Jazz Pharmaceuticals’ (NASDAQ: JAZZ) $935 million acquisition of Chimerix (NASDAQ: CMRX) marks a significant milestone in precision neuro-oncology, highlighting the growing potential of targeted therapies for brain cancers and signaling a shift towards biomarker-driven approaches in treating central nervous system tumors. The $935 million acquisition includes dordaviprone, a novel small molecule therapy targeting H3 K27M-mutant diffuse glioma in children and young adults. This rare pediatric brain tumor affects approximately 2,000-2,200 U.S. patients annually, representing 7-10% of brain cancers. Jazz will purchase Chimerix shares at $8.55 each, a 72% premium over the last closing price on March 4, 2025. The deal is expected to close in the second quarter of 2025, with FDA approval for dordaviprone anticipated in August 2025. Jazz has indicated a potential treatment cost of $300,000-$500,000 per patient, positioning dordaviprone as a significant addition to their oncology portfolio.

Precision Neuro-Oncology Advances

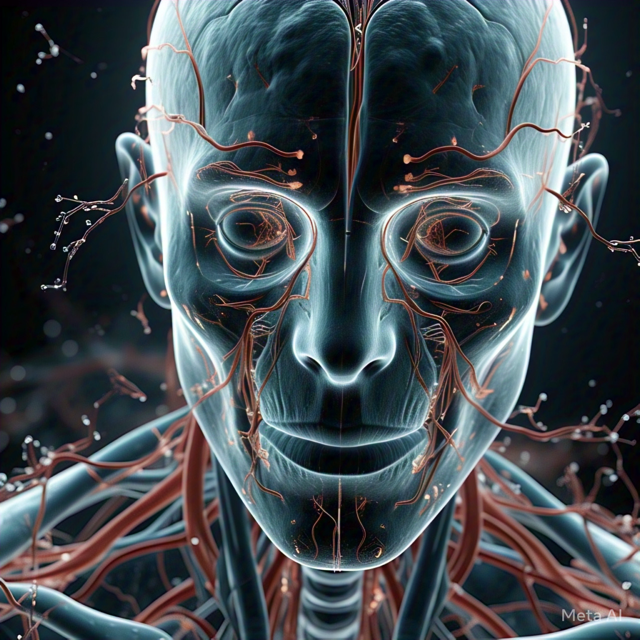

Recent advancements in precision neuro-oncology have led to a paradigm shift in treating central nervous system (CNS) tumors. Researchers are increasingly focusing on patient-derived models and functional precision medicine to evaluate therapeutic efficacy by directly treating living patient tumors ex vivo, potentially improving treatment selection and patient outcomes. This approach, combined with artificial intelligence applications in diagnosis, prognosis, and precision treatment, is transforming the landscape of neuro-oncology.

-

Gene therapy techniques, such as CAR-T cell therapy, show promise in extending survival for patients with aggressive brain tumors like glioblastoma.

-

Innovative immunotherapy approaches, including bi-specific antibodies and protein degraders, are emerging as potential game-changers in solid tumor treatment.

-

The integration of AI-driven technologies is enhancing the understanding of tumor microenvironments and potentially identifying new predictive biomarkers.

STAR-001 vs. Dordaviprone

STAR-001, Lantern Pharma’s (NASDAQ; LTRN) precision oncology candidate developed by its subsidiary Starlight Therapeutics, offers several potential advantages over dordaviprone in the neuro-oncology market. With a target population of 60-70% of glioblastoma multiforme (GBM) cases, STAR-001 addresses a significantly larger patient group of 12,000-15,000 U.S. patients annually, compared to dordaviprone’s 2,000-2,200 patients. This broader reach translates to an estimated $3.4 billion addressable market in the U.S. alone, assuming a $250,000 per treatment cost.

Key differentiators for STAR-001 include:

-

Biomarker-driven activation by PTGR1, an enzyme overexpressed in many GBM cells

-

Potential efficacy in brain metastases from other cancers, expanding the addressable market

-

Synergistic effects when combined with spironolactone, potentially enhancing efficacy and safety

-

Multiple Rare Pediatric Disease Designations, which could yield valuable Priority Review Vouchers

-

Ongoing development for additional indications, including a Fast Track Designation for triple-negative breast cancer treatment

Future Neuro-Oncology Trends

Emerging trends in neuro-oncology for 2025 include advancements in precision medicine, immunotherapy, and artificial intelligence applications. Bi-specific antibodies are expected to lead an immuno-oncology renaissance in solid tumors, while synthetic lethality approaches gain traction for targeted cancer therapies. AI-driven technologies are enhancing diagnosis, prognosis, and treatment precision, potentially revolutionizing patient care.

-

Novel treatment modalities, such as CAR-T cell therapy and gene therapy, show promise for brain tumors.

-

Addressing cancer disparities and improving access to cutting-edge treatments remain key focus areas.

-

The integration of patient-derived models and functional precision medicine is expected to improve treatment selection and patient outcomes.

Last Idea Of The Day

An idea would be for investors to look further into companies that have precision, neuro-oncology assets, and that are actively managing them to successful milestones for example companies like Lantern Pharma’s (NASDAQ; LTRN) and also Starlight Therapeutics.