PPI Cools, Stocks Soar, Fed Ponders (Sept. 12, 2024) – $ADT $CHWY $INDP $MCD $MODD $ORCL $SMMT Rise!

Wall Street’s wild ride continued on Thursday, with stocks performing a financial tango that would make even the most seasoned dancers dizzy. The S&P 500 sashayed its way to a .75% gain, closing out its fourth consecutive winning session like a champion marathoner on a sugar high. Not to be outdone, the tech-heavy Nasdaq Composite leapt by 1%, apparently fueled by the same mysterious energy drink that’s been powering Silicon Valley startups. Even the usually stodgy Dow Jones Industrial Average got in on the action, inching up .58% as if it had finally decided to join the cool kids’ table. Investors’ enthusiasm reached fever pitch as the bears retreated to their caves, leaving the bulls to run wild on Wall Street. The market’s upward trajectory seemed unstoppable, with even traditionally cautious sectors joining the party. HPL Electric & Power Limited exemplified this trend, receiving work orders worth ₹143.77 crore and seeing its shares surge 5.12% on the BSE. Meanwhile, Oracle’s (ORCL) after-hours performance has added fuel to the fire, with its shares soaring over 8% at one point following impressive fiscal first-quarter results and a new collaboration with Amazon Web Services, after closing at $161.38, +2.67%. This bullish sentiment indeed extended beyond individual stocks, reflecting a broader market optimism that seemed to defy gravity and economic concerns alike. The growth/small cap stocks on the Russell 2000 also jumped a cool 1.22%, while the iShares Micro-Cap ETF that closed at $119.91, +1.08%.

Positive Vibing

Fueling the positive sentiment, today’s economic data served up a smorgasbord of data points, with the Producer Price Index showing inflation cooling faster than expected. Wholesale prices rose a mere .2% M/M. Meanwhile, jobless claims decided to crash the party, unexpectedly climbing to 230,000 (up 2k from the previous week) and leaving traders scratching their heads. However, this economic cocktail had investors somewhat giddy that the odds of a 25 basis point rate cut from the Federal Reserve next week skyrocketed to 87%, up from a measly 50% just days ago. It seems the Fed might finally loosen its grip on interest rates, much to the delight of borrowers everywhere who’ve been feeling like they’re stuck in a financial escape room. However the yield curve today diverged as the 10-yr note yield rose 3bps closing at 3.68% and the 2-yr note yield remained flat at 3.65%.

Fear Index & Oil Prices

The CBOE Volatility Index (VIX), often referred to as the “fear index,” closed at $17.07, down 3.5% for the day, while Crude oil prices rebounded approximately .52% to settle at $69.33 per barrel

McDonald’s Budget Bonanza Bonanza

McDonald’s (MCD, $292.35, +.73%), the fast-food giant known for its golden arches and ability to make even the most health-conscious individuals crave a Big Mac, has decided to extend its $5 value meal offer into December at most U.S. locations. It seems the burger behemoth has realized that in these economically challenging times, the way to America’s heart is through its wallet. The $5 meal deal, which includes a choice of McDouble or McChicken sandwich, small fries, four-piece Chicken McNuggets, and a small soft drink, has been such a hit that McDonald’s executives are probably doing the “Dollar Menu Dance” in their corner offices. Launched in June as a limited-time offer, this budget-friendly feast has proven more popular than a clown at a children’s birthday party. With this move, McDonald’s has essentially declared war on both inflation and empty stomachs, proving that in the fast-food world, the early bird may get the worm, but the savvy chain gets the customers.

VP Watchlist Updates

In a surprising turn of events, Summit Therapeutics ($27.41, +20.75% and now up a whopping 119.28% over the last 5-days) pulled off a financial magic trick, announcing a $235 million private placement deal reportedly with the who’s who in biotech land. This unexpected move caught the attention of investors, who seem to be betting big on Summit’s potential breakthrough in cancer treatment that outshined Merck’s (MRK) blockbuster cancer treatment Keytruda in a recent trial.

Chewy, Inc. (NYSE: CHWY, $30.94, +2.31% and up +18.27% over the last 5-days), a trusted destination for pet parents and partners everywhere, released its financial results (August 28) for the second quarter of fiscal year 2024 ended July 28, 2024. They highlighted the following: Net sales of $2.86 billion increased 2.6 percent year over year & Gross margin of 29.5 percent increased 120 basis points year over year.

Modular Medical, Inc. (NASDAQ: MODD, $2.19, +4.29% & is up +97.30% over the last year), an insulin delivery system technology company preparing to launch a market expansion product with a more accessible, easier to prescribe, and easier to pay for and live with technology. Using its patented technologies, the company seeks to eliminate the tradeoff between complexity and efficacy, thereby making top quality insulin delivery both affordable and simple to learn. Their mission is to improve access to the highest standard of glycemic control for people with diabetes taking it beyond “superusers” and providing “diabetes care for the rest of us.” Modular Medical was founded by Paul DiPerna, a seasoned medical device professional and microfluidics engineer. Prior to founding Modular Medical, Mr. DiPerna was the founder (in 2005) of Tandem Diabetes and invented and designed its t:slim insulin pump. More information is available at https://modular-medical.com.

On September 11, Modular Medical’s CEO Jeb Besser presented at Tribe Public’s Webinar Presentation and Q&A Event titled “Diabetes, Obesity, GLP-1, & The MODD-1 Opportunity.” The event video can now be viewed below:

On Wednesday, September 4, Modular announced it has received U. S. Food and Drug Administration (“FDA”) clearance to market and sell its MODD1 pump in the United States. With its commercial manufacturing infrastructure substantially established, the Company anticipates the MODD1 should be available for sale in early 2025.

James (Jeb) Besser, CEO of Modular Medical (NASDAQ: MODD)

“For too long, the benefits of superior glycemic control achieved by insulin pumps have, due to cost and complexity, been restricted to only the most sophisticated, motivated and well-insured users. The goal of Modular Medical has always been to change this by making diabetes technology accessible and affordable to underserved communities. We seek to make the experience of going ‘on a pump’ simpler and less intimidating and to widen the base beyond the current pump users,” said Jeb Besser, CEO of Modular Medical.

Paul DiPerna, Chairman and President of Modular Medical

“I want to thank our employees for their hard work and dedication in bringing this product to the market and our shareholders for their ongoing support of the Company. We will continue to deliver on our mission of enabling ‘diabetes care for the rest of us’ and delivering on the needs of all patients and clinicians,” added Paul DiPerna, Chairman and President of Modular Medical.

Shares of Indaptus Therapeutics, Inc. (Nasdaq: INDP) closed at $1.53, +o.oo% and is now up +7.84% at $1.6499 in the aftermarket. Indaptus is a company with the ability to harness both the body’s innate and adaptive immune responses, believes that they are uniquely positioned to revolutionize the treatment of cancer and certain infectious diseases. Indaptus Therapeutics has evolved from more than a century of immunotherapy advances. The Company’s novel approach is based on the hypothesis that efficient activation of both innate and adaptive immune cells and pathways and associated anti-tumor and anti-viral immune responses will require a multi-targeted package of immune system-activating signals that can be administered safely intravenously (i.v.). Indaptus’ patented technology is composed of single strains of attenuated and killed, non-pathogenic, Gram-negative bacteria producing a multiple Toll-like receptor (TLR), Nucleotide oligomerization domain (Nod)-like receptor (NLR) and Stimulator of interferon genes (STING) agonist Decoy platform. The products are designed to have reduced i.v. toxicity, but largely uncompromised ability to prime or activate many of the cells and pathways of innate and adaptive immunity. Decoy products represent an antigen-agnostic technology that have produced single-agent activity against metastatic pancreatic and orthotopic colorectal carcinomas, single agent eradication of established antigen-expressing breast carcinoma, as well as combination-mediated eradication of established hepatocellular carcinomas and non-Hodgkin’s lymphomas in standard pre-clinical models, including syngeneic mouse tumors and human tumor xenografts.

Shares of Indaptus Therapeutics, Inc. (Nasdaq: INDP) closed at $1.53, +o.oo% and is now up +7.84% at $1.6499 in the aftermarket. Indaptus is a company with the ability to harness both the body’s innate and adaptive immune responses, believes that they are uniquely positioned to revolutionize the treatment of cancer and certain infectious diseases. Indaptus Therapeutics has evolved from more than a century of immunotherapy advances. The Company’s novel approach is based on the hypothesis that efficient activation of both innate and adaptive immune cells and pathways and associated anti-tumor and anti-viral immune responses will require a multi-targeted package of immune system-activating signals that can be administered safely intravenously (i.v.). Indaptus’ patented technology is composed of single strains of attenuated and killed, non-pathogenic, Gram-negative bacteria producing a multiple Toll-like receptor (TLR), Nucleotide oligomerization domain (Nod)-like receptor (NLR) and Stimulator of interferon genes (STING) agonist Decoy platform. The products are designed to have reduced i.v. toxicity, but largely uncompromised ability to prime or activate many of the cells and pathways of innate and adaptive immunity. Decoy products represent an antigen-agnostic technology that have produced single-agent activity against metastatic pancreatic and orthotopic colorectal carcinomas, single agent eradication of established antigen-expressing breast carcinoma, as well as combination-mediated eradication of established hepatocellular carcinomas and non-Hodgkin’s lymphomas in standard pre-clinical models, including syngeneic mouse tumors and human tumor xenografts.

On September 5, Indaptus provided an update regarding key clinical advancements. The independent Safety Review Committee overseeing the Company’s Phase 1 clinical trial convened in August to review the safety data at the higher Decoy20 dose with single dose administration and the safety data at the lower Decoy20 dose with weekly administration.

The encouraging data has led to the decision to:

- Continue dosing additional patients at the lower Decoy20 dose on a weekly schedule

- Initiate dosing patients at the higher Decoy20 dose on a weekly schedule

The safety profile being observed to date continues to be consistent with Decoy20’s mechanism of action. The most clinically relevant treatment-related adverse events — infusion-related reaction and hypotension – have been mild-to-moderate in severity, and resolved quickly with i.v. fluids or over-the-counter therapy.

“We continue to be encouraged by the evolving safety profile of Decoy20 during the expansion part of our Phase 1 trial. Our goal is to continue to evaluate patients receiving two distinct weekly doses of Decoy20 to identify potential monotherapy activity, and to accumulate sufficient safety data to initiate combination therapy next year,” said Dr. Roger Waltzman, Indaptus Chief Medical Officer. “We ultimately believe that Decoy20’s broad but transient activation of multiple cytokines and chemokines responsible for stimulating both innate and adaptive immune pathways in concert with other therapies will enhance tumor regression.”

Jeffrey Meckler, Chief Executive Officer, added, “The clinical trial is progressing as planned. Enrolling multiple patients at two different weekly doses should accelerate the progress of our trials. We look forward to providing more updates later in the year.”

On Aug. 12, Indaptus announced financial results for the second quarter ended June 30, 2024, and provided a corporate update. Jeffrey Meckler, Indaptus Therapeutics’ Chief Executive Officer, commented, “During the second quarter we had multiple opportunities to share our findings regarding our Phase 1 clinical trial to date, and to demonstrate the unique approach that our Decoy platform offers. These included impactful conferences such as the American Association for Cancer Research (AACR) annual meeting and the American Society of Clinical Oncology (ASCO) annual meeting, which are considered among the top annual oncology conferences. Further, our founder was once again recognized by the industry when he was named chair of the STING & TLR-Targeted Therapies Summit. We are encouraged by the results we have reported, along with the data we are seeing as we continue the multi-dose stage of the Phase 1 clinical trial. As Decoy20 continues to be well-tolerated in our Phase 1 clinical trial, we expect to progress to dosing multiple patients simultaneously. This will increase the data we receive and, as a result, is expected to accelerate the progress of the trial. We look forward to demonstrating continued impactful outcomes in the second half of the year.”

Key recent highlights:

-

Completed a $3 million registered direct offering and concurrent private placement on August 8, 2024, for net proceeds of approximately $2.5 million

-

Advancing clinical trial from single to weekly doses of Decoy20, the company completed one month of weekly dosing in three patients at the 3-x 10^7 Decoy20 dose

-

Completed a single dose cohort at the higher dose of 7 x 10^7 Decoy20 and intend to initiate weekly dosing later this year

-

Presented poster outlining data from 3 x 10^7 and 7 x 10^7 dose at the ASCO annual meeting on June 1, 2024, in Chicago

-

Presented poster outlining new mechanism of action data for Decoy platform at the AACR annual meeting in April 2024

-

Founder and Chief Scientific Officer, Michael Newman, Ph.D. presented additional data on the Company’s lead product candidate, Decoy20, at the 5th Annual STING & TLR-Targeted Therapies Summit in San Diego on June 19-20, 2024, where he was also named chair of the Summit

Eupraxia Pharmaceuticals (EPRX, $2.42, -1.63%) is a clinical-stage biotechnology company leveraging its proprietary DiffuSphere™ technology to optimize drug delivery for applications with significant unmet need. The Company strives to provide improved patient benefit and has developed technology designed to deliver targeted, long-lasting activity with fewer side effects. DiffuSphere™, a proprietary, polymer-based micro-sphere technology, is designed to facilitate targeted drug delivery, with extended duration of effect, and offers multiple, highly tuneable pharmacokinetic (PK) profiles. This investigational technology can be engineered for use with multiple active pharmaceutical ingredients and delivery methods.

Today, September 11, Eupraxia announced additional positive clinical data from its RESOLVE Phase 1b/2a trial, which is evaluating the safety and efficacy of EP-104GI as a treatment for eosinophilic esophagitis (“EoE”). The results announced today from the fourth cohort of the RESOLVE trial, using Eupraxia’s DiffuSphere™ technology for EoE, are derived from twelve 2.5 mg injections of EP-104GI (total dose of 30 mg) administered to less than two-thirds of each patient’s lower esophagus. The data show:

- Straumann Dysphagia Index (“SDI”)1, a patient-reported outcome measure designed to assess symptom severity, was lower for all three patients post-administration with peak reductions up to four points (67% from baseline). At 12 weeks post-administration, SDI was reduced by a mean of 45% or 3.3 points – a level comparable with currently approved therapies.

- Eosinophilic Esophagitis Histology Scoring System (“EoEHSS”)2 scores, which evaluate the severity and extent of EoE, showed the largest percent reduction of any cohort to date, with a mean 39% reduction in Composite Stage and a mean 37% reduction in Composite Grade at 12 weeks – a level comparable with currently approved therapies.

- Using data from four biopsy sites, which is consistent with the U.S. Food and Drug Administration (“FDA”) Guidance for Developing Drugs for the Treatment of EoE, the mean reduction in Peak Eosinophil Counts (“PEC”)3 was 67% at 12 weeks.

On July 9, a Tribe Public CEO Presentation and Q&A Webinar Event titled “Exploring The Rapid Rise Of Osteoarthritis” was held with James A. Helliwell, MD, Director and Chief Executive Officer of Eupraxia Pharmaceuticals (NASDAQ: EPRX). Please view the event video below:

Shares of Lantern (LTRN), an artificial intelligence (“AI”) company developing targeted and transformative cancer therapies using its proprietary RADR® AI and machine learning (“ML”) platform with multiple clinical stage drug program, closed at $3.79, +1.88%.

Shares of Lantern (LTRN), an artificial intelligence (“AI”) company developing targeted and transformative cancer therapies using its proprietary RADR® AI and machine learning (“ML”) platform with multiple clinical stage drug program, closed at $3.79, +1.88%.

On August 9, announced operational highlights and financial results for the second quarter 2024, ending June 30, 2024 highlighting the following:

- Active clinical trials across three AI-guided drug candidates with additional ADC-based preclinical molecules in evaluation for development.

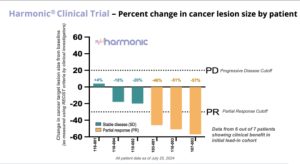

- Preliminary patient data and clinical readouts for Phase 2 LP-300 Harmonic™ Trial released showing an 86% clinical benefit rate in the initial 7 patient safety lead-in cohort.

- Issued a Certificate of Patent by the Japanese Patent Office directed to Lantern Pharma’s drug candidate LP-284, including claims covering the new molecular entity.

- Phase 1 clinical trials for both synthetic lethal drug candidates, LP-184 and LP-284, continue to advance with no dose-limiting toxicities observed in any of the patient cohorts enrolled and over 40 patients dosed to-date.

- Achieved significant advancement towards key milestone in the development of molecular diagnostic for use with drug candidate LP-184 in future oncology clinical trials to improve patient selection and stratification.

- Launched strategic drug development collaboration leveraging our AI platform, RADR®, with Oregon Therapeutics to optimize the development of first-in-class drug candidate XCE853 – a potent inhibitor of cancer metabolism.

- Starlight Therapeutics, a wholly owned subsidiary of Lantern Pharma focused on CNS and brain cancers advanced with initiating site selection and feasibility for a Phase 1B/Phase 2 trial in recurrent GBM with drug candidate, STAR-001.

- Launched Webinar Wednesdays, a webinar series that focuses on the areas of artificial intelligence and oncology drug development with leading physicians, scientists and Lantern collaborators.

Approximately $33.3 million in cash, cash equivalents, and marketable securities as of June 30, 2024.

On August 7, Lantern announced a significant advancement demonstrating the preclinical synergy of LP-184 with checkpoint inhibitors and the ability of LP-184 to resensitize tumors that have become non-responsive to Anti-PD1 therapies. The company will be presenting preliminary data from the recent work done in conjunction with Drs. Yong Du and Shiaw-Yih (Phoebus) Lin at MD Anderson at The Immuno-Oncology Summit 2024 in Philadelphia.

The data will be presented in the form of poster entitled, LP-184, a Novel Acylfulvene, Sensitizes Immuno-Refractory Triple Negative Breast Cancers (TNBCs) To Anti-PD1 Therapy by Affecting the Tumor Microenvironment, (assigned Poster # P17). The poster highlights the following key points:

-

LP-184 seems to potentiate anti-PD1 response in a mouse model of TNBC that is non-hypermutated and resistant to immunotherapy in the absence of LP-184.

-

LP-184 can potentially transform immunologically “cold” tumors (non-responsive to IO therapies) into “hot” tumors (responsive to IO therapies) by modulating T cell activity in the tumor microenvironment and inducing a replication stress response defect.1

-

LP-184 seems to reshape the tumor microenvironment (TME) by significantly reducing the amount of M2 macrophages – which are associated with tumor drug resistance, tumor cell proliferation and are involved in helping the tumor cells escape immune cell death2.

-

LP-184 combined with an anti-PD1 agent elicited a greater anti-tumor response than monotherapies in mouse TNBC tumors that are non-hypermutated and resistant to immune checkpoint inhibitors

LP-184 is being investigated in an ongoing first-in-human Phase 1 trial (NCT05933265) in advanced recurrent solid tumors to establish a maximum tolerated dose and assess its overall safety and suitability in more targeted cancer indications, including TNBC.

Immunotherapy with checkpoint inhibitors (CPI) account for nearly $48 billion in sales annually according to Grand View Research and has profoundly changed the landscape of treatment in oncology since their introduction by providing outstanding durable responses and potential long-term remission in a significant proportion of cancer patients.3 Treatments are now approved for more than thirty cancer indications including melanoma, lung, colon, renal, urothelial, gastric, liver, lymphoma, head and neck but only a minority of patients benefit (10% to 50% depending on the stage and site of the tumor) and often patients will be non-responsive to CPI.

“Our drug-candidate, LP-184 has shown very promising preclinical evidence supporting its role in immuno-oncology to help patients improve response and durability of response to IO therapies. This work in collaboration with MD-Anderson supports our initial AI-driven hypothesis regarding the role of LP-184 to synergize with PD1 and PDL1 drugs and potentially improve the lives of a greater number of cancer patients globally. We look forward to developing combination drug studies and clinical trials with LP-184 and checkpoint inhibitors,” said Lantern Chief Scientific Officer, Kishor Bhatia, PhD, FRCP.

The entirety of the data and poster to be presented at The Immuno-Oncology Summit 2024 in Philadelphia will be available on the Lantern website after 6pm Eastern today, August 7th 2024.

On August 5, Lantern Pharma announced promising preliminary results from its Phase 2 HARMONIC™ clinical trial, evaluating LP-300 in combination with standard chemotherapy for never-smokers with advanced non-small cell lung cancer (NSCLC). As reported earlier today, August 5, the study has shown an impressive 86% clinical benefit rate in the initial patient group, offering hope for a patient population with limited treatment options. The proportion of never-smoking patients with non-small cell lung cancer (NSCLC) has been significantly increasing globally over the past 30 years, from 15% in the 1970s to 33% in the 2000s. The high proportion of never smokers with NSCLC in East Asian countries is of particular note with Japan estimated to be 33 to 40% of new cases and Taiwan at over 50% of new cases. Lantern has received regulatory approval to initiate the LP-300 clinical trial in multiple Asian countries, and has started activation of sites in Japan and Taiwan, including the National Cancer Center in Tokyo, a globally recognized center of cancer research excellence. Read the balance of the story.

Panna Sharma, CEO of Lantern Pharma was interviewed recently on the ‘Today In Nashville’, a program hosted by Carole Sullivan and associated with Nashville’s WSMV 4, an NBC affiliate. Watch it here to learn more.

Shares of ADT Inc. (ADT), a leading provider of monitored security and automation solutions for residential and small business customers in the United States and Canada, closed at $6.92, +.92% after recently establishing a new 52-wk high of $7.92 during intraday trading.

On Aug. 21, ADT announced the appointment of Suzanne Yoon to the Company’s Board of Directors as an additional independent director. Yoon is the founder and managing partner of Kinzie Capital Partners, a Chicago-based private equity firm. In 2017, she launched Kinzie and currently serves as the Chair of its Investment and Management Committees. Prior to founding Kinzie, Yoon held senior roles at Versa Capital Management, CIT Group and LaSalle Bank/ABN AMRO. She is a current member and former Chair of the National Philanthropic Trust Board of Trustees, the largest independent donor advised fund manager in the world with approximately $40 billion under management and is a member of the first-ever Women’s Advisory Board for the Chicago Bears.

On Aug. 1, ADT reported its second quarter results for 2024 that read like a thrilling spy novel, complete with mysterious numbers and covert operations. The company reported a 3% increase in total revenue, reaching $1.2 billion – apparently, securing homes is more lucrative than ever in our paranoid future. Their recurring monthly revenue (RMR) grew by 2% to $355 million, proving that once ADT gets its foot in your door, it’s there to stay

The company boasted “strong customer retention” with a gross revenue attrition of 12.9%, which in ADT speak means they’re only hemorrhaging about 1 in 8 customers. Their “revenue payback” sits at 2.2 years, suggesting it takes that long for customers to stop regretting their decision to sign up.

In a plot twist worthy of a summer blockbuster, ADT’s GAAP income from continuing operations dropped by $54 million. But fear not, shareholders! Their “adjusted” income increased by $3 million. It seems ADT has mastered the art of financial alchemy, turning red numbers green faster than you can say “creative accounting”.

CEO Jim DeVries, channeling his inner motivational speaker, declared that ADT’s success is ‘powered by our employees’ dedication to the proposition that every second counts.” One can only imagine the intense pressure of working in an environment where bathroom breaks are timed to the millisecond.

On July 24, 2024, CalEthos signed an Option Agreement to purchase 315 acres of land in the soon-to-be approved “Manufacturing Zone” of Lithium Valley. The new property provides CalEthos with significant advantages over its previous data center development site, which include:

-

Larger, strategically located, industrial-zoned property with acreage for on-site switchyard, substation and additional data center buildings

-

Better options for connectivity to high-voltage transmission lines

-

Closer proximity to existing and planned geothermal power plants

-

Shorter fiber routing distances to internet backbone and communications networks

-

Directly on the main north/south transportation corridor (Hwy. 111) and gateway entrance (Sinclair Rd.) to the planned 51,000-acre Lithium Valley development area

-

Lower flood risk – outside of the 100- and 500- year flood zones in a FEMA X (Unshaded) area

CalEthos’ first of three development phases on the property is a planned 100-acre/420-megawatt (MW) campus, with up to 1,000,000 square feet of clean energy powered build-to-suit data centers to support AI, Cloud and Hyperscale customers.

“This new property gives CalEthos the acreage to develop 3 to 4 million square feet of data center over time as more geothermal power plants and other renewable energy and storage solutions come online in and around Lithium Valley”, said Joel Stone, the Company’s President and Chief Operating Officer.

CalEthos has been working over the last couple of years with the County of Imperial, Imperial Valley Economic Development Corp. (IVEDC), Imperial Irrigation District (IID), and geothermal power producers to develop a comprehensive plan that leverages the region’s clean energy resources to support a large-scale data center operation.

“CalEthos has the county’s full support to develop its data centers in alignment with the broader vision for Lithium Valley,” said Chairman Luis A. Plancarte, Imperial County Board of Supervisors. “The sooner CalEthos builds its data centers and utilizes locally produced power for their operations, the sooner our geothermal power producers can expand operations and increase lithium recovery.”

“CalEthos’ energy needs advance the building of additional local transmission, supports adding more sources of clean energy to the grid, and expedites plans for new geothermal power plants, without waiting for new long-distance transmission lines to be built to get power in and out of the area,” added Alex Cardenas, Chairman of IID.

Sean Wilcock, Vice President of IVEDC, emphasized the project’s positive economic impact, stating, “CalEthos’ data center plans accelerate Lithium Valley’s development by providing energy offtake opportunities, creates jobs, and stimulates the local economy. This project is a vital component of the long-term vision for the region and is a testament that Imperial County has the attributes necessary for the green data center industry.”

Quote of the Day

“The object of the superior man is truth.” – Confucius

Videos

Post View Count : 501