Dow, Nasdaq, S&P 500 Retreat Ahead of Fed; Apple, Tesla, Nvidia Move Markets – September 16, 2025 Recap – ( $AAPL $EPRX $GLD $GOVX $INTC $LLY $MCD $META $ORCL $TDOC $TSLA $TURB Rise!)

- Published Sep 16, 2025

- Agriculture & Energy

- Apple

- Biotech & Healthcare

- Consumer Goods & Trends

- Eupraxia Pharmaceuticals Inc.

- Financials & Fintech

- GeoVax Labs

- Investing & Inspiration

- Market News

- Materials & Natural Resources

- McDonald's

- Modular Medical, Inc.

- NVIDIA

- Serina Therapeutics, Inc.

- Technology & Beyond

- Tesla

U.S. Equities Market Performance

On Tuesday, September 16, 2025, the U.S. stock market experienced a modest pullback from record highs reached earlier in the week as investors braced for the Federal Reserve’s highly anticipated rate decision. The S&P 500 slipped 0.1% to close at 6,606.76, the Dow Jones Industrial Average declined 0.3% to 45,757.90, while the Nasdaq Composite dropped 0.1% to 22,333.96. The Russell 1000 traded with a slight range closed at 2,403.03, -.09% and showed marginal softness as well, with about 12% of components hitting new highs and 33% registering new lows, reflecting sector rotation and risk moderation near historic benchmarks.

Macroeconomic Reports

Today’s primary economic report was August retail sales, which came in stronger than expected with a monthly rise of 0.6% against forecasts of 0.2%, highlighting resilient consumer spending despite inflationary pressures. There were no other major U.S. macro releases today, as market attention remained fixed on the start of the Federal Reserve’s two-day policy meeting.

Notable Stock Highlights

Apple (AAPL)

Apple shares advanced in Tuesday’s session closing at $238.15, +.61%, propelled by robust early demand signals for the new iPhone lineup. Lead-times for the iPhone 17 models, especially the Pro and Pro Max, lengthened globally, fueling investor optimism and supporting upward share movement for the day.

Broadcom (AVGO)

Broadcom closed down 1.12% at $360 amid constructive analyst commentary. Susquehanna reiterated its Buy rating, emphasizing confidence in Broadcom’s AI revenue trajectory, even as the loss of some Apple chip business is expected to temper near-term sales.

NVIDIA (NVDA)

NVIDIA retreated 1.61% to $174.88 following reports of tepid demand for its latest AI chips in China. The stock was a drag on the Dow, reflecting periodic sector consolidation after a significant year-to-date rally.

Tesla (TSLA)

Tesla continued its upward streak, rising over 2.77% to $421.62—its highest close since January. The rally follows CEO Elon Musk’s disclosure of a $1 billion open-market stock purchase last week, signaling renewed long-term commitment to advancing Tesla’s dominance in AI, robotics, and EVs.

Meta Platforms (META)

Meta’s stock was steady ahead of the Meta Connect 2025 event closing up 1.87% at $779, which is set to unveil new AI-powered smart glasses (the “Hypernova”) as well as other major developments in the company’s AI and wearables initiatives, reflecting ongoing investment in next-generation consumer hardware.

McDonald’s (MCD)

McDonald’s distributed its regular quarterly dividend of $1.77 per share today, underscoring the company’s stable financial position and multi-decade track record of annual dividend increases. Shares closed at $303.29, +.40%.

Intel (INTC)

Intel shares showed strength after the company completed the divestiture of its Altera division, providing a $3.3 billion capital boost and aiding cost-control efforts. In addition, Intel secured a historic $8.9 billion investment through the U.S. government’s CHIPS Act and related programs, reinvigorating domestic semiconductor manufacturing. Intel shares closed at $25.27, +2.02%.

Oracle (ORCL)

Oracle extended gains closing up +1.49% ay $306.65 as investors digested last week’s earnings surprise and bullish guidance on AI cloud infrastructure growth. The potential extension of its TikTok cloud partnership and a string of multi-billion dollar AI contracts supported further share price appreciation.

Palantir Technologies (PLTR)

Palantir shares traded quietly amid scrutiny over insider activity and closed at $170.26, -.55% and the company’s continuing dominance in defense-focused AI contracts. No notable insider share sales have been reported this year, as the firm executes a $10 billion U.S. Army contract while navigating ethical and competitive challenges.

Rio Tinto Group (RIO)

Rio Tinto shares closed down .44% at $63.44, drawing attention for their compelling free cash flow generation and discounted valuation in the global mining sector. Analysts cited the miner’s favorable price-to-earnings and price-to-cash flow metrics as differentiators for value-oriented investors.

Other Noteworthy Movers

Eli Lilly (LLY) was a major newsmaker today after announcing a $5 billion investment to construct a new manufacturing facility in Virginia, aimed at boosting production of active pharmaceutical ingredients for cancer and autoimmune therapies. This expansion marks the first of four new U.S. plants planned over the next five years, representing the company’s strategic response to potential drug import tariffs and a buildup of domestic supply chain resilience. In addition to this, there were headlines about the FDA possibly fast-tracking approval for Lilly’s experimental weight-loss pill and the company receiving a drug advertising warning letter from the agency. LLY shares traded 2.21% higher on the news to $764.71, closing around $764.71, as the initiative was seen as positive for the firm’s U.S. innovation posture, with Citi maintaining a bullish $1,190 price target, though JPMorgan trimmed its target to $1,050.

Turbo Energy (TURB) delivered one of the most dramatic performances of the day, soaring intraday by as much as 359% to hit a record high of $20.44 before settling at $12.40 at the close—still up over 359.26% from the session’s open. This extraordinary move followed news of a $53 million contract to install 366 MWh of AI-optimized solar storage across ten factories in Spain, and was bolstered by a recent collaboration with Uber in the Spanish market for solar/EV solutions. The project is regarded as transformative, cementing TURB’s leadership in industrial-scale green energy and earning the stock a surge in retail investor enthusiasm and record trading volumes.

Monetary Policy, Yield Curve, and Rates

- Federal Reserve: The FOMC opened its September meeting today, with markets pricing in a 25-basis-point rate cut—the first in 2025. Investors expect clarifying language on future rate policy and balance sheet guidance at tomorrow’s announcement

- Yield Curve: The 10-year Treasury yield eased slightly to 4.03% from 4.05% the previous session, while the 2-year yield traded in a narrow range ahead of the Fed’s decision, with real-time rates hovering around recent highs

- Tariffs: Tariff policy discussions persisted in Washington, with no material changes or new measures announced today. U.S.-China trade negotiations remain in focus, keeping pressure on certain industrial and technology stocks.

Key Commodities and Crypto

- Gold: Settled around $3.727.20/oz, fractionally higher as investors hedged ahead of the Fed announcement. The SPDR Gold shares ETF closed at $339.59, +.20%.

- Silver: Traded near $42.88/oz, down -.19%.

- Oil (WTI): Ended at approximately $64.55/bbl, +1.97%.

- Bitcoin: Traded near $116,959, +1.39% holding steady as digital assets consolidated recent gains.

Vista Partners Watchlist Highlights & Updates

Eupraxia Pharmaceuticals (EPRX, $5.33, +.57% and is up +68.14% YTD) is clinical-stage biotechnology firm headquartered in Victoria, Canada, that is leveraging its proprietary Diffusphere™ technology designed to optimize local, controlled drug delivery for applications with significant unmet need & has quietly become one of the more intriguing stories on both sides of the border in 2025. The company’s shares now trade under the ticker EPRX on both the Nasdaq and the Toronto Stock Exchange, following its U.S. market debut in April 2024. This dual listing has broadened its investor base at a time when the company’s clinical and financial narrative is gaining momentum. All covering analysts currently rate the stock as a “Buy” or better, with not a single “Hold” or “Sell” recommendation in sight. In a sector defined by binary outcomes and frequent disappointment, such unanimity is striking. Overall, analysts cite Eupraxia’s strong clinical pipeline and revenue growth potential as key drivers behind their bullish outlook.

On Sept. 2, Eupraxia announced additional positive clinical data from its ongoing Phase 1b/2a RESOLVE trial evaluating EP-104GI for the treatment of eosinophilic esophagitis (“EoE”), including the first clinical data measured 52 weeks after patients were treated with EP-104GI. Dr. James A. Helliwell, Chief Executive Officer of Eupraxia stated, “We believe the prolonged duration of symptom response that we are seeing with EP-104GI is truly a unique clinical result and will potentially provide a once-a-year therapy to patients with EoE. And overall, we continue to see that the more drug we deliver to the tissues, the better the results. Independent market research has shown that the majority of patients with EoE undergo a routine endoscopy at least once a year to monitor the progress of their disease, which is also consistent with national guidelines. Based on this, leading KOLs in EoE see a potential treatment regimen where EP-104GI is administered during this routine annual procedure, in contrast to current standards of care which are inconvenient and involve swallowing oral steroids daily or injecting themselves weekly with a biologic. As a result, we believe EP-104GI has the potential to significantly enhance the current standard of care for patients with EoE. We look forward to reporting additional 12-month data from a larger patient set later this year.”

On August 12, Eupraxia announced its financial results for the second quarter of 2025 and provided a business update. All dollar values are in U.S. dollars unless stated otherwise. Dr. James A. Helliwell, Director and Chief Executive Officer of Eupraxia, stated, “The expansion into the placebo-controlled, Phase 2b portion of the RESOLVE trial represents a key clinical milestone for Eupraxia, as we seek to advance EP-104GI for the treatment of eosinophilic esophagitis. Recent data updates support the potential of EP-104GI as a durable treatment option. In the most recent data update, all three patients demonstrated a sustained or improved treatment outcome after nine months of therapy. We look forward to announcing more results from the Phase 1b/2a portion of the RESOLVE trial in October. As we continue to survey the treatment landscape for EoE, we are increasingly confident in the potential of EP-104GI to fundamentally transform the therapeutic management of EoE. We are off to a strong start with respect to enrollment in the Phase 2b study and we are looking forward to reporting topline results in the second half of 2026.”

On July 24, Cantor Fitzgerald initiated coverage on Eurpaxia with an Overweight rating and a $11 Price Target. Their report is titled “Set It and Forget It” Approach to EOE & Beyond.” Here are the other analysts that cover Eupraxia currently:

-

HC Wainwright: Initiated Covrage on EPRX with a “Strong Buy” on June 26, 2025.

-

Canaccord Genuity: Initiated coverage with a “Speculative Buy” rating in June 2025.

-

Raymond James Ltd.: Maintains a “Strong Buy” rating as of June 2025, with a history of upgrades from “Outperform” to “Strong Buy” over the past year.

-

Research Capital Corporation: Maintains a “Buy” rating, consistently reaffirming its positive stance throughout 2024 and 2025.

Eupraxia announced on July 8 that the first patient dosed in their Phase 2b randomized, placebo-controlled portion of the RESOLVE clinical trial evaluating EP-104GI, an investigational treatment for eosinophilic esophagitis (“EoE”). EP-104GI is injected directly into the affected tissues of the esophagus to reduce inflammation with stable, localized, and long-duration drug delivery, while minimizing unwanted systemic adverse events and side effects often associated with steroid-based therapies. The Phase 2b portion of the RESOLVE study will enroll a minimum of 60 participants randomized in a 1:1:1 ratio to receive one of two doses of EP-104GI or placebo. After six months, eligible patients initially dosed with placebo may elect to receive EP-104GI. The primary objective is to assess the efficacy of EP-104GI in improving tissue health, as measured by the Eosinophilic Esophagitis Histology Scoring System (“EoEHSS”). Secondary and exploratory objectives include evaluating symptomatic improvement through patient-reported outcomes — Straumann Dysphagia Index score (SDI) and Dysphagia Symptom Questionnaire (DSQ), endoscopic and histologic changes (including Peak Eosinophil Count, “PEC”), pharmacokinetics, safety, and tolerability of the selected dose regimens. Up to 25 sites globally are expected to participate in the trial.The Phase 2b portion of the study employs an innovative adaptive design to select the doses of EP-104GI that are administered to patients. The first active dose selection was based on available data from cohorts 1 to 8 of the Phase 2a portion of the study. Based on the previously reported safety, pharmacokinetic, and efficacy data from cohorts 1 to 6, and additional one month data from cohorts 7 and 8, the 120 mg dose (20 injections of 6 mg per site) from cohort 8 was selected for the first treatment arm in the dose optimization phase. A second dose will be selected for evaluation after enrollment in the first arm is complete, based on additional long-term data from the Phase 2a portion of the study. James Helliwell, CEO of Eupraxia Pharmaceuticals stated, “Entering into the Phase 2b stage of the RESOLVE trial is a significant event for Eupraxia. This is an important step for us before proceeding towards the pivotal trials necessary for submitting an application for regulatory approval. We are optimistic that EP-104GI has the potential to significantly advance the standard of care and offer a meaningful new treatment paradigm for patients living with EoE.”

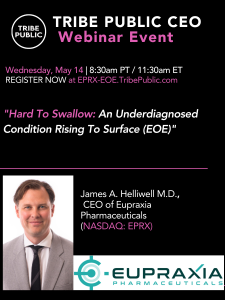

Tribe Public hosted a CEO Presentation and Q&A Webinar Event on Wednesday, May 14th with James A. Helliwell, Director and CEO of Eupraxia Pharmaceuticals (NASDAQ: EPRX). The event is titled “Hard To Swallow: An Underdiagnosed Condition Rising To Surface (EOE).” You may view it now at https://youtu.be/tCtY_27EJG4?si=0PJIp-oyGDEpzxzR

Modular Medical, Inc. (NASDAQ: MODD, $.6996) is an insulin delivery technology company with the first FDA-cleared patch pump designed specifically to target the estimated $3 billion dollar adult “almost-pumpers” market with its user-friendly and affordable design. Using its patented technologies, the company seeks to eliminate the tradeoff between complexity and efficacy, thereby making top quality insulin delivery both affordable and simple to learn. Their mission is to improve access to the highest standard of glycemic control for people with diabetes taking it beyond “superusers” and providing “diabetes care for the rest of us.” Modular Medical was founded by Paul DiPerna, a seasoned medical device professional and microfluidics engineer. Prior to founding Modular Medical, Mr. DiPerna was the founder (in 2005) of Tandem Diabetes and invented and designed its t:slim insulin pump. More information is available at https://modular-medical.com.

On Sept. 15, Modular Medical announced Institutional Review Board (“IRB”) approval to conduct an in-house feasibility study of its next-generation Pivot insulin delivery system using sterile saline (the “Study”). Pursuant to U.S. Food and Drug Administration (“FDA”) regulations, an IRB is a group that has been formally designated to review and monitor biomedical research involving human subjects. The Study will simulate real-world conditions by delivering sterile saline to adult participants for up to 90 days to gather critical data on device usability, extended wear performance and user feedback.

On September 11, Modular Medical announced the successful completion of a clinical study with the MODD1 pump. The MODD1 was worn by nine clinicians with Type 1diabetes who currently wear a continuous glucose monitor (“CGM”) and other pumps to provide the Company with real-world experience and feedback to make further refinements for the launch of its next-generation Pivot pump product. This MODD1 study was conducted to test and refine its ease of use for converting multiple daily injectors to this system and will continue as we prepare for the Pivot launch.

On August 26, Modular Medical announced that the MODD1 product cartridge production run has been completed and its manufacturing line is being converted to production for its Pivot product.“I want to congratulate our operational team for the successful validation of our MODD1 manufacturing process and production of human use cartridges,” said Jeb Besser, CEO of Modular Medical. “We will now begin converting our cartridge line to Pivot production, and we expect it to be ready to produce cartridges for our Pivot product upon receipt of clearance from the U.S. Food and Drug Administration (the “FDA”). We expect to submit the Pivot product to the FDA for clearance in October 2025. The Pivot will be the first tubeless, removable 3 milliliter patch to be available to the consumer when it is cleared. Along with these features, the ability to scale production is a key differentiator in the pump space, especially given the much higher volumes required for a patch pump. Modular Medical’s simple, low-cost platform was designed from the ground up for high volume manufacturing.”

On August 8, Modular Medical announced its participation at the Association of Diabetes Care & Education Specialists (“ADCES”) Conference, which is being held in Phoenix, Arizona from August 8 to August 11, 2025. With over 11,000 members, the ADCES is a national network of diabetes care and education specialists working to optimize clinical outcomes for people with diabetes. “The ADCES conference is an ideal location for us to showcase our next-generation patch pump, branded as Pivot, for which we plan to file for U.S. Food and Drug Administration (“FDA”) clearance in October 2025. Diabetes care and education specialists are crucial in offering and prescribing pumps to achieve improved clinical outcomes, and we believe they will appreciate the user-friendly design of the Pivot pump and our focus on making diabetes care simpler to learn and manage for our targeted audience of Almost Pumpers,” stated Jeb Besser, CEO of Modular Medical. Modular Medical will also showcase the first playable level of the new Pivot pump gamified training module, which is being developed by Level Ex. Level Ex (powered by Relevate) is the developer of numerous medical games, including Level One, a game designed to teach the basics of caring for diabetes. Level One is endorsed by Breakthrough T1D, a leading global type 1 diabetes research and advocacy organization. Gamification has been proven to make medical training more effective, be more efficient for the clinician and dramatically improve retention of knowledge. Complexity, including support for technology, is a key issue in pump uptake and continues to serve as a barrier to adoption, impacting both the patient and provider.

On August 6, Modular Medical, Inc. announced the first human use of the MODD1 pump to deliver insulin to a person with diabetes in a real-world setting. The MODD1 is delivering insulin to a clinician with Type 1 under institutional review board approval from the United States Food and Drug Administration, which is necessary because the reusable controller line is being validated for human use.

On August 4, Modular Medical announced that the MODD1 cartridge line has been validated for human-use production in the United States. “This is an important milestone for scaling up our manufacturing infrastructure to support our commercial pilot for MODD1 and, eventually, our 3ml Pivot tubeless patch pump launch,” stated Jeb Besser, CEO of Modular Medical. “While we encountered significant delays with the initial shipment of equipment for the manufacturing line to our contract manufacturing site in Mexico, all equipment for the controller line has been installed and validation is underway. We continue to target controller line validation in October for MODD1 with the commercial pilot for MODD1 to follow immediately thereafter.” The ability to scale production is a key differentiator in the pump space, especially given the much higher volumes required for a patch pump. Modular Medical’s simple, low-cost platform was designed from the ground up for high volume manufacturing.

On June 16, Modular Medical announced its participation in the American Diabetes Association (“ADA”) 85th Scientific Sessions, that took place June 20-23, 2025, at the McCormick Place Convention Center in Chicago, Illinois. The Company featured a poster, number 783-P, titled “Elucidating the potential benefit of pump-delivered subcutaneous GLP-1R agonist: an exploratory study in the diet-induced obese mouse,” to be presented by David Maggs, MD, FRCP during the General Poster Session on Sunday, June 22, 2025, from 12:30pm to 1:30pm in the Poster Hall. The presentation highlighted data from an exploratory study evaluating the effects of pump-delivery of a short-acting GLP-1RA on weight, food intake, and glucose tolerance in a diet-induced obese (“DIO”) mouse.“We are excited to share our findings from this novel study in the DIO mouse comparing the pump delivery of exenatide to intermittent dosing of semaglutide,” said Jeb Besser, CEO of Modular Medical. “Given the high rate of gastrointestinal tolerability challenges and resultant discontinuation that is characteristic of GLP-1 therapy, we believe that a personalized approach to GLP-1 titration and dosing, including a mealtime bolus option, would give patients an opportunity to reach their treatment goals, while experiencing easier therapy initiation and a more tolerable maintenance regimen.”

After the close May 28, Modular Medical announced the appointment of Jeff Goldberg to its Board of Directors. Mr. Goldberg brings decades of experience in health care, life sciences, and medical device leadership, including development of generic insulin. Mr. Goldberg began his work in medical technology alongside pioneering medical entrepreneur, and founder of MiniMed, Alfred E. Mann. Mr. Goldberg currently serves as Chairman of Lannett Company, Inc., a generic pharmaceutical manufacturer where he has helped execute a post-restructuring turnaround. During his tenure, Lannett has made significant strides in launching a generic insulin product – progress that aligns closely with Modular Medical’s commitment to innovation and affordability in diabetes care. In addition to his work at Lannett, Mr. Goldberg previously served as President and CEO within Alfred E. Mann’s incubator, IncuMed, where he oversaw multiple portfolio companies focused on drug-device combination products, including an insulin patch-pump program. His tenure with Mr. Mann’s enterprises included pivotal roles in regulatory strategy, operations turnaround, and successful exits, underscoring his ability to guide early-stage technologies to commercial viability. Mr. Goldberg also serves on the boards of several health-care and consumer-focused companies, including ATI Physical Therapy, Cano Health, and Eating Recovery Centers. He holds a JD from UCLA School of Law and an AB from Harvard College. Mr. Goldberg stated, “Modular Medical is advancing a truly disruptive approach to insulin delivery. I’m excited to join the board and contribute to the Company’s journey toward simplifying treatment for people living with diabetes, particularly as the industry shifts toward more accessible and patient-friendly solutions.”

Shares of ADT Inc. (ADT, $8.68, -1.03%) is a leading provider of monitored security and automation solutions for residential and small business customers in the United States and Canada.

ADT released Q1, 2025 results on Thursday, April 24 and highlighted the following: Continued strong financial results with record recurring monthly revenue and customer retention, GAAP operating cash flows up 28%, Adjusted Free Cash Flow including interest rate swaps up 105%, Returned $445 million to shareholders through share repurchases and dividends, and that they are on track to achieve full year 2025 guidance metrics.

GeoVax Labs, Inc. (Nasdaq: GOVX, $.6973, +1.59%) is a clinical-stage biotechnology company developing immunotherapies and vaccines against cancers and infectious diseases.

On Sept. 15, GeoVax Labs showcased positive interim results for its lead COVID-19 vaccine candidate, GEO-CM04S1 at the XXI International Workshop on Chronic Lymphocytic Leukemia (iwCLL 2025) in Krakow, Poland.

On Sept. 8, GeoVax Labs announced that its Chief Medical Officer and clinical collaborators will present data highlighting the cross-variant antibody and robust cellular immune responses induced by the Company’s next-generation COVID-19 vaccine (GEO-CM04S1) in immunocompromised patients with hematologic malignancies at two upcoming scientific meetings in September.

On Sept. 3, GeoVax announced that its Chairman and CEO, David Dodd, will present a company overview and host investor meetings during the H.C. Wainwright 27th Annual Global Investment Conference, taking place at the Lotte New York Palace Hotel in New York City, September 8-10, 2025. A webcast of Mr. Dodd’s presentation will be available beginning at 7:00 am ET on Monday, September 8, during which he will discuss recent progress and upcoming milestones across GeoVax’s pipeline.

On August 20, GeoVax Labs announced that the U.S. Patent and Trademark Office (USPTO) has issued a Notice of Allowance for U.S. Patent Application No. 17/888,131, titled “Vaccines and Uses Thereof to Induce an Immune Response to SARS-CoV-2.” The allowed claims broadly cover recombinant Modified Vaccinia Ankara (MVA) viral vectors encoding multiple SARS-CoV-2 proteins – including Spike (S), Membrane (M), and Envelope (E) antigens – configured to generate virus-like particles (VLPs) upon expression. These constructs are designed to induce both antibody and T-cell responses, providing durable and broad immune protection against current and emerging variants of SARS-CoV-2.

On August 7, GeoVax Labs today issued a statement in response to the U.S. Department of Health and Human Services’ (HHS) decision to terminate nearly $500 million in BARDA-funded mRNA vaccine development contracts. This action reflects a policy shift, underscored by HHS Secretary Kennedy addressing fundamental concerns around mRNA vaccines. In a post on X, Secretary Kennedy stated: “mRNA vaccines don’t perform well against viruses that infect the upper respiratory tract”. The Secretary added that this is due to a concept known as “antigenic shift, meaning that the vaccine paradoxically encourages new mutations and can actually prolong pandemics as the virus constantly mutates”. GeoVax’s vaccine candidates, including GEO-CM04S1 for COVID-19, are designed to induce immunity using multiple antigens. GEO-CM04S1 expresses both the Spike (S) and Nucleocapsid (N) proteins of SARS-CoV-2, enabling broader and more durable protection – even as the virus mutates. Data from clinical studies have demonstrated that GEO-CM04S1 induces immune responses across variants, from the original Wuhan strain through Omicron, even in immunocompromised patients.

On July 30, GeoVax renewed its call for decisive U.S. action on pandemic preparedness and biodefense. With escalating outbreak risks, public health system strain, and growing bipartisan consensus for domestic solutions, GeoVax underscored the urgent need to modernize the nation’s countermeasure infrastructure and end foreign vaccine dependency. GeoVax’s Modified Vaccinia Ankara (MVA)-based vaccine platform anchors two front-line candidates: GEO-MVA for Mpox/smallpox, designed to protect against both Clade I and II Mpox strains. GEO-CM04S1, a multi-antigen, next-generation COVID-19 vaccine targeting the 40 million U.S. immunocompromised through robust, durable, antibody and T-celldriven immune protection.

On July 29, GeoVax announced an expedited development strategy for its GEO-MVA Mpox vaccine candidate, following newly reaffirmed global emergency status by the World Health Organization (WHO), a record-setting surge in Mpox cases across Africa, and recent favorable scientific advice from the European Medicines Agency (EMA) supporting an expedited development path for GEO-MVA.

On Aug. 14, Teladoc Health announced it has acquired Telecare, an innovative, Australian tech-enabled provider of specialist and allied health care via virtual delivery. Telecare operates Australia’s leading virtual care clinic and provides software solutions to the healthcare sector. With over 300 virtual specialists in over 30 specialties, supporting both GP-referred appointments as well as providing virtual care services to public hospitals across Australia, Telecare helps reduce patient wait times and increases access to speciality care in underserved areas. Teladoc Health is the global virtual care leader, with revenues over $2.5 billion in 2024 and nearly 5,000 employees. The company provides access to care for more than 100 million people and its technology enables virtual care across leading hospitals and health systems, including many of the US leading healthcare institutions, the NHS in the United Kingdom, Charité in Germany, as well as the Canadian health system and the French Social Security. The acquisition supports Teladoc Health’s enterprise strategy, which includes expanding its international business. With a 15-year history in Australia, Teladoc Health already provides millions of Australian members access to virtual health services through relationships with insurers and hospitals. Additionally, Teladoc Health has recently deployed innovative virtual care solutions into the Australian hospital market, including a virtual neonatology solution at the Mater Misericordiae University Hospital, and a virtual telesurgery support system with Central Queensland Hospital and Health Service.

Teladoc, (July 29), reported financial results for the three months ended June 30, 2025 (“Second Quarter 2025”). Unless otherwise noted, percentage and other changes are relative to the three months ended June 30, 2024 (“Second Quarter 2024”). Highlights:

- Second Quarter 2025 revenue of $631.9 million, down 2% year-over-year

- Second Quarter 2025 net loss of $32.7 million, or $0.19 per share

- Second Quarter 2025 adjusted EBITDA of $69.3 million, down 23% year-over-year

- Integrated Care segment revenue of $391.5 million, up 4% year-over-year, and adjusted EBITDA margin of 14.7%

- BetterHelp segment revenue of $240.4 million, down 9% year-over-year, and adjusted EBITDA margin of 4.9%

- Paid $550.6 million using cash on hand to retire convertible senior notes due in Second Quarter 2025

- On July 17, 2025, they entered into a credit agreement providing for a five-year, $300.0 million senior secured revolving credit facility to preserve and enhance our financial and operational flexibility

Quote of The Day

“The best and most beautiful things in the world cannot be seen or even touched – they must be felt with the heart.” –

Helen Keller

Sources

- https://www.wsj.com/livecoverage/stock-market-today-dow-sp-500-nasdaq-09-16-2025

- https://ca.finance.yahoo.com/news/stock-market-today-dow-drops-sp-500-nasdaq-slip-from-records-as-wall-street-counts-down-to-fed-decision-200039975.html

- https://www.reuters.com/business/wall-st-ends-lower-investors-turn-cautious-ahead-fed-rate-decision-2025-09-16/

- https://www.latimes.com/business/story/2025-09-16/wall-street-edges-back-from-its-record-heights

- https://www.barchart.com/stocks/indices/russell/russell1000

- https://www.sfgate.com/business/article/how-major-us-stock-indexes-fared-tuesday-21051607.php

- https://www.kiplinger.com/investing/live/fed-meeting-live-updates-and-commentary-september-2025

- https://macdailynews.com/2025/09/16/new-iphone-lineup-sees-strong-demand-apple-stock-rises/

- https://www.insidermonkey.com/blog/susquehanna-reiterates-broadcom-avgo-buy-rating-400-target-on-ai-solutions-growth-1609951/

- https://www.nasdaq.com/articles/company-news-sep-16-2025

- https://carboncredits.com/tesla-tsla-stock-surges-on-musks-1-billion-buy-and-gigaberlin-ev-growth-strategy/

- https://www.barrons.com/articles/tesla-stock-price-today-overbought-4429141b

- https://www.investors.com/news/tesla-stock-ceo-elon-musk-burning-midnight-oil-china-registrations-lag/

- https://www.morningstar.com/news/dow-jones/202509164891/tesla-on-track-for-highest-close-since-january-data-talk

- https://pro.thestreet.com/trade-ideas/new-price-target-for-tesla-amid-stock-frenzy-and-fsd-success

- https://www.tomsguide.com/news/live/meta-connect-2025-live

- https://gizmodo.com/live-updates-from-meta-connect-2025-2000658450

- https://www.aol.com/articles/meta-aims-win-smart-glasses-191012268.html

- https://www.investing.com/news/company-news/mcdonalds-declares-177-quarterly-dividend-payable-in-september-93CH-4147055

- https://www.marketbeat.com/instant-alerts/rep-julie-johnson-sells-mcdonalds-corporation-nysemcd-stock-2025-09-14/

- https://finance.yahoo.com/news/why-intel-intc-stock-climbing-200837938.html

- https://www.stocktitan.net/news/INTC/

- https://markets.financialcontent.com/wral/article/stockstory-2025-9-15-why-mongodb-mdb-stock-is-trading-up-today

- https://www.investors.com/news/technology/mongodb-stock-mdb-news-oracle-ai-software/

- https://www.cnn.com/2025/09/16/tech/oracle-larry-ellison-ai-computing

- https://finance.yahoo.com/news/91-2025-too-buy-breakout-141613209.html

- https://www.ainvest.com/news/palantir-insider-share-sale-signal-noise-high-stakes-ai-era-2509/

- https://finance.yahoo.com/news/rio-tinto-group-rio-bull-170136649.html

- https://www.marketwatch.com/livecoverage/stock-market-today-sp500-nasdaq-record-highs-dow-steady-fed-starts-meeting-retail-sales

- https://www.investopedia.com/5-things-to-know-before-the-stock-market-opens-september-16-2025-11810739

- https://rollingout.com/2025/09/16/why-fed-sept-16-meeting-brings-good-news/

- https://finance.yahoo.com/news/stock-market-news-sep-16-131900103.html

- https://www.cnbc.com/2025/09/15/stock-market-today-live-updates.html

- https://www.bloomberg.com/news/articles/2025-09-15/asian-futures-show-cautious-optimism-ahead-of-fed-markets-wrap

- https://tradingeconomics.com/calendar

- https://www.cnbc.com/2025/09/16/market-track-record-is-stellar-when-fed-cuts-rates-with-sp-500-at-record.html

- https://www.zacks.com/stock/news/2752010/stock-market-news-for-sep-16-2025

- https://www.investing.com/indices/us-30

- https://www.investopedia.com/tesla-stock-near-its-2025-high-after-a-5-day-win-streak-key-levels-for-investors-to-monitor-11810733

- https://www.youtube.com/watch?v=nIoT9LFP4jk

Investing & Inspiration

Post View Count : 501