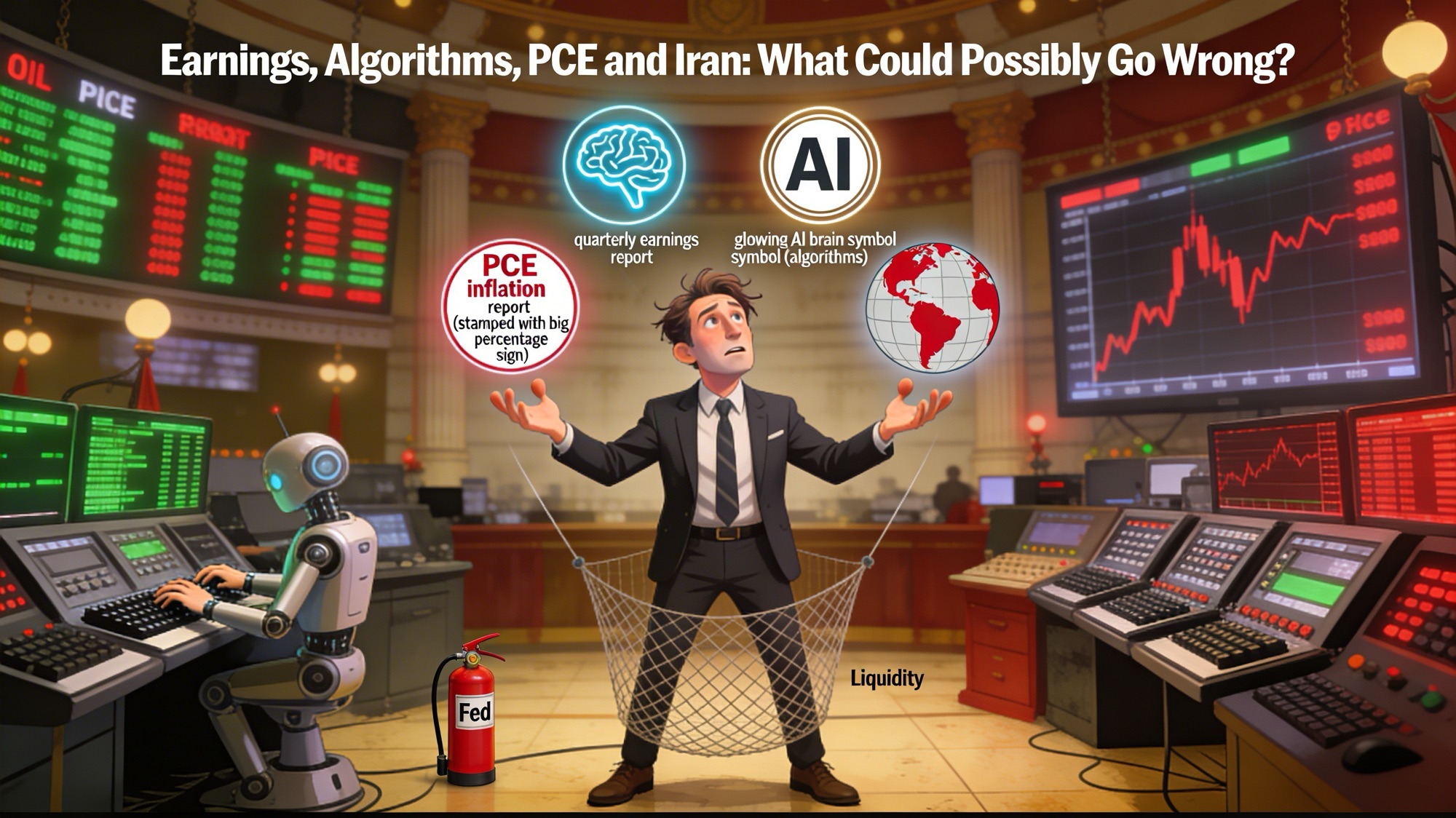

Wall Street closed Thursday walking a now-familiar tightrope: cheering resilient earnings and AI-fueled innovation while eyeing rising US-Iran tensions and a looming inflation check that could jostle the Federal Reserve’s carefully choreographed exit from peak rates.

Futures Lean Green As Geopolitics Heat Up

US stock futures tilted higher late Thursday, hinting at a tentative rebound after a choppy cash session that saw major indexes wobble under the weight of higher oil and headline risk out of the Middle East. The setup captures a market increasingly conditioned to price in geopolitical flare-ups without abandoning its core belief that the US economy remains sturdy enough to weather higher-for-longer rates.

- S&P 500 futures edged up as traders weighed a modest weekly gain against elevated volatility in single stocks.

- Nasdaq futures firmed, positioning the tech-heavy benchmark to extend an early effort to break a five-week losing streak.

- Dow futures also ticked higher, signaling a steadier open after recent swings tied to heavyweight components’ earnings.

One could say the market has adopted a new routine: read the headlines, glance at oil, then go back to debating AI valuations.

Oil Near Six-Month High, Inflation Gauge Ahead

Energy markets told a more anxious story, with crude hovering near six-month highs as investors digested reports of the largest US military buildup in the Middle East since the early 2000s and a ticking deadline from President Donald Trump for negotiations with Iran. Brent traded near 72 dollars a barrel and West Texas Intermediate hovered around 67 dollars, levels that quietly reinsert an energy risk premium into inflation and growth forecasts.

The timing is delicate.

- On Friday, investors will parse the Personal Consumption Expenditures index, the Fed’s preferred inflation gauge, for signs that price pressures are cooling convincingly enough to keep rate-cut hopes alive later this year.

- A fresh uptick tied to energy could complicate that narrative, especially with the 10-year Treasury yield still anchored above 4 percent as markets debate how far the Fed can go in easing without reigniting inflation.

For the central bank, the combination of resilient demand, firm labor markets, and pricier oil is the monetary-policy equivalent of being asked to juggle while reading the fine print.

Earnings Season: Less Euphoria, More Cross-Examination

Beneath the macro noise, Wall Street is grinding through the final innings of a contentious earnings season defined less by broad disappointment and more by a ruthless repricing of tech and AI expectations. Investors have punished companies seen as vulnerable to AI disruption even when headline results beat estimates, a pattern that has hit industries as diverse as software, legal services, and online travel.

- Some legacy platforms in travel and e-commerce have watched their shares sell off despite solid profits, as markets fret over AI-enabled competitors that promise sleeker user experiences and lower costs.

- Other tech names at the center of the AI buildout have faced a different challenge: living up not only to lofty earnings expectations but also to storylines that priced in years of flawless execution.

The result is a market that still believes in AI’s long-term potential but is no longer willing to pay science-fiction multiples for business plans that read like early-stage screenplays.

Consumers, Big-Box Retail, and the Quiet Strength of the US Economy

If investors are searching for a real-time pulse of the US consumer, big-box retailers have again become must-read earnings reports. Recent results from a leading retail giant showed solid performance for the prior fiscal year but a more cautious profit outlook, reflecting shoppers who remain willing to spend but are increasingly price-sensitive and selective.

- The labor market, while cooling from peak tightness, continues to show resilience, with jobless claims signaling that layoffs are not spiraling.

- That backdrop supports steady consumer demand even as higher borrowing costs pinch parts of the economy from housing to small-business lending.

For now, Main Street appears to be doing its part in keeping the expansion alive, even if it occasionally trades name brands for store labels.

Markets at the Crossroads: Risk Premium Meets AI Premium

Taken together, Thursday’s setup leaves investors juggling two competing premiums: one tied to geopolitical and energy risk, the other to the still-powerful promise of AI-driven productivity. The S&P 500 is on track for a modest weekly gain, while the Nasdaq is trying to snap its losing streak, suggesting that, for all the angst, money has not yet abandoned the growth story.

The path forward may hinge on three questions:

- Does the US-Iran standoff escalate into a sustained oil shock or fade into the background as prior flare-ups have?

- Does PCE inflation cooperate enough to give the Fed room to ease without spooking bond markets?

- Do AI leaders and would-be disruptors prove their earnings power at a pace that justifies their valuations rather than merely their narratives?

For now, Wall Street seems content to keep both hands on the wheel: one eye on crude, one eye on chip stocks, and a healthy respect for the notion that markets, like diplomats, can only ignore rising tension for so long.

The Sources

[1] Stock market today: Dow, S&P 500, Nasdaq futures rise as US-Iran … https://finance.yahoo.com/news/live/stock-market-today-dow-sp-500-nasdaq-futures-rise-as-us-iran-tensions-rise-pce-inflation-looms-000113842.html

[2] Yahoo Finance – Stock Market Live, Quotes, Business & Finance News https://finance.yahoo.com

[3] Stock market today: Dow, S&P 500, Nasdaq futures rise as US-Iran … https://sg.finance.yahoo.com/news/stock-market-today-dow-sp-500-nasdaq-futures-rise-as-us-iran-tensions-rise-pce-inflation-looms-000113842.html

[4] Dow, S&P 500, Nasdaq futures steady as US-Iran tensions rise, PCE … https://finance.yahoo.com/news/live/stock-market-today-dow-sp-500-nasdaq-futures-steady-as-us-iran-tensions-rise-pce-inflation-looms-000113385.html

[5] Economic News and Analysis – Yahoo Finance https://finance.yahoo.com/topic/economic-news/

[6] US stock indexes drift lower as Walmart swings and oil prices rise https://www.wdrb.com/news/national/us-stocks-slip-as-oil-prices-rise-on-worries-about-a-potential-us-iran-conflict/article_c6c30cc3-149f-54bd-8aaa-31768f9c898e.html

[7] S&P 500 Price, Real-time Quote & News – Google Finance https://www.google.com/finance/quote/.INX:INDEXSP?hl=en

[8] S&P 500 (^GSPC) Charts, Data & News – Yahoo Finance https://finance.yahoo.com/quote/%5EGSPC/

[9] US stocks fall as oil prices climb again on worries about a potential … https://www.piquenewsmagazine.com/the-mix/us-stocks-fall-as-oil-prices-climb-again-on-worries-about-a-potential-us-iran-conflict-11897901