The Stock Market Rests On The 8th Day (Aug. 20, 2024) – $AAPL $EPRX $LLY $MODD $MSFT $PANW Rise!

After an impressive eight-day winning streak, the stock market decided to take a bit of a breather on Tuesday, with all three major indexes closing slightly in the red. The S&P 500 dipped .2%, ending its longest rally since November, while the Dow Jones Industrial Average and Nasdaq Composite followed suit with similar modest declines. This pause in the market’s upward trajectory came as investors shifted their focus to upcoming events, particularly Federal Reserve Chair Jerome Powell’s speech at the Jackson Hole economic symposium later in the week. The day’s trading was characterized by a lack of conviction from both buyers and sellers, resulting in relatively light volume totals at the NYSE and Nasdaq for the second consecutive day this week. However, the small caps on Russell 2000 closed down significantly by 1.17% at 2,142.19 & the VIX volatility index, the markets ‘fear gauge’, closed at $15.88, popping up +7.29% after hitting an intraday high of $15.89. The iShares Micro-Cap ETF (IWC) also fell by -.99% closing at $119.75.

Notable Stock Movements

While the broader market took a breather, individual stocks provided some excitement. Palo Alto Networks (PANW) surged 7.18% on impressive earnings and guidance, while Eli Lilly (LLY), the most valuable (by Mkt Cap) pharmaceutical firm in the world, jumped another 3.1% after announcing that tirzepatide, its GLP-1 weightless drug, reduced the risk of developing type 2 diabetes by 94% in adults with pre-diabetes in a study. Boeing (BA), however, hit turbulence, dropping 4.2% following reports of paused test flights for its 777X due to cracks in a key part. Lowe’s (LOW) also stumbled, losing 1.2% after issuing disappointing FY25 guidance, echoing rival Home Depot’s (HD) concerns about muted consumer demand for big-ticket items.

Sector Performance Highlights

The energy sector took the biggest hit, plunging 2.7% as every component registered losses in what appeared to be a coordinated move to reduce exposure. WTI crude futures dipped 0.8% to $73.17/bbl. Consumer staples and materials sectors showed modest movements, with the former gaining 0.5% and the latter losing 0.4%. These sector-specific shifts occurred against a backdrop of declining Treasury yields, as the 2-year note yield dropped seven basis points to 4.00% and the 10-year note yield fell five basis points to 3.82%. The U.S. Dollar Index continued its downward trend, falling 0.5% to 101.48, marking a 4.2% decline for the quarter and reaching its lowest level since the start of the year.

Anticipation for Upcoming Events

Investors held their breath for Wednesday’s lineup of market-moving events, including earnings reports from retail giants Target, Macy’s, and TJX Cos. before the opening bell. The day’s agenda also featured the release of benchmark revisions to nonfarm payrolls for April 2023-March 2024 at 10:00 a.m. ET, a $16 billion 20-year bond auction at 1:00 p.m. ET, and the much-anticipated release of the Minutes from the July 30-31 FOMC meeting at 2:00 p.m. ET. Wall Street’s attention was particularly focused on Fed Chair Powell’s upcoming speech at the Jackson Hole symposium, with expectations building for potential signals of a September rate cut.

Tech’s Magnificent Market Makeover

Hold onto your silicon chips, folks! The tech sector just pulled off a comeback that would make Rocky Balboa jealous. Nvidia (NVDA), the heavyweight champion of AI chips, flexed its muscles with a jaw-dropping 30% surge, leading the charge in a tech rally that’s got Wall Street doing the robot dance. The “Magnificent Seven” tech titans – Apple (AAPL, $226.51, +.27%), Alphabet, Microsoft (MSFT, $424.80, +.78%), Amazon, Meta, Tesla, and Nvidia – have been pumping iron and bulking up their market caps like there’s no tomorrow. These digital bodybuilders have collectively packed on a whopping $1.4 trillion in muscle mass, accounting for nearly half of the S&P 500’s total gains. Talk about skipping leg day and focusing on the upper body! After taking a nosedive in July that had investors reaching for their airsickness bags, the Nasdaq Composite also bounced back faster than a cat video goes viral. It shook off its correction in just 11 days, setting a new speed record not seen since 2011.

Precious Metals Price Update

Gold and silver played a game of financial tug-of-war on August 20, 2024, leaving investors scratching their heads and checking their calculators. Gold, the shiny yellow metal that’s been humanity’s favorite bling for millennia, decided to take a microscopic siesta on the Multi Commodity Exchange, dropping a whopping 0.02% – a dip so small, you’d need a magnifying glass to spot it. Meanwhile, on the global stage, gold perked up like it had just sipped an espresso, rising 0.2% and flirting with the $2,500 mark. Silver, not to be outdone by its glitzier cousin, put on quite the show. It strutted its stuff on the MCX, strutting up 0.28% and making it rain rupees. But in a plot twist worthy of a soap opera, global silver prices took a stumble, falling 0.8% faster than you can say “tarnished teaspoon.” This precious metal mambo leaves us wondering if gold and silver are secretly competing in some bizarre financial dance-off, with local demand, currency mood swings, and global economic shenanigans as their unpredictable DJs.

VP Watchlist Updates

Eupraxia Pharmaceuticals (EPRX, $2.71, +2.26% and is up 3.32% at $2.80 in the aftermarket) is a clinical-stage biotechnology company focused on the development of locally delivered, extended-release products that have the potential to address therapeutic areas with high unmet medical need. The Company strives to provide improved patient benefit and has developed technology designed to deliver targeted, long-lasting activity with fewer side effects. DiffuSphere™, a proprietary, polymer-based micro-sphere technology, is designed to facilitate targeted drug delivery, with extended duration of effect, and offers multiple, highly tuneable pharmacokinetic (PK) profiles. This investigational technology can be engineered for use with multiple active pharmaceutical ingredients and delivery methods.

On Aug. 7, Eupraxia announced its financial results for the second quarter of 2024. Dr. James Helliwell, CEO of Eupraxia stated, “Our eosinophilic esophagitis (“EoE”) clinical program is making excellent progress, as additional safety and efficacy data from our ongoing RESOLVE study continues to suggest that EP-104GI could represent a significant improvement over currently approved therapies for this debilitating condition. In addition, during the second quarter, we presented data at two medical meetings highlighting the potential of our candidate for the treatment of knee osteoarthritis (“OA”), EP-104IAR, which also holds the potential to advance the current standard of care in OA. “Looking ahead, we anticipate reporting new data from the fourth cohort of the RESOLVE study in the near term and we continue to engage prospective partners for possible licensing of the EP-10IAR program. We look forward to engaging with the U.S. Food and Drug Administration in the fourth quarter of 2024 on the EP-104GI program and potentially expanding our gastrointestinal trials into the U.S. With two clinical-stage assets each having the potential to represent a meaningful improvement over currently approved therapies, we believe Eupraxia remains well positioned to create shareholder value.” Learn more here.

On Aug. 2, Eupraxia announced entry into a new C$12 million convertible debt facility. Under the Convertible Debt Facility, Yabema Capital Limited and other current Eupraxia shareholders (together, the “Lenders”) will make available for drawdown an aggregate amount of C$12 million for a period of 120 days following entry into the agreement. The decision to draw on the facility within 120 days of closing is at the discretion of Eupraxia and is subject to the full and final release of the SVB Facility (as defined below), originally agreed to on June 21, 2021. The aggregate unpaid principal amount and any accrued and unpaid interest thereon will be convertible at each individual lender’s discretion into Eupraxia common shares (the “Common Shares”), at a conversion price equal to C$4.84375 per Common Share. The conversion is further subject to certain threshold limitations with respect to each lender’s aggregate ownership of the Common Shares. “The new convertible debt facility provides an important source of additional funding from long term, supportive investors, and creates greater stability to Eupraxia’s cap structure as we continue to advance our clinical programs in eosinophilic esophagitis and osteoarthritis,” said Dr. James Helliwell, Chief Executive Officer of Eupraxia. The Convertible Debt Facility is subject to final approval of the Toronto Stock Exchange.

Dr. James Helliwell, CEO of Eupraxia Pharmaceuticals (NASDAQ: EPRX)

On July 9, a Tribe Public CEO Presentation and Q&A Webinar Event titled “Exploring The Rapid Rise Of Osteoarthritis” was held with James A. Helliwell, MD, Director and Chief Executive Officer of Eupraxia Pharmaceuticals (NASDAQ: EPRX). The event video can now be viewed at the Tribe Public YouTube Channel!

On July 24, 2024, CalEthos signed an Option Agreement to purchase 315 acres of land in the soon-to-be approved “Manufacturing Zone” of Lithium Valley. The new property provides CalEthos with significant advantages over its previous data center development site, which include:

-

Larger, strategically located, industrial-zoned property with acreage for on-site switchyard, substation and additional data center buildings

-

Better options for connectivity to high-voltage transmission lines

-

Closer proximity to existing and planned geothermal power plants

-

Shorter fiber routing distances to internet backbone and communications networks

-

Directly on the main north/south transportation corridor (Hwy. 111) and gateway entrance (Sinclair Rd.) to the planned 51,000-acre Lithium Valley development area

-

Lower flood risk – outside of the 100- and 500- year flood zones in a FEMA X (Unshaded) area

CalEthos’ first of three development phases on the property is a planned 100-acre/420-megawatt (MW) campus, with up to 1,000,000 square feet of clean energy powered build-to-suit data centers to support AI, Cloud and Hyperscale customers.

“This new property gives CalEthos the acreage to develop 3 to 4 million square feet of data center over time as more geothermal power plants and other renewable energy and storage solutions come online in and around Lithium Valley”, said Joel Stone, the Company’s President and Chief Operating Officer.

CalEthos has been working over the last couple of years with the County of Imperial, Imperial Valley Economic Development Corp. (IVEDC), Imperial Irrigation District (IID), and geothermal power producers to develop a comprehensive plan that leverages the region’s clean energy resources to support a large-scale data center operation.

“CalEthos has the county’s full support to develop its data centers in alignment with the broader vision for Lithium Valley,” said Chairman Luis A. Plancarte, Imperial County Board of Supervisors. “The sooner CalEthos builds its data centers and utilizes locally produced power for their operations, the sooner our geothermal power producers can expand operations and increase lithium recovery.”

“CalEthos’ energy needs advance the building of additional local transmission, supports adding more sources of clean energy to the grid, and expedites plans for new geothermal power plants, without waiting for new long-distance transmission lines to be built to get power in and out of the area,” added Alex Cardenas, Chairman of IID.

Sean Wilcock, Vice President of IVEDC, emphasized the project’s positive economic impact, stating, “CalEthos’ data center plans accelerate Lithium Valley’s development by providing energy offtake opportunities, creates jobs, and stimulates the local economy. This project is a vital component of the long-term vision for the region and is a testament that Imperial County has the attributes necessary for the green data center industry.”

Shares of Lantern (LTRN), an artificial intelligence (“AI”) company developing targeted and transformative cancer therapies using its proprietary RADR® AI and machine learning (“ML”) platform with multiple clinical stage drug program, closed at $4.40, -1.12%.

Shares of Lantern (LTRN), an artificial intelligence (“AI”) company developing targeted and transformative cancer therapies using its proprietary RADR® AI and machine learning (“ML”) platform with multiple clinical stage drug program, closed at $4.40, -1.12%.

On August 9, announced operational highlights and financial results for the second quarter 2024, ending June 30, 2024 highlighting the following:

- Active clinical trials across three AI-guided drug candidates with additional ADC-based preclinical molecules in evaluation for development.

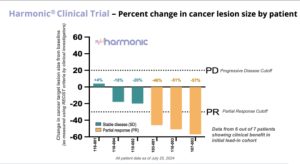

- Preliminary patient data and clinical readouts for Phase 2 LP-300 Harmonic™ Trial released showing an 86% clinical benefit rate in the initial 7 patient safety lead-in cohort.

- Issued a Certificate of Patent by the Japanese Patent Office directed to Lantern Pharma’s drug candidate LP-284, including claims covering the new molecular entity.

- Phase 1 clinical trials for both synthetic lethal drug candidates, LP-184 and LP-284, continue to advance with no dose-limiting toxicities observed in any of the patient cohorts enrolled and over 40 patients dosed to-date.

- Achieved significant advancement towards key milestone in the development of molecular diagnostic for use with drug candidate LP-184 in future oncology clinical trials to improve patient selection and stratification.

- Launched strategic drug development collaboration leveraging our AI platform, RADR®, with Oregon Therapeutics to optimize the development of first-in-class drug candidate XCE853 – a potent inhibitor of cancer metabolism.

- Starlight Therapeutics, a wholly owned subsidiary of Lantern Pharma focused on CNS and brain cancers advanced with initiating site selection and feasibility for a Phase 1B/Phase 2 trial in recurrent GBM with drug candidate, STAR-001.

- Launched Webinar Wednesdays, a webinar series that focuses on the areas of artificial intelligence and oncology drug development with leading physicians, scientists and Lantern collaborators.

Approximately $33.3 million in cash, cash equivalents, and marketable securities as of June 30, 2024.

On August 7, Lantern announced a significant advancement demonstrating the preclinical synergy of LP-184 with checkpoint inhibitors and the ability of LP-184 to resensitize tumors that have become non-responsive to Anti-PD1 therapies. The company will be presenting preliminary data from the recent work done in conjunction with Drs. Yong Du and Shiaw-Yih (Phoebus) Lin at MD Anderson at The Immuno-Oncology Summit 2024 in Philadelphia.

The data will be presented in the form of poster entitled, LP-184, a Novel Acylfulvene, Sensitizes Immuno-Refractory Triple Negative Breast Cancers (TNBCs) To Anti-PD1 Therapy by Affecting the Tumor Microenvironment, (assigned Poster # P17). The poster highlights the following key points:

-

LP-184 seems to potentiate anti-PD1 response in a mouse model of TNBC that is non-hypermutated and resistant to immunotherapy in the absence of LP-184.

-

LP-184 can potentially transform immunologically “cold” tumors (non-responsive to IO therapies) into “hot” tumors (responsive to IO therapies) by modulating T cell activity in the tumor microenvironment and inducing a replication stress response defect.1

-

LP-184 seems to reshape the tumor microenvironment (TME) by significantly reducing the amount of M2 macrophages – which are associated with tumor drug resistance, tumor cell proliferation and are involved in helping the tumor cells escape immune cell death2.

-

LP-184 combined with an anti-PD1 agent elicited a greater anti-tumor response than monotherapies in mouse TNBC tumors that are non-hypermutated and resistant to immune checkpoint inhibitors

LP-184 is being investigated in an ongoing first-in-human Phase 1 trial (NCT05933265) in advanced recurrent solid tumors to establish a maximum tolerated dose and assess its overall safety and suitability in more targeted cancer indications, including TNBC.

Immunotherapy with checkpoint inhibitors (CPI) account for nearly $48 billion in sales annually according to Grand View Research and has profoundly changed the landscape of treatment in oncology since their introduction by providing outstanding durable responses and potential long-term remission in a significant proportion of cancer patients.3 Treatments are now approved for more than thirty cancer indications including melanoma, lung, colon, renal, urothelial, gastric, liver, lymphoma, head and neck but only a minority of patients benefit (10% to 50% depending on the stage and site of the tumor) and often patients will be non-responsive to CPI.

“Our drug-candidate, LP-184 has shown very promising preclinical evidence supporting its role in immuno-oncology to help patients improve response and durability of response to IO therapies. This work in collaboration with MD-Anderson supports our initial AI-driven hypothesis regarding the role of LP-184 to synergize with PD1 and PDL1 drugs and potentially improve the lives of a greater number of cancer patients globally. We look forward to developing combination drug studies and clinical trials with LP-184 and checkpoint inhibitors,” said Lantern Chief Scientific Officer, Kishor Bhatia, PhD, FRCP.

The entirety of the data and poster to be presented at The Immuno-Oncology Summit 2024 in Philadelphia will be available on the Lantern website after 6pm Eastern today, August 7th 2024.

On August 5, Lantern Pharma announced promising preliminary results from its Phase 2 HARMONIC™ clinical trial, evaluating LP-300 in combination with standard chemotherapy for never-smokers with advanced non-small cell lung cancer (NSCLC). As reported earlier today, August 5, the study has shown an impressive 86% clinical benefit rate in the initial patient group, offering hope for a patient population with limited treatment options. The proportion of never-smoking patients with non-small cell lung cancer (NSCLC) has been significantly increasing globally over the past 30 years, from 15% in the 1970s to 33% in the 2000s. The high proportion of never smokers with NSCLC in East Asian countries is of particular note with Japan estimated to be 33 to 40% of new cases and Taiwan at over 50% of new cases. Lantern has received regulatory approval to initiate the LP-300 clinical trial in multiple Asian countries, and has started activation of sites in Japan and Taiwan, including the National Cancer Center in Tokyo, a globally recognized center of cancer research excellence. Read the balance of the story.

Panna Sharma, CEO of Lantern Pharma was interviewed recently on the ‘Today In Nashville’, a program hosted by Carole Sullivan and associated with Nashville’s WSMV 4, an NBC affiliate. Watch it here to learn more.

Shares of Indaptus Therapeutics, Inc. (Nasdaq: INDP) closed at $1.60, -2.44% and is up +15% at $1.84 in the aftermarket. Indaptus is a company with the ability to harness both the body’s innate and adaptive immune responses, believes that they are uniquely positioned to revolutionize the treatment of cancer and certain infectious diseases. Indaptus Therapeutics has evolved from more than a century of immunotherapy advances. The Company’s novel approach is based on the hypothesis that efficient activation of both innate and adaptive immune cells and pathways and associated anti-tumor and anti-viral immune responses will require a multi-targeted package of immune system-activating signals that can be administered safely intravenously (i.v.). Indaptus’ patented technology is composed of single strains of attenuated and killed, non-pathogenic, Gram-negative bacteria producing a multiple Toll-like receptor (TLR), Nucleotide oligomerization domain (Nod)-like receptor (NLR) and Stimulator of interferon genes (STING) agonist Decoy platform. The products are designed to have reduced i.v. toxicity, but largely uncompromised ability to prime or activate many of the cells and pathways of innate and adaptive immunity. Decoy products represent an antigen-agnostic technology that have produced single-agent activity against metastatic pancreatic and orthotopic colorectal carcinomas, single agent eradication of established antigen-expressing breast carcinoma, as well as combination-mediated eradication of established hepatocellular carcinomas and non-Hodgkin’s lymphomas in standard pre-clinical models, including syngeneic mouse tumors and human tumor xenografts.

Shares of Indaptus Therapeutics, Inc. (Nasdaq: INDP) closed at $1.60, -2.44% and is up +15% at $1.84 in the aftermarket. Indaptus is a company with the ability to harness both the body’s innate and adaptive immune responses, believes that they are uniquely positioned to revolutionize the treatment of cancer and certain infectious diseases. Indaptus Therapeutics has evolved from more than a century of immunotherapy advances. The Company’s novel approach is based on the hypothesis that efficient activation of both innate and adaptive immune cells and pathways and associated anti-tumor and anti-viral immune responses will require a multi-targeted package of immune system-activating signals that can be administered safely intravenously (i.v.). Indaptus’ patented technology is composed of single strains of attenuated and killed, non-pathogenic, Gram-negative bacteria producing a multiple Toll-like receptor (TLR), Nucleotide oligomerization domain (Nod)-like receptor (NLR) and Stimulator of interferon genes (STING) agonist Decoy platform. The products are designed to have reduced i.v. toxicity, but largely uncompromised ability to prime or activate many of the cells and pathways of innate and adaptive immunity. Decoy products represent an antigen-agnostic technology that have produced single-agent activity against metastatic pancreatic and orthotopic colorectal carcinomas, single agent eradication of established antigen-expressing breast carcinoma, as well as combination-mediated eradication of established hepatocellular carcinomas and non-Hodgkin’s lymphomas in standard pre-clinical models, including syngeneic mouse tumors and human tumor xenografts.

On Aug. 12, Indaptus announced financial results for the second quarter ended June 30, 2024, and provided a corporate update. Jeffrey Meckler, Indaptus Therapeutics’ Chief Executive Officer, commented, “During the second quarter we had multiple opportunities to share our findings regarding our Phase 1 clinical trial to date, and to demonstrate the unique approach that our Decoy platform offers. These included impactful conferences such as the American Association for Cancer Research (AACR) annual meeting and the American Society of Clinical Oncology (ASCO) annual meeting, which are considered among the top annual oncology conferences. Further, our founder was once again recognized by the industry when he was named chair of the STING & TLR-Targeted Therapies Summit. We are encouraged by the results we have reported, along with the data we are seeing as we continue the multi-dose stage of the Phase 1 clinical trial. As Decoy20 continues to be well-tolerated in our Phase 1 clinical trial, we expect to progress to dosing multiple patients simultaneously. This will increase the data we receive and, as a result, is expected to accelerate the progress of the trial. We look forward to demonstrating continued impactful outcomes in the second half of the year.”

Key recent highlights:

-

Completed a $3 million registered direct offering and concurrent private placement on August 8, 2024, for net proceeds of approximately $2.5 million

-

Advancing clinical trial from single to weekly doses of Decoy20, the company completed one month of weekly dosing in three patients at the 3-x 10^7 Decoy20 dose

-

Completed a single dose cohort at the higher dose of 7 x 10^7 Decoy20 and intend to initiate weekly dosing later this year

-

Presented poster outlining data from 3 x 10^7 and 7 x 10^7 dose at the ASCO annual meeting on June 1, 2024, in Chicago

-

Presented poster outlining new mechanism of action data for Decoy platform at the AACR annual meeting in April 2024

-

Founder and Chief Scientific Officer, Michael Newman, Ph.D. presented additional data on the Company’s lead product candidate, Decoy20, at the 5th Annual STING & TLR-Targeted Therapies Summit in San Diego on June 19-20, 2024, where he was also named chair of the Summit

Shares of ADT Inc. (ADT), a leading provider of monitored security and automation solutions for residential and small business customers in the United States and Canada, closed at $7.37, -2.90% after recently establishing a new 52-wk high of $7.92 during intraday trading.

On Aug. 1, ADT reported its second quarter results for 2024 that read like a thrilling spy novel, complete with mysterious numbers and covert operations. The company reported a 3% increase in total revenue, reaching $1.2 billion – apparently, securing homes is more lucrative than ever in our paranoid future. Their recurring monthly revenue (RMR) grew by 2% to $355 million, proving that once ADT gets its foot in your door, it’s there to stay

The company boasted “strong customer retention” with a gross revenue attrition of 12.9%, which in ADT speak means they’re only hemorrhaging about 1 in 8 customers. Their “revenue payback” sits at 2.2 years, suggesting it takes that long for customers to stop regretting their decision to sign up.

In a plot twist worthy of a summer blockbuster, ADT’s GAAP income from continuing operations dropped by $54 million. But fear not, shareholders! Their “adjusted” income increased by $3 million. It seems ADT has mastered the art of financial alchemy, turning red numbers green faster than you can say “creative accounting”.

CEO Jim DeVries, channeling his inner motivational speaker, declared that ADT’s success is “powered by our employees’ dedication to the proposition that every second counts.” One can only imagine the intense pressure of working in an environment where bathroom breaks are timed to the millisecond.[

Modular Medical, Inc. (NASDAQ: MODD, $1.71, +.59%), is a development-stage, insulin delivery technology company seeking to launch the next generation of user-friendly and affordable insulin pump technology. Using its patented technologies, the company seeks to eliminate the tradeoff between complexity and efficacy, thereby making top quality insulin delivery both affordable and simple to learn. Their mission is to improve access to the highest standard of glycemic control for people with diabetes taking it beyond “superusers” and providing “diabetes care for the rest of us.” Modular Medical was founded by Paul DiPerna, a seasoned medical device professional and microfluidics engineer. Prior to founding Modular Medical, Mr. DiPerna was the founder (in 2005) of Tandem Diabetes and invented and designed its t:slim insulin pump. More information is available at https://modular-medical.com.

In a move that’s sure to spice up the insulin pump manufacturing scene, Modular Medical announced today, August 7, that it is packing its bags and heading south of the border. The company has begun transferring its pilot line manufacturing operations to a Phillips Medisize site in Queretaro, Mexico. Trusted for nearly 60 years, Phillips Medisize, a Molex company, is a global leader in front-end design, development and manufacturing solutions for highly regulated industries — pharma, in vitro diagnostics, med tech, consumer, automotive and defense. Operating as a single integrated collaborator, they help their customers reduce risk and achieve product realization quickly and efficiently. Their innovation, quality and reliability enhance the lives of millions of people around the world. Modular Medical’s relocation is happening alongside the FDA’s ongoing 510(k) review of the MODD1 Insulin Delivery System. Chief Operating Officer Kevin Schmid confidently predicts that the manufacturing operation will be validated and ready for human-use production by early next year. The MODD1 system will be manufactured in a clean room in Queretaro, while the printed circuit board assembly will be crafted in Guadalajara, showcasing a truly international effort in diabetes care technology. Phillips Medisize, a Molex company, has been a crucial partner in developing Modular Medical’s platform product, supply chain, and manufacturing operations. Their collaboration extends beyond basic manufacturing, providing expertise in injection molding, packaging, electronics design, and assembly operations. This partnership has been instrumental as Modular Medical transitions from pre-commercial production to high-volume device manufacturing. The collaboration leverages Phillips Medisize’s global and diversified supplier base, enabling the design and development of manufacturing capabilities specifically tailored for the MODD1 Insulin Delivery System. Phillips Medicine was founded in 1964 in Phillips, WI, employs 6 thousand employees worldwide, has 24 manufacturing locations in 11 countries, including 5 R&D centers globally 2.5M+ square feet of manufacturing space, & maintains Class 7 & 8 cleanrooms and tool building sites. The insulin pump market is experiencing robust growth, with a valuation of USD 6.05 billion in 2023 and a projected compound annual growth rate (CAGR) of 8.22% from 2024 to 2030. This expansion is driven by technological advancements, increasing diabetes prevalence, and a growing elderly population. Key players in the market include Medtronic (MDT), Abbott Laboratories (ABT), Roche Diagnostics & Tandem Diabetes Care, Inc (TNDM). The global diabetes care devices market is expected to reach USD 52.34 billion by 2029, growing at a CAGR of 12.22% from 2024 to 2029. This growth is fueled by rising healthcare spending, increased awareness about diabetes management, and the development of innovative devices like continuous glucose monitors and automated insulin delivery systems.

Gain Further Insights From The CEO of Modular Medical…

On Friday, August 9, our sister organization, Tribe Public (www.TribePublic.com), hosted a brief CEO Presentation and Q&A Webinar-based event with Jeb Besser, CEO of Modular Medical (NASDAQ: MODD). The event is titled “Diabetes Care Innovator Modular Medical Takes Next Steps.”

Quote of the Day

Economic Reports

On Monday,

Videos

Post View Count : 501