuticals (EPRX) is clinical-stage biotechnology firm headquartered in Victoria, Canada, has quietly become one of the more intriguing stories on both sides of the border in 2025. The company’s shares now trade under the ticker EPRX on both the Nasdaq and the Toronto Stock Exchange, following its U.S. market debut in April 2024. This dual listing has broadened its investor base at a time when the company’s clinical and financial narrative is gaining momentum. All covering analysts currently rate the stock as a “Buy” or better, with not a single “Hold” or “Sell” recommendation in sight. In a sector defined by binary outcomes and frequent disappointment, such unanimity is striking. Overall, analysts cite Eupraxia’s strong clinical pipeline and revenue growth potential as key drivers behind their bullish outlook.

Eupraxia Pharmaceuticals (EPRX) is clinical-stage biotechnology firm headquartered in Victoria, Canada, has quietly become one of the more intriguing stories on both sides of the border in 2025. The company’s shares now trade under the ticker EPRX on both the Nasdaq and the Toronto Stock Exchange, following its U.S. market debut in April 2024. This dual listing has broadened its investor base at a time when the company’s clinical and financial narrative is gaining momentum. All covering analysts currently rate the stock as a “Buy” or better, with not a single “Hold” or “Sell” recommendation in sight. In a sector defined by binary outcomes and frequent disappointment, such unanimity is striking. Overall, analysts cite Eupraxia’s strong clinical pipeline and revenue growth potential as key drivers behind their bullish outlook.

-

HC Wainwright: Initiated Covrage on EPRX with a “Strong Buy” on June 26, 2025.

-

Canaccord Genuity: Initiated coverage with a “Speculative Buy” rating in June 2025.

-

Raymond James Ltd.: Maintains a “Strong Buy” rating as of June 2025, with a history of upgrades from “Outperform” to “Strong Buy” over the past year.

-

Research Capital Corporation: Maintains a “Buy” rating, consistently reaffirming its positive stance throughout 2024 and 2025.

Eupraxia announced on July 8 that the first patient dosed in their Phase 2b randomized, placebo-controlled portion of the RESOLVE clinical trial evaluating EP-104GI, an investigational treatment for eosinophilic esophagitis (“EoE”). EP-104GI is injected directly into the affected tissues of the esophagus to reduce inflammation with stable, localized, and long-duration drug delivery, while minimizing unwanted systemic adverse events and side effects often associated with steroid-based therapies. The Phase 2b portion of the RESOLVE study will enroll a minimum of 60 participants randomized in a 1:1:1 ratio to receive one of two doses of EP-104GI or placebo. After six months, eligible patients initially dosed with placebo may elect to receive EP-104GI. The primary objective is to assess the efficacy of EP-104GI in improving tissue health, as measured by the Eosinophilic Esophagitis Histology Scoring System (“EoEHSS”). Secondary and exploratory objectives include evaluating symptomatic improvement through patient-reported outcomes — Straumann Dysphagia Index score (SDI) and Dysphagia Symptom Questionnaire (DSQ), endoscopic and histologic changes (including Peak Eosinophil Count, “PEC”), pharmacokinetics, safety, and tolerability of the selected dose regimens. Up to 25 sites globally are expected to participate in the trial.The Phase 2b portion of the study employs an innovative adaptive design to select the doses of EP-104GI that are administered to patients. The first active dose selection was based on available data from cohorts 1 to 8 of the Phase 2a portion of the study. Based on the previously reported safety, pharmacokinetic, and efficacy data from cohorts 1 to 6, and additional one month data from cohorts 7 and 8, the 120 mg dose (20 injections of 6 mg per site) from cohort 8 was selected for the first treatment arm in the dose optimization phase. A second dose will be selected for evaluation after enrollment in the first arm is complete, based on additional long-term data from the Phase 2a portion of the study. James Helliwell, CEO of Eupraxia Pharmaceuticals stated, “Entering into the Phase 2b stage of the RESOLVE trial is a significant event for Eupraxia. This is an important step for us before proceeding towards the pivotal trials necessary for submitting an application for regulatory approval. We are optimistic that EP-104GI has the potential to significantly advance the standard of care and offer a meaningful new treatment paradigm for patients living with EoE.”

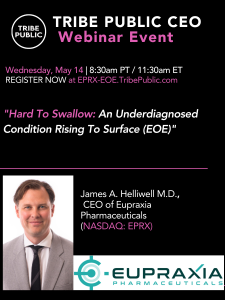

Tribe Public hosted a CEO Presentation and Q&A Webinar Event on Wednesday, May 14th with James A. Helliwell, Director and CEO of Eupraxia Pharmaceuticals (NASDAQ: EPRX). The event is titled “Hard To Swallow: An Underdiagnosed Condition Rising To Surface (EOE).” You may view it now at https://youtu.be/tCtY_27EJG4?si=0PJIp-oyGDEpzxzR

Tribe Public hosted a CEO Presentation and Q&A Webinar Event on Wednesday, May 14th with James A. Helliwell, Director and CEO of Eupraxia Pharmaceuticals (NASDAQ: EPRX). The event is titled “Hard To Swallow: An Underdiagnosed Condition Rising To Surface (EOE).” You may view it now at https://youtu.be/tCtY_27EJG4?si=0PJIp-oyGDEpzxzR

Summit Therapeutics Inc. (NASDAQ: SMMT) is a biopharmaceutical oncology company focused on the discovery, development, and commercialization of patient-, physician-, caregiver- and societal-friendly medicinal therapies intended to improve quality of life, increase potential duration of life, and resolve serious unmet medical needs.

Summit announced (May 30) topline results from the Phase III clinical trial, HARMONi, the first global Phase III study evaluating ivonescimab, successfully met the progression-free survival (PFS) primary endpoint and showed a positive trend in the other primary endpoint, overall survival (OS). HARMONi is a multiregional, double-blinded, placebo-controlled, Phase III study sponsored by Summit evaluating ivonescimab plus platinum-doublet chemotherapy compared to placebo plus platinum-doublet chemotherapy in patients with epidermal growth factor receptor (EGFR)-mutated, locally advanced or metastatic non-squamous non-small cell lung cancer (NSCLC) who have progressed after treatment with a 3rd generation EGFR tyrosine kinase inhibitor (TKI). This is a clinical setting with a patient population where PD-1 monoclonal antibodies have previously been unsuccessful in Phase III global clinical trials in showing either a PFS or OS benefit.

Summit Therapeutics Inc. (NASDAQ: SMMT) is a biopharmaceutical oncology company focused on the discovery, development, and commercialization of patient-, physician-, caregiver- and societal-friendly medicinal therapies intended to improve quality of life, increase potential duration of life, and resolve serious unmet medical needs.

Summit announced (May 30) topline results from the Phase III clinical trial, HARMONi, the first global Phase III study evaluating ivonescimab, successfully met the progression-free survival (PFS) primary endpoint and showed a positive trend in the other primary endpoint, overall survival (OS). HARMONi is a multiregional, double-blinded, placebo-controlled, Phase III study sponsored by Summit evaluating ivonescimab plus platinum-doublet chemotherapy compared to placebo plus platinum-doublet chemotherapy in patients with epidermal growth factor receptor (EGFR)-mutated, locally advanced or metastatic non-squamous non-small cell lung cancer (NSCLC) who have progressed after treatment with a 3rd generation EGFR tyrosine kinase inhibitor (TKI). This is a clinical setting with a patient population where PD-1 monoclonal antibodies have previously been unsuccessful in Phase III global clinical trials in showing either a PFS or OS benefit.

Jeb Besser, CEO of Modular Medical, presented on May 29 at Tribe Public’s Webinar Presentation and Q&A Event titled“Making Diabetes Management Simpler: The New Era of Insulin Therapy.”You may view the event video now at the Tribe Public YouTube Channel.

Jeb Besser, CEO of Modular Medical, presented on May 29 at Tribe Public’s Webinar Presentation and Q&A Event titled“Making Diabetes Management Simpler: The New Era of Insulin Therapy.”You may view the event video now at the Tribe Public YouTube Channel.

Shares of ADT Inc. (ADT) is a leading provider of monitored security and automation solutions for residential and small business customers in the United States and Canada.

ADT released Q1, 2025 results on Thursday, April 24 and highlighted the following: Continued strong financial results with record recurring monthly revenue and customer retention, GAAP operating cash flows up 28%, Adjusted Free Cash Flow including interest rate swaps up 105%, Returned $445 million to shareholders through share repurchases and dividends, and that they are on track to achieve full year 2025 guidance metrics.

On April 30, ADT in collaboration with Yale and the Z-Wave Alliance, announced the launch of the Yale Assure Lock 2 Touch with Z-Wave for ADT+. The Z-Wave 800 Series smart lock is the only one on the market with fingerprint control and the first smart lock to leverage the newly introduced Z-Wave User Credential Command Class. This industry-first innovation allows users to unlock and disarm their ADT+ security system using just their fingerprint.On Jan. 22, ADT announced the appointment of Thomas Gartland to the Company’s Board of Directors as an additional independent director. In conjunction with his appointment, Gartland will join the Board’s Audit Committee. Gartland is chairman and chief executive officer of Montway Auto Transport, a privately held auto transport company, and has held this position since 2023. Prior to Montway, Gartland served as executive chairman of Scan Global Logistics and as president, North America, for Avis Budget Group. Gartland serves on the boards of Xenia Hotels & Resorts, Inc. and ABM.

GeoVax Labs, Inc. (Nasdaq: GOVX) is a clinical-stage biotechnology company developing immunotherapies and vaccines against cancers and infectious diseases.

On July 3, GeoVax emphasized the urgent need for innovation in COVID-19 vaccination as the NB.1.8.1 variant – commonly known as “Nimbus” – spreads rapidly across the globe. Nimbus, a highly transmissible Omicron subvariant classified by the World Health Organization as a “Variant Under Monitoring,” is now dominant in multiple U.S. states and surging across Europe and Asia. Though not more severe, its rapid spread and potential for immune escape reflect an increasingly clear reality: COVID-19 is not going away, and it will continue to evolve.

On July 2, GeoVax emphasized the growing global public health importance of its GEO-MVA Mpox/smallpox vaccine in response to rising public health threats and a rapidly evolving regulatory environment. With favorable regulatory input from the European Medicines Agency (EMA), GEO-MVA is on an expedited path toward market access, accelerating GeoVax’s focus toward regulatory approval and commercialization. “GeoVax is entering a value inflection phase,” said David Dodd, Chairman and CEO. “The EMA’s expedited development path brings us closer to regulatory registration and commercial readiness, providing the opportunity to address urgent public health needs, expanding the critically needed supply option of MVA-vaccine, addressing both expanding outbreak needs and stockpile opportunities.”

On July 1, GeoVax Labs announced that it has entered into definitive securities purchase agreements with several institutional and individual investors for the purchase and sale of approximately 9.2 million units, each comprised of one share of the Company’s common stock and warrants, as described below, to purchase shares of the Company’s common stock, at a price of $0.65 per unit in a public offering. The Company will issue warrants to purchase up to approximately 18.5 million shares of common stock. The warrants will have an exercise price of $0.65 per share, will be exercisable immediately following the date of issuance and will have a term of five years following the date of issuance. Roth Capital Partners is acting as the exclusive placement agent for the offering. The gross proceeds to the Company from this offering are expected to be approximately $6 million, before deducting the placement agent’s fees and other offering expenses payable by the Company. The Company intends to use the net proceeds from this offering for working capital and general corporate purposes. The closing of the offering is expected to occur on or about July 2, 2025, subject to the satisfaction of customary closing conditions.

GeoVax Labs, Inc. (Nasdaq: GOVX) is a clinical-stage biotechnology company developing immunotherapies and vaccines against cancers and infectious diseases.

On July 3, GeoVax emphasized the urgent need for innovation in COVID-19 vaccination as the NB.1.8.1 variant – commonly known as “Nimbus” – spreads rapidly across the globe. Nimbus, a highly transmissible Omicron subvariant classified by the World Health Organization as a “Variant Under Monitoring,” is now dominant in multiple U.S. states and surging across Europe and Asia. Though not more severe, its rapid spread and potential for immune escape reflect an increasingly clear reality: COVID-19 is not going away, and it will continue to evolve.

On July 2, GeoVax emphasized the growing global public health importance of its GEO-MVA Mpox/smallpox vaccine in response to rising public health threats and a rapidly evolving regulatory environment. With favorable regulatory input from the European Medicines Agency (EMA), GEO-MVA is on an expedited path toward market access, accelerating GeoVax’s focus toward regulatory approval and commercialization. “GeoVax is entering a value inflection phase,” said David Dodd, Chairman and CEO. “The EMA’s expedited development path brings us closer to regulatory registration and commercial readiness, providing the opportunity to address urgent public health needs, expanding the critically needed supply option of MVA-vaccine, addressing both expanding outbreak needs and stockpile opportunities.”

On July 1, GeoVax Labs announced that it has entered into definitive securities purchase agreements with several institutional and individual investors for the purchase and sale of approximately 9.2 million units, each comprised of one share of the Company’s common stock and warrants, as described below, to purchase shares of the Company’s common stock, at a price of $0.65 per unit in a public offering. The Company will issue warrants to purchase up to approximately 18.5 million shares of common stock. The warrants will have an exercise price of $0.65 per share, will be exercisable immediately following the date of issuance and will have a term of five years following the date of issuance. Roth Capital Partners is acting as the exclusive placement agent for the offering. The gross proceeds to the Company from this offering are expected to be approximately $6 million, before deducting the placement agent’s fees and other offering expenses payable by the Company. The Company intends to use the net proceeds from this offering for working capital and general corporate purposes. The closing of the offering is expected to occur on or about July 2, 2025, subject to the satisfaction of customary closing conditions.

Indaptus Therapeutics, Inc. (Nasdaq: INDP) is a company with the ability to harness both the body’s innate and adaptive immune responses, believes that they are uniquely positioned to revolutionize the treatment of cancer and certain infectious diseases.

On July 1, Indaptus announced the additional sale of approximately $3.4 million in aggregate principal amount of convertible promissory notes and accompanying warrants. Together with a prior sale of $2.3 million of convertible promissory notes and accompanying warrants, the Company raised an aggregate of $5.7 million in gross proceeds in this offering.

On June 2, Indaptus announced that the first patient has been dosed in the expansion arm of its Phase 1b/2 clinical trial evaluating Decoy20 in combination with BeOne’s (formerly known as Beigene) PD-1 checkpoint inhibitor, tislelizumab. This newly activated arm of the trial will assess safety, dose optimization, and early signs of anti-tumor activity in patients with advanced solid tumors, previously treated with a checkpoint inhibitor or with tumors typically unresponsive to a checkpoint inhibitor. Jeffrey Meckler, Indaptus’ CEO commented, “This is an important milestone in our clinical development. We have long believed the Decoy platform has the potential to be a game-changing approach to treating solid tumors. Preclinical data consistently demonstrated that Decoy20 works synergistically with a checkpoint inhibitor. Now, for the first time, we are testing this combination in patients. Checkpoint inhibitors, like tislelizumab, have been one of the biggest breakthroughs in cancer therapy and have significantly improved outcomes in a variety of cancers. However, most patients still do not benefit. We believe the combination of Decoy20 plus a PD-1 inhibitor, such as tislelizumab, could enhance immune responses, potentially helping patients who have not responded or have tumors that classically do not respond to checkpoint inhibitor therapy.”

Indaptus Therapeutics, Inc. (Nasdaq: INDP) is a company with the ability to harness both the body’s innate and adaptive immune responses, believes that they are uniquely positioned to revolutionize the treatment of cancer and certain infectious diseases.

On July 1, Indaptus announced the additional sale of approximately $3.4 million in aggregate principal amount of convertible promissory notes and accompanying warrants. Together with a prior sale of $2.3 million of convertible promissory notes and accompanying warrants, the Company raised an aggregate of $5.7 million in gross proceeds in this offering.

On June 2, Indaptus announced that the first patient has been dosed in the expansion arm of its Phase 1b/2 clinical trial evaluating Decoy20 in combination with BeOne’s (formerly known as Beigene) PD-1 checkpoint inhibitor, tislelizumab. This newly activated arm of the trial will assess safety, dose optimization, and early signs of anti-tumor activity in patients with advanced solid tumors, previously treated with a checkpoint inhibitor or with tumors typically unresponsive to a checkpoint inhibitor. Jeffrey Meckler, Indaptus’ CEO commented, “This is an important milestone in our clinical development. We have long believed the Decoy platform has the potential to be a game-changing approach to treating solid tumors. Preclinical data consistently demonstrated that Decoy20 works synergistically with a checkpoint inhibitor. Now, for the first time, we are testing this combination in patients. Checkpoint inhibitors, like tislelizumab, have been one of the biggest breakthroughs in cancer therapy and have significantly improved outcomes in a variety of cancers. However, most patients still do not benefit. We believe the combination of Decoy20 plus a PD-1 inhibitor, such as tislelizumab, could enhance immune responses, potentially helping patients who have not responded or have tumors that classically do not respond to checkpoint inhibitor therapy.”

Quote of the Day

“People only see what they are prepared to see.” – Ralph Waldo Emerson

Investing & Inspiration

“We cannot live only for ourselves. A thousand fibers connect us with our fellow men.” – Herman Melville

Post View Count : 501