Broad Markets Tread Water As Microcap Bids Resurface This Week – See $ATOS $INVO $INMB & $KDNY

- Published May 22, 2021

- American Express

- Apple

- Atossa Therapeutics, Inc.

- Boeing

- Caterpillar

- Chevron

- Chinook Therapeutics

- Coca-Cola

- Current Coverage

- Disney

- Fate Therapeutics, Inc.

- Goldman Sachs

- Hecla Mining

- Intel

- INVO Bioscience

- Johnson & Johnson

- JPMorganChase

- Market News

- Merck

- Microsoft

- Neubase Therapeutics

- Nike

- Plug Power

- Salesforce

- Tesla

- Visa

- Walmart

Happy Saturday All!

I hope that all of you had a great week and once again made progress towards creating generational wealth for you and your family.

The markets seemed to be working against us in the early-to-mid part of the week, but in the back half somewhat of a positive tone seemed to even things out a bit in the broad markets leaving us basically in place. However, having stated this and to my pleasure and many others, it was a very profitable week if you were invested in a number of smaller names as investors found fertile ground broadly in the microcaps as bids were of plenty. Maybe growth investors were seeking alpha in another spot this week as the cryptocurrency markets turned south post Elon Musk tweets, the China crackdown, & the U.S. Treasury’s call for stricter cryptocurrency compliance with the IRS, maybe it was a reaction to the Fed’s steadfast belief and reconfirmation with the FOMC minutes regarding their belief that inflation is currently transitory in nature, or maybe it was the news that the Biden admin is now seeking only $1.7T.

I have to admit that is allot of ‘maybe’s’, but regardless of the reason, its was certainly a welcomed realization to see a large increase in bids for the little guys and a willingness of a broader group of investors to invest in many of these speculative companies across all sectors, especially tech and biotech. This postive turn was also evidenced in several issues that we had positions in this week i.e. a number of our VP Watchlist Stocks including INmune Bio (INMB). INMB moved up $4.16/share up from the $9.78 close at the end of last week to touch $14.09 on Friday, prior to closing at $13.81. On Tuesday, May 18th, I hosted Immune Bio’s CEO RJ Tesi at the Tribe Public Presentation & Q&A Event for a fascinating discussion and his presentation titled “Advancing Treatment To Repair Our Aging Innate Immune System to Fight Alzheimer’s.” To learn more and to view the event video please click here. Chinook Therapeutics (KDNY), a clinical-stage biotechnology company developing precision medicines for kidney diseases, also closed at $17.75 jumping $3.1/share an up from last week’s $14.85 close.

Switching back to the broad markets, the major indices ticked lower week over week with only the Nasdaq closing slightly in the green: The Dow 30 closed at 34,207.84 (-5%) for the week & remains up +11.8% YTD & the S&P 500 closed at 4,155.86 (-.4%) for the week and remains up +10.6% YTD. The Nasdaq closed at 13,470.99 (+.3%) for the week and is now up +4.5% YTD. The smalls on the Russell 2000 closed at 2,215.27 (-.4%) for the week & remain up +12.2% YTD. The sectors that dragged us down a bit included the energy sector which closed down 2.8%, the industrials moved down 1.7%, the materials fell 1.4%,the consumer discretionary closed lower by 1.2%m & the financials were down .9%.

The FAANGs ended basically flat overall as follows: Apple (AAPL) shares closed at $125.43 down $2.02 from last Friday’s close of $127.45, Amazon (AMZN) closed at $3,203.08 down $19.82 from last Friday’s close of $3,222.90, Alphabet (GOOG) closed at $2,345.10 up $28.84/share from last Friday’s close of $2,316.16, Facebook (FB) closed at $316.23 down $3.14/share from last Friday’s close of $319.94 & Netflix (NFLX) closed at $497.89 up $4.52/share from last Friday’s close of $493.37/share.

Leading EV car maker Tesla (TSLA) moved lower again this week to close at $580.88 & down $8.86/share from the $589.74 close. Cathie Wood’s ARK Innovation ETF closed at $150.84 down .7% on Friday and well off her 52-wk high of $159.70. Apparently, she now believes that Bitcoin is going to $500,000. See her interview in the video section below. Bitcoin closed at $37,458.13 this week after taking another hit from its all-time high and recently established high of $64,863.10.

THE MACRO & RATES

On Monday, the macroeconomic schedule produced the NAHB Housing Market Index report for May which clocked in flat at 83. The Empire State Manufacturing Survey report also dropped to 24.3 in May. On Tuesday, the total housing starts report confirmed a drop by 9.5% m/m to a seasonally adjusted annual rate of 1.569M units and well under the consensus estimates. The total permits report confirmed a rise by .3% m/m to 1.760M. On Wednesday, the weekly MBA Mortgage Applications Index report confirmed a rise by 1.2%. On Thursday, the Initial jobless claims report for the week ending May 15 which confirmed a drop by 34k to 444k, however continuing claims for the week ending May 8 rose by 111k to 3.751M. The Conference Board’s Leading Economic Index (LEI) report confirmed a rise by 1.6% month/month in April. The Philadelphia Fed Index report showed pullback to 31.5 in May. On Friday, the existing home sales report confirmed a drop by 2.7% month/month in April to a seasonally adjusted annual rate of 5.85M, while total sales in April were 33.9% y/y during the early part of the shutdown. The preliminary IHS Markit Manufacturing for May rose to 61.5 & the preliminary IHS Markit Services PMI for May rose to 70.1. Next week, the schedule will proved the GDP report, the building permits report, & the Core PCE deflator report.

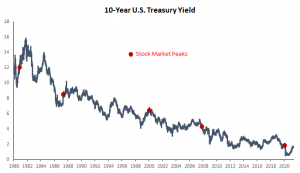

The yield curve was relatively calm this week as the 10-yr yield fell 1 basis point wk/wk to close 1.63, while the 2-yr settled rose 1 basis point wk/wk close at .15% as investors resolved to the Fed’s transitory position. Here’s an interesting chart that shows the fall in government bond yields over time which was created by FactSet showing the 10-Year Government Treasury Yield through 5/20/2021.

The U.S. Dollar Index also ticked lower from 90.32 to 89.99.

VISTA STORIES FROM THE DOW 30

Microsoft To Say Goodbye To Internet Explorer & Hello To Edge!

J.P. Morgan Secures Top Spot As European Web Transaction Acquirer

Goldman’s Consumer Business CFO, Sherry Ann Mohan To Join JPMorgan Chase Business Banking Unit

IBM’s ‘Hybrid Work Plans’ For Returning To Work Post Pandemic

IBM Acquires Salesforce Partner Waeg

Home Depot Rides High On Q1 Earnings, Crushes Estimates

Verizon Opens Recruitment Nationwide For 1,000 Roles, Amid Surge In Customer Demand

BIOTECH ‘FOUND GROUND’ THIS WEEK

The Biotech sector found a little ground this week as a number of issues moved forward somewhat indiscriminately. The Nasdaq Biotechnology ETF (IBB) closed at $151.38 up 1.7 points from last week’s close of $149.68. The NYSE ARCA Biotech Index (^BTK) closed at 5,595 up 30.43 points from last week’s close of 5,564.58. The SPDR S&P Biotech ETF (XBI) closed at $126.67, basically even with last Friday’s close of $126.92 but moved up nicely intraday during the week. The XBI’s 52-wk range is $$97.15-$174.79 and had been getting hit harshly since the early part of March!

GOLD REACHES FOR $1900 & SILVER MOVES HIGHER

Gold prices closed significantly above $1800/oz again this week at $1,884, up $39 from the $1,845 close last week. This Friday silver prices closed at $27.69/oz. up $.15 from the $27.52/oz. close last Friday. Hecla Mining (HL) reported impressive Q1 2021 financial and operating results recently and closed at $8.68 up $1.12 from the $7.56 close last Friday after establishing a new-52-wk high of $9.14. See our update story here for greater details.

OIL

Oil prices moved lower by 2.3% this week to close at $63.85/bbl and remains up +31.6% YTD. I might hold off buying a Tesla if oil continues to fall…lol.

TRADING

We are back to 5-trading sessions again next week leading into the Memorial Day Weekend Holiday.

- Shares of Chinook Therapeutics (KDNY), a clinical-stage biotechnology company developing precision medicines for kidney diseases, closed at $17.75 jumping back up from last week’s $14.85 close. Chinook is a clinical-stage biopharmaceutical company discovering, developing and commercializing precision medicines for rare, severe chronic kidney diseases, a severe and growing worldwide problem with a lack of effective treatments often leading to dialysis, transplantation, and high costs to health care systems. In the U.S. alone, kidney diseases affect an estimated 37 million people and account for over $120 billion in annual costs.

-

-

On May 12, Chinook provided a business update and reported financial results for the first quarter ended March 31, 2021. Eric Dobmeier, president and chief executive officer of Chinook Therapeutics stated, “During the first quarter of 2021, Chinook made strong progress with its pipeline of programs for kidney diseases, including initiating the phase 3 ALIGN and phase 2 AFFINITY trials of atrasentan, presenting encouraging clinical data from the BION-1301 program and entering into a strategic collaboration with Evotec. We are well-capitalized and resourced to execute across our programs to generate additional data catalysts and continue building Chinook into a leading kidney disease company.”

-

-

- On April 15, Chinook’s CEO Eric Dobmeier & CBO Tom Frohlich delivered a presentation titled “Revolutionizing The Treatment of Kidney Disease” followed by a Q&A session at the Tribe Public Network. You can view the video of the event here.

- INmune Bio, Inc. (NASDAQ: INMB, $13.94 up $4.16 from last Friday’s close of $4.16) (52-wk range $4.50-$29.99), a clinical-stage immunology company focused on developing treatments that harness the patient’s innate immune system to fight disease i.e. Alzheimer’s Disease.

-

- INmune Bio’s DN-TNF product platform utilizes dominant-negative technology to selectively neutralize soluble TNF, a key driver of innate immune dysfunction and mechanistic target of many diseases. DN-TNF is in clinical trial to determine if it can treat for COVID-19 complications (Quellor™), cancer (INB03™), Alzheimer’s and treatment resistant depression (XPro595), and NASH (LIVNate™). The Natural Killer Cell Priming Platform includes INKmune™ aimed at priming the patient’s NK cells to eliminate minimal residual disease in patients with cancer. INmune Bio’s product platforms utilize a precision medicine approach for the treatment of a wide variety of hematologic malignancies, solid tumors and chronic inflammation.

-

- On May 18th, I hosted Immune Bio’s CEO RJ Tesi at the Tribe Public Presentation & Q&A Event for a fascinating discussion and his presentation titled “Advancing Treatment To Repair Our Aging Innate Immune System to Fight Alzheimer’s.” Please view the event video here.

-

- On May 5th, INMB reported its financial results for the first quarter ended March 31, 2021 and provided a business update on Wednesday, May 5th. RJ Tesi, M.D., chief executive officer of INmune Bio stated, “We continued to treat patients in the Phase I XPro1595 Alzheimer’s disease trial and expand the extensive biomarker data. The interim data that we reported in January confirms that XPro1595 decreases neuroinflammation in patients with Alzheimer’s disease and supports transitioning to a blinded randomized placebo-controlled Phase II trial later this year. We regard these results as extremely promising and look forward to further confirmation of XPro1595’s potential benefit to these patients in a rigorously designed Phase 2 study. We will report the additional biomarker data later this Summer. We have started screening patients in the Phase I INKmune NK cell priming platform trial in patients with high-risk myelodysplastic syndrome (MDS). MDS is a serious hematopoietic stem cell disorder in which patients have functionally defective NK cells, and approximately one-third of cases progress to AML. We created a short 5-minute video that we believe does a wonderful job explaining why NK cells fail to clear cancer and how the cellular and molecular interactions by INKmune activate NK cells to kill resistant tumors. The video can be found by clicking here.”

- Shares of Natural-Killer cell (NKcell) focused biopharmaceutical firm Fate Therapeutics (FATE) closed at $73.81 & down from last Friday’s close of $76.70.

-

- On May 13th, Fate announced encouraging interim Phase 1 data from the Company’s off-the-shelf, iPSC-derived natural killer (NK) cell programs in relapsed / refractory acute myeloid leukemia (AML). The ongoing Phase 1 dose-escalation study of FT516 as monotherapy is currently enrolling patients in the third dose cohort (900 million cells per dose), with three patients treated in the first dose cohort (90 million cells per dose) and six patients treated in the second dose cohort (300 million cells per dose). The Phase 1 dose-escalation study of FT538 as monotherapy is currently ongoing, with three patients treated in the first dose cohort (100 million cells per dose). Learn more.

-

On May 5th, Fate reported their business highlights and financial results for the first quarter ended March 31, 2021. Scott Wolchko, President and Chief Executive Officer of Fate Therapeutics stated, “During the first quarter of 2021, we strengthened our balance sheet by raising $460 million and successfully positioned our off-the-shelf, iPSC-derived NK cell pipeline to achieve significant clinical milestones across our disease franchises throughout the remainder of the year. We look forward to sharing Phase 1 clinical data from our FT516 and FT538 programs in relapsed / refractory AML at an investor event to be held alongside the ASGCT conference. We are also pleased with the clinical expansion of our FT538 program into solid tumors, where we plan to combine with FDA-approved monoclonal antibodies targeting EGFR, HER2, and PDL1. While we are disappointed that the PROTECT study of ProTmune did not meet its primary endpoint for prevention of acute graft-versus-host disease following allogeneic stem cell transplant, we will now turn our full attention and resources to our deep pipeline of off-the-shelf, iPSC-derived cancer immunotherapies. We would like to sincerely thank the patients, caregivers and investigators who participated in the clinical investigation of ProTmune, and we intend to share our clinical findings with that community.”

-

- In related news, we have made another investment in a private NKcell company called Cytovia Therapeutics, a biopharmaceutical company developing allogeneic “off-the-shelf” gene-edited Chimeric Antigen Receptor (CAR)-NK cells derived from induced pluripotent stem cells (iPSCs) and NK cell engager multifunctional antibodies. Their website is www.cytoviatx.com. This week, Cytovia announced that Jason Aryeh, a long time biotech investor and board director, has been elected to the Cytovia Board of Directors, effective immediately. In addition, to support the rapid development of the company, Elizabeth Schwarzbach, PhD and Boris Reznik, PhD have joined the Strategic Advisory Board and Elysa Mantel has been appointed as Vice President, General Counsel and Corporate Secretary. Cytovia is seeking to go public in the 2H 2021.

- Shares of Atossa Therapeutics, Inc. (Nasdaq: ATOS), a clinical-stage biopharmaceutical company seeking to discover and develop innovative medicines in areas of significant unmet medical need with a current focus on breast cancer and COVID-19, closed at $3.23 up from the $2.90 closes last Friday and is trading 11.57M shares a day.

-

- On May 21,Physician-Scientist Dr. Steven C. Quay, M.D., Ph.D., CEO of Atossa Therapeutics (NASDAQ: ATOS) announced that he has been asked to brief the elected members and staff of the United States Congress on his work on the origin of the COVID-19 pandemic. The virtual meeting will take place from 2:00 to 3:30 pm EDT, Monday, May 24, 2021. Dr. Quay will speak about his research on the origin of the pandemic, which he published in January 2021 and which is available here. In this analysis he concludes that it is beyond a reasonable doubt the virus came from a laboratory accident, a so called “laboratory-acquired infection”, in Wuhan, China. The briefing will also include a discussion by David Asher, a senior fellow at the Hudson Institute, about his work at the U.S. State Department looking into the origins of COVID-19 and the role of the Chinese government.

-

- On May 14, Atossa announced financial results for the fiscal quarter ended March 31, 2021, and provided an update on recent company developments. Dr. Steven Quay, Atossa’s President and Chief Executive Officer stated, “During the first quarter of 2021 we continued our two key development programs, namely our Phase 2 study of oral Endoxifen for the ‘window of opportunity’ between diagnosis of breast cancer and surgery and our Phase 1 study of AT-301 nasal spray for at-home use for patients recently diagnosed with COVID-19. In addition, we continued our ongoing expanded access program with Endoxifen in which the drug continues to be well tolerated and breast cancer recurrence has not been seen clinically. We also received an important authorization from the FDA for an additional expanded access treatment program in an ovarian cancer patient. Combined with very encouraging results in our COVID-19 program with AT-301 nasal spray, we continued to make great progress over the quarter. In the meantime, we leveraged favorable conditions in the capital markets to strengthen our balance sheet over the last few months placing Atossa in a good position to execute on these and potential additional business opportunities during the remainder of 2021. As a result, we are diligently moving our existing programs forward, while actively exploring the possibility for strategic expansion into other areas where we might see near-term milestones and results. We look forward to continuing to update our stockholders on these opportunities as they develop.

- Shares of INVO Bioscience, Inc. (INVO), a medical device company focused on creating alternative treatments for patients diagnosed with infertility and developers of INVOcell®, the world’s only in vivo Intravaginal Culture System, keeps ticking higher and closed at $4.30 up from the close of $3.93/share last Friday.

- Could we be setting up for another March 9, 2021 type of run where +96M shares traded for this low-float stock (~10.4M shares are issued and outstanding) & the stock shot to a new 52-week high of $12.30….?

-

- On May 17, INVO announced financial results for the first quarter of 2021 ended March 31, 2021 and provides a business update. Steve Shum, Chief Executive Officer of INVO Bioscience stated, “This was an exciting start to the year 2021 for INVO Bioscience as we advanced our INVO Clinic strategy with the signing of our first U.S.-based INVOcell exclusive facility in Birmingham, Alabama, the signing of a partnership agreement to establish and operate a center in Northern California, and the completion of our product registration in Mexico. We expect these initial centers to become operational in the second half of the year. Throughout this year, we have expanded our real-world experience data and positive results with INVOcell, enhanced our online training tools, materials, and capabilities and have experienced a substantial increase in active training sessions for our international partners and distributors. We believe the combination of strong commercialization partnerships and company-owned clinics, both in the U.S. and around the world, is key to expanding INVOcell’s adoption within the fertility industry. In addition to the progress made executing new commercialization agreements, we have strengthened our marketing capabilities to support the INVOcell-only centers and our growing number of distribution partners. Meryle Lynn Chamberlain, a tenured women’s health and fertility solution marketing professional, joined us as Director of Marketing in March 2021, while Rebecca Messina, current Senior Advisor at McKinsey & Co. and former Global Chief Marketing Officer at both Uber and Beam Suntory joined our board of directors in April 2021. As we look to increase access to care and expand fertility treatment across the globe, our market positioning and overall strategies are more important than ever. The addition of Meryle Lynn and Rebecca will enhance our ability to successfully accomplish these goals. As we look to the remainder of 2021, we have set a number of key objectives, including the opening of our first company-owned clinics in Mexico and the United States. Additionally, we will seek to build our international revenues this year through our growing list of international distribution partners as they finish training, and we complete local product registration requirements. Of note, we are extremely pleased to see the initial INVO procedures performed recently in Spain and Malaysia, which reflects the groundwork done by our team in these specific markets, which we believe will help in further expanding the overall awareness of the potential outside of the U.S. Finally, we are continuing to advance our 5-day label expansion efforts with the FDA in the U.S. market with a goal of completing this effort in 2021. It remains our belief that there is strong global demand for fertility services and INVOcell is well-positioned through our growing, global footprint to play a key role in helping to turn the dream of creating a family for millions of people around the world into a reality through our accessible, efficient, and affordable fertility treatment.”

-

- On May 11, a 13G was filed that confirms that David Sable’s (a former #IVF doc turned portfolio manager) Special Situations Fund of AWM Investment Company increased their ownership to 11.1% or 1,154,153 share ownership of INVO Bioscience (INVO). They held 625k/6.5% as of the 13G filing 2-12-2021. If you are not familiar with them, I believe if you do a relatively small amount sleuthing you will find out that they are one of the most successful multi-billion funds over the last 20-years, especially in finding small undiscovered microchips. I believe that they led the round of $13M at $3.20 a share in November 12, 2020 that pushed INVO uplist to the NASDAQ. Here’s the 13G filing. The company only has 10,424,229 shares issued and outstanding as of March 31, 2021.

-

- Industry forecasts suggest that only 1% to 2% of the estimated 150 million infertile couples worldwide are currently being treated. INVO’s mission is to increase access to care and expand infertility treatment across the globe with a goal of improving patient affordability and industry capacity. Since January 2019, INVO Bioscience has signed commercialization agreements in the United States, India, as well as parts of Africa and Eurasia and Mexico for the INVOcell device.

- Shares of NeuBase Therapeutics (NBSE) closed trading this week at $5.21 up from the $5.08 close last Friday.

-

- NeuBase is developing the next generation of gene silencing therapies with its flexible, highly specific synthetic antisense oligonucleotides. The proprietary NeuBase peptide-nucleic acid (PNA) antisense oligonucleotide (PATrOL™) platform allows for the rapid development of targeted drugs, increasing the treatment opportunities for the hundreds of millions of people affected by rare genetic diseases, including those that can only be treated through accessing of secondary RNA structures. Using PATrOL technology, NeuBase aims to first tackle rare, genetic neurological disorders.

-

NeuBase will host a virtual R&D day for investors and analysts on Tuesday, June 8, 2021, from 12:30 p.m. to 2:30 p.m. EDT. During the event, NeuBase will present new data, along with an in-depth review of the Company’s pipeline of drug candidates – including in Huntington’s disease, myotonic dystrophy type 1, and a new oncology program for a target that has previously been thought of as undruggable – as well as an introduction to the expanded management team.

-

on May 13, NBSE reported its financial results for the three- and six-month periods ended March 31, 2021. Dietrich A. Stephan, Ph.D., Founder, CEO and Chairman of NeuBase stated, “We continue to expand and scale our unique precision genetic medicine platform that we believe can turn genes on, off, or edit them in vivo, and thus address most mechanisms that cause diseases in a single industry-unifying solution. Our recent financing led by top-tier healthcare investors enables us to advance our lead program into the clinic next year and expand our pipeline to address historically undruggable oncogenic driver mutations. We look forward to hosting our R&D day on June 8th, during which we will present an update on our current pipeline programs, as well as introduce an oncology program targeting a genetic driver mutation in a high value indication.”

Thanks again for your attention this week. Please continue to share your thoughts, questions, & ideas as we move forward.

In the meantime, please enjoy the balance of the weekly newsletter’s videos, quotes, updates.

Investing & Inspiration

- “In my view, the biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. Not only is the mere drop in stock prices not risk, but it is an opportunity. Where else do you look for cheap stocks?” – Li Lu

- “Modern medical advances have helped millions of people live longer, healthier lives. We owe these improvements to decades of investment in medical research.”– Ike Skelton

- “Stock market goes up or down, and you can’t adjust your portfolio based on the whims of the market, so you have to have a strategy in a position and stay true to that strategy and not pay attention to noise that could surround any particular investment.” – John Paulson

- “Your mindset matters. It affects everything – from the business and investment decisions you make, to the way you raise your children, to your stress levels and overall well-being.” – Peter Diamandis

- “Inflation destroys savings, impedes planning, and discourages investment. That means less productivity and a lower standard of living.” – Kevin Brady

- “Cash – in savings accounts, short-term CDs or money market deposits – is great for an emergency fund. But to fulfill a long-term investment goal like funding your retirement, consider buying stocks. The more distant your financial target, the longer inflation will gnaw at the purchasing power of your money.” – Suze Orman

- “Bitcoin, in the short or even long term, may turn out be a good investment in the same way that anything that is rare can be considered valuable. Like baseball cards. Or a Picasso.” – Andrew Ross Sorkin

- “I think you have to learn that there’s a company behind every stock and there’s only one real reason why stocks go up. Companies go from doing poorly to doing well or small companies grow to large companies.” – Peter Lynch

- “Historically, there has been a bull market in the commodities every 20 or 30 years.” – Jim Rogers

- “The markets generally are unpredictable, so that one has to have different scenarios. The idea that you can actually predict what’s going to happen contradicts my way of looking at the market.” – George Soros

- “Stop trying to predict the direction of the stock market, the economy or the elections.” – Warren Buffett

- “An important key to investing is to remember that stocks are not lottery tickets.” – Peter Lynch

- “Learn everyday, but especially from the experiences of others. It’s cheaper!” – John Bogle

- “When purchasing depressed stock in troubled companies, seek out the ones with the superior financial positions and avoid the ones with loads of bank debt.” – Peter Lynch

- “No stock price is too low for bears or too high for bulls.” – John F. Heerdink, Jr.

- “Investment is most successful when it is most businesslike.” – Ben Graham

- “Value stocks are about as exciting as watching grass grow, but have you ever noticed just how much your grass grows in a week?” – Christopher Browne

- “Even the intelligent investor is likely to need considerable willpower to keep from following the crowd.” – Benjamin Graham

- “Individual who cannot master their emotions are ill-suited to profit from the investment process.” – Benjamin Graham

- “I made my first investment at age eleven. I was wasting my life until then.” – Warren Buffet

- “I don’t look to jump over seven-foot bars; I look around for one-foot bars that I can step over.” — Warren Buffett

- “There are only three measurements that tell you nearly everything you need to know about your organization’s overall performance: employee engagement, customer satisfaction, and cash flow. It goes without saying that no company, small or large, can win over the long run without energized employees who believe in the mission and understand how to achieve it.” – Jack Welch, former CEO of GE

- “Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble” ― Warren Buffett

- “If you buy things you do not need, soon you will have to sell things you need.” – Warren Buffet

- “How many millionaires do you know who have become wealthy by investing in savings accounts? I rest my case.” — Robert G. Allen

- “It’s far better to buy a wonderful company at a fair price, than a fair company at a wonderful price.” – Warren Buffett

- “A market downturn doesn’t bother us. It is an opportunity to increase our ownership of great companies with great management at good prices.” — Warren Buffett

- “Every once in a while, the market does something so stupid it takes your breath away.” — Jim Cramer

- “The person who starts simply with the idea of getting rich won’t succeed; you must have a larger ambition.” — John D. Rockefeller

- “Know what you own, and know why you own it.” – Peter Lynch

- “Although it’s easy to forget sometimes, a share is not a lottery ticket… it’s part ownership of a business.” – Peter Lynch

-

“Wise spending is part of wise investing. And it’s never too late to start.” – Rhonda Katz

-

“Invest for the long haul. Don’t get too greedy and don’t get too scared.” – Shelby M.C. Davis

-

“Fear incites human action far more urgently than does the impressive weight of historical evidence.”

-Jeremy Siegel - “With a good perspective on history, we can have a better understanding of the past and present, and thus a clear vision of the future.” — Carlos Slim Helu

- “If we like a business, we’re going to buy as much of it as we can and keep it as long as we can. And when we change our mind, we don’t take half measures.” – Warren Buffett

- “The most contrarian thing of all is not to oppose the crowd but to think for yourself.” — Peter Thiel

- “Never depend on a single income, make an investment to create a second source.” Warren Buffet“Games are won by players who focus on the playing field –- not by those whose eyes are glued to the scoreboard.” ― Warren Buffett

- “The key to making money in stocks is not to get scared out of them.” – Peter Lynch

- “Courage taught me no matter how bad a crisis gets … any sound investment will eventually pay off.” — Carlos Slim Helu

- “Investing puts money to work. The only reason to save money is to invest it.” – Grant Cardone

- “As time goes on, I get more and more convinced that the right method of investment is to put fairly large sums into enterprises which one thinks one knows something about and in the management of which one thoroughly believes.” — John Maynard Keynes

- “Given a 10% chance of a 100 times payoff, you should take that bet every time.” — Jeff Bezos

- “Money is always eager and ready to work for anyone who is ready to employ it.” ― Idowu Koyenikan

- “The secret to investing is to figure out the value of something – and then pay a lot less.” – Joel Greenblatt

- “We don’t have an analytical advantage, we just look in the right place.” – Seth Klarman

- “Men, it has been well said, think in herds. It will be seen that they go mad in herds, while they only recover their senses slowly, and one by one.” – Charles Mackay

- “It’s not whether you’re right or wrong that’s important, but how much money you make when you’re right and how much you lose when you’re wrong.” – George Soros

- “In investing, what is comfortable is rarely profitable.” — Robert Arnott

- “Don’t look for the needle in the haystack. Just buy the haystack!” — John Bogle

- “No Price is too low for a bear or too high for a bull.” — Anonymous

- “Investment is an asset or item that is purchased with the hope that it will generate income or appreciate in the future.” — Anonymous

- “Behind every stock is a company. Find out what it’s doing.” — Peter Lynch

- “Wise spending is part of wise investing. And it’s never too late to start.” –Rhonda Katz

- “If there is one common theme to the vast range of the world’s financial crises, it is that excessive debt accumulation, whether by the government, banks, corporations, or consumers, often poses greater systemic risks than it seems during a boom.” — Carmen Reinhart

- “It amazes me how people are often more willing to act based on little or no data than to use data that is a challenge to assemble.” ― Robert Shiller

- “A bull market is like sex. It feels best just before it ends.” — Barton Biggs

- “The investor’s chief problem — even his worst enemy — is likely to be himself.” — Benjamin Graham

- “No profession requires more hard work, intelligence, patience, and mental discipline than successful speculation.” – Robert Rhea

- “The most contrarian thing of all is not to oppose the crowd but to think for yourself.” — Peter Thiel

- “Money is like a sixth sense – and you can’t make use of the other five without it.” – William Somerset Maugham

- “Compound interest is the eighth wonder of the world. He who understands it, earns it. He who doesn’t, pays it.” — Albert Einstein

- “The stock market is a device for transferring money from the impatient to the patient.” – Warren Buffett

- “Thousands of experts study overbought indicators, head-and-shoulder patterns, put-call ratios, the Fed’s policy on money supply…and they can’t predict markets with any useful consistency, any more than the gizzard squeezers could tell the Roman emperors when the Huns would attack.” – Peter Lynch

- “Investing puts money to work. The only reason to save money is to invest it.” – Grant Cardone

- “Formal education will make you a living; self-education will make you a fortune.” – Jim Rohn

- “You cannot save time for your future use however you can invest time for your future.” – John F. Heerdink, Jr.

- “We always live in an uncertain world. What is certain is that the United States will go forward over time.” – Warren Buffett

- “Never test the depth of the river with both of your feet.” – Warren Buffet

- “Know what you own, and know why you own it.” – Peter Lynch

- “Liquidity is only there when you don’t need it.” -Old Proverb

- “There is no such thing as no risk. There’s only this choice of what to risk, and when to risk it.” – Nick Murray

- “If you want to be a millionaire, start with a billion dollars and launch a new airline.” – Richard Branson

- “Fear incites human action far more urgently than does the impressive weight of historical evidence.” – Jeremy Siegel

- “In investing, what is comfortable is rarely profitable.” – Robert Arnott

- “Spend each day trying to be a little wiser than you were when you woke up.” – Charlie Munger

- “The entrance strategy is actually more important than the exit strategy.” – Edward Lampert

- “The rivers don’t drink their own water; Trees don’t eat their own fruits. The sun does not shine for itself, And flowers do not spread their fragrance For themselves. Living for others is a rule of nature” – PopeFrancis

- “It is impossible to produce superior performance unless you do something different from the majority.” – John Templeton

- “Inaction and patience are almost always the wisest options for investors in the stock market.” – Guy Spier

- “Remember that the stock market is a manic depressive.” – Warren Buffett

- “An investment in knowledge pays the best interest.” – Benjamin Franklin

- “I believe the returns on investment in the poor are just as exciting as successes achieved in the business arena, and they are even more meaningful!” -Bill Gates

- “Every portfolio benefits from bonds; they provide a cushion when the stock market hits a rough patch. But avoiding stocks completely could mean your investment won’t grow any faster than the rate of inflation.” – Suze Orman

- “The tax on capital gains directly affects investment decisions, the mobility and flow of risk capital… the ease or difficulty experienced by new ventures in obtaining capital, and thereby the strength and potential for growth in the economy.” – John F. Kennedy

- “If all the economists were laid end to end, they’d never reach a conclusion.

-George Bernard Shaw - “The riskiest thing we can do is just maintain the status quo. I get up at 4:30 in the morning, seven days a week, no matter where I am in the world. I think it is important for people who are given leadership roles to assume that role immediately. What I’ve really learned over time is that optimism is a very, very important part of leadership.” – Bob Iger, Former Ceo of Disney

- “In the short run, the market is a voting machine. But in the long run, it is a weighing machine.” – Ben Graham

- “In investing, what is comfortable is rarely profitable.” -Robert Arnott

- “The fundamental law of investing is the uncertainty of the future.” -Peter Bernstein

- “How many millionaires do you know who have become wealthy by investing in savings accounts?” -Robert G Allen

- “Greed is all right, by the way. I think greed is healthy. You can be greedy and still feel good about yourself.”-Ivan Boesky

- “Michael Marcus taught me one other thing that is absolutely critical: You have to be willing to make mistakes regularly; there is nothing wrong with it. Michael taught me about making your best judgment, being wrong, making your next best judgment, being wrong, making your third best judgment, and then doubling your money.” -Bruce Kovner

- “The policy of being too cautious is the greatest risk of all.” -Jawaharlal Nehru

- “I talk about macro themes a lot because they are fun to talk about, but it is the risk management that is the most important thing. The risk control is all bottom-up. I structured the business right from the get-go so that we would have lots of diversification.” -Michael Platt

- “Blaming speculators as a response to financial crisis goes back at least to the Greeks. It’s almost always the wrong response.” -Larry Summers

Videos

Please consider viewing these interesting videos: